-

The percentage of home loans with late payments is unlikely to fall much further in 2020 when mortgages made to lower credit-score borrowers could rise slightly, according to TransUnion.

December 12 -

The company will hold off on making loans under the Advantage Loan program as it conducts an audit and implements new policies and procedures.

December 9 -

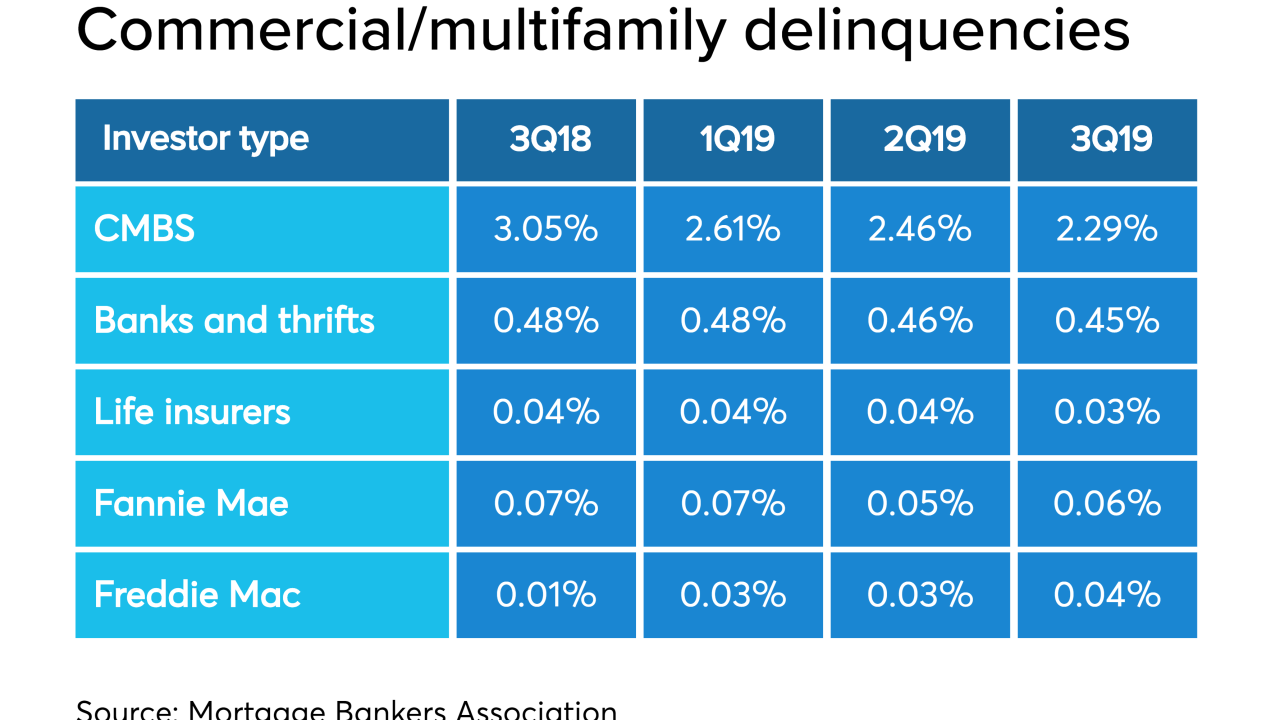

Most commercial and multifamily loan delinquency rates remained near record lows in the third quarter extending a long run of declines in the securitized market, according to the Mortgage Bankers Association.

December 6 -

The percentage of farm lenders losing money hit a six-year high in the third quarter, according to the FDIC.

December 5 -

Yale researchers have recommended several consumer banking products and services that could help those with mental health challenges manage their money.

November 26 -

David Becker, who founded First Internet Bank two decades ago, says traditional banks' digital-only ventures are only making his bank look more mainstream.

November 26 -

Lenders contend the proposal goes beyond policing third-party debt collectors and could expose banks to enforcement actions and lawsuits.

November 25 -

The nonbank share of large mortgage servicing is growing, but smaller players tend to be depositories, the Consumer Financial Protection Bureau found in a new report aimed at examining regulatory impacts.

November 22 -

A new National Credit Union Administration proposal would raise the threshold for residential mortgages that require appraisals. However, the final rule is by no means a done deal.

November 21 -

In recent months federal regulators have been speaking out on the risks that extreme weather events pose to the financial system, something their European counterparts have been doing for some time.

November 18 -

Stephen Calk, who faces a bribery charge in connection with loans his bank made to former Trump campaign chair Paul Manafort, is asking a judge to suppress evidence that prosecutors obtained from his mobile phone.

November 18 -

The 2015 decision posed new legal challenges for institutions trying to sell loans to third parties, but the federal regulatory agency proposed steps Monday for banks and debt parties to evade state interest rate caps.

November 18 -

Lenders have bundled more than $18 billion worth of non-QM, private-label loans into bonds this year that they then sold to investors, a 44% increase from 2018 and the most for any year since the securities became common post-crisis.

November 18 -

The third-quarter delinquency rate fell to its lowest point since 1995, according to the MBA. However, Attom Data Solutions' numbers show foreclosure filings experienced a near-term growth spurt in October.

November 14 -

The percentage of recent mortgage borrowers with subprime credit scores still resides in the single digits, but nearly doubled what is was in 2013, according to TransUnion.

November 13 -

Home loan originations rose by double digits in the third quarter while auto loan originations approached an all-time high, according to new household credit data from the New York Fed.

November 13 -

Such credits, which reflect borrowers with financial challenges, increased significantly during the third quarter.

November 13 -

So far farm loans are holding up well, but bankers gathered at an industry conference this week said they are growing increasingly concerned that credit quality will weaken if the U.S. and China don’t reach a deal soon.

November 12 -

Overall home-loan delinquencies remain near 20-year lows, but in Iowa, Minnesota, Nebraska, Rhode Island and Wisconsin, they are inching up in moves that may be tied to local economic concerns.

November 12 -

Tom Marano, a former Bear Stearns banker, was apparently well compensated following the housing crisis for heading up ResCap and Ditech, both of which went into bankruptcy.

November 11