-

The fintech world is expanding at a sometimes breathtaking pace. Much of that growth is driven by venture capital, but how do VCs decide which companies to invest it in--or not? Join Greycroft partner Will Szczerbiak in a discussion with Olugbenga Agboola, the founder and CEO of Flutterwave, the San Francisco-based startup building the largest payments infrastructure in Africa. Guest host James Ledbetter, editor and publisher of the fintech newsletter FIN, will explore these questions: What are VCs looking for in a fintech startup? What are the hottest fintech sectors in 2021? How has the rise in fintech valuations affected the market? Where will growth be strongest in the next few years?

-

Issuance of securitizations backed by these loans is becoming more dependable, and Fannie will need more mortgages that finance newly-built energy-efficient homes to keep it going.

February 1 -

The transaction consisting of $24 million in securitized Ginnie pools followed a 265% jump in broader industry eNote registrations last year.

January 29 -

The Financial Stability Oversight Council could determine that a broad range of mortgage companies should be subject to “heightened prudential standards,” said Andrew Olmem, a partner at Mayer Brown and a former senior economic adviser to the White House.

January 25 -

The former president and CEO of GE Capital’s restructuring and strategic ventures group was named executive vice president and chief risk officer soon after the departure of Fannie EVP Andrew Bon Salle.

January 22 -

Upcoming changes to underwriting regulations, as well as the end of the QM patch, in addition to growing home values, all add up for this market to have a good year.

January 19 -

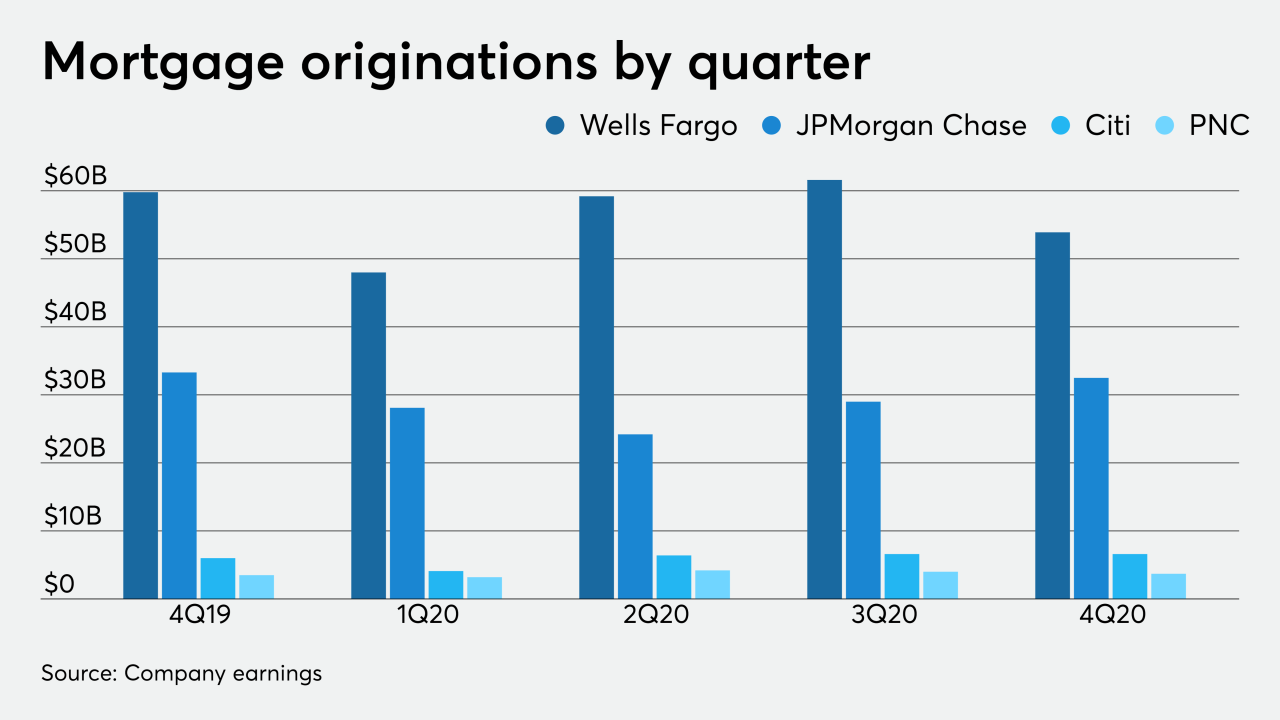

While some industry forecasts predicted origination volumes would fall 7% quarter-to-quarter in 4Q, early earnings numbers from Wells Fargo, JPMorgan Chase, Citi and PNC Bank show they were down just 3% when purchased loans are excluded.

January 15 -

After doubling its valuation in five months, Blend plans to use its latest funding to strengthen its digital lending experiences for banking and mortgages.

January 13 -

The volume of Ginnie securities issued in December marked the first time more than $80 billion has been issued in a month.

January 11 -

A new path forward for digital banks and their customers.

-

Industry watchers make their wildest guesses (more or less) about developments in real estate finance that could rock the industry in the upcoming months.

December 29 -

The availability of financing hasn’t been an issue to date, but it still could be.

December 23 -

Michael Gramins, who a jury convicted in 2017, was among more than a half-dozen traders charged by federal prosecutors in Connecticut with misrepresenting the prices of mortgage-backed securities to clients in order to increase their firm’s profits and their bonuses.

December 18 - LIBOR

The deadline for inclusion in Ginnie mortgage-backed securities has been extended and an exception will be made for some participations.

December 16 -

Last year, smaller lenders were put at a slight disadvantage in terms of what they were charged in guarantee fees when they sold loans for cash.

December 15 -

The problem in the sector boils down to a lack of portability of data, whether it’s digital or contained in documents, that can be trusted between parties, LoanLogics Chief Product Officer Dave Parker argues.

December 10 LoanLogics

LoanLogics -

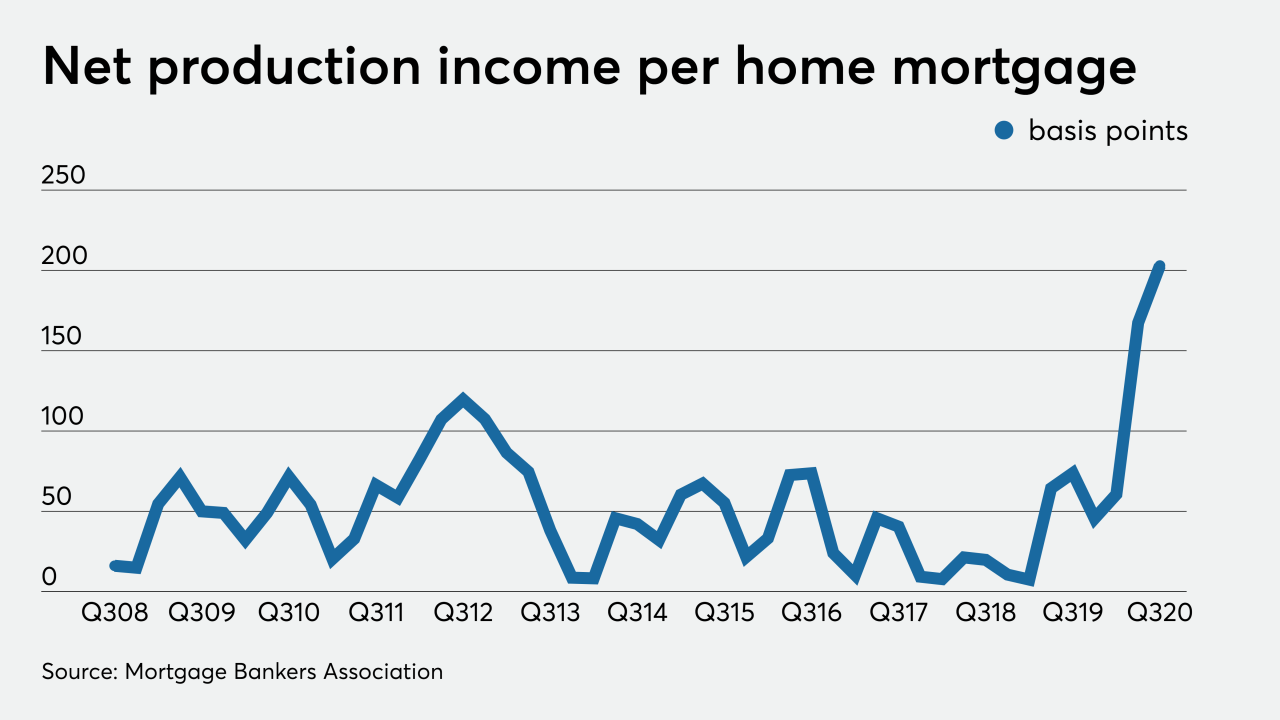

The average per-loan profit margin remains incredibly strong, but the share of senior executives expecting it to fall has risen markedly.

December 9 -

Whether Ginnie issuance increases in the future may depend in part on the extent to which the Biden administration wishes to tap the FHA to promote affordable housing and homeownership.

December 8 -

If CMBS litigation picks up in earnest in the aftermath of the pandemic, lessons gleaned from over a decade of RMBS litigation could pay dividends, Bilzen Sumberg lawyers Philip Stein and Kenneth Duvall say.

December 8 Bilzin Sumberg

Bilzin Sumberg -

The money lenders are making on each home loan hit another survey-record high in the third quarter, but it may not be quite as high going forward.

December 3