-

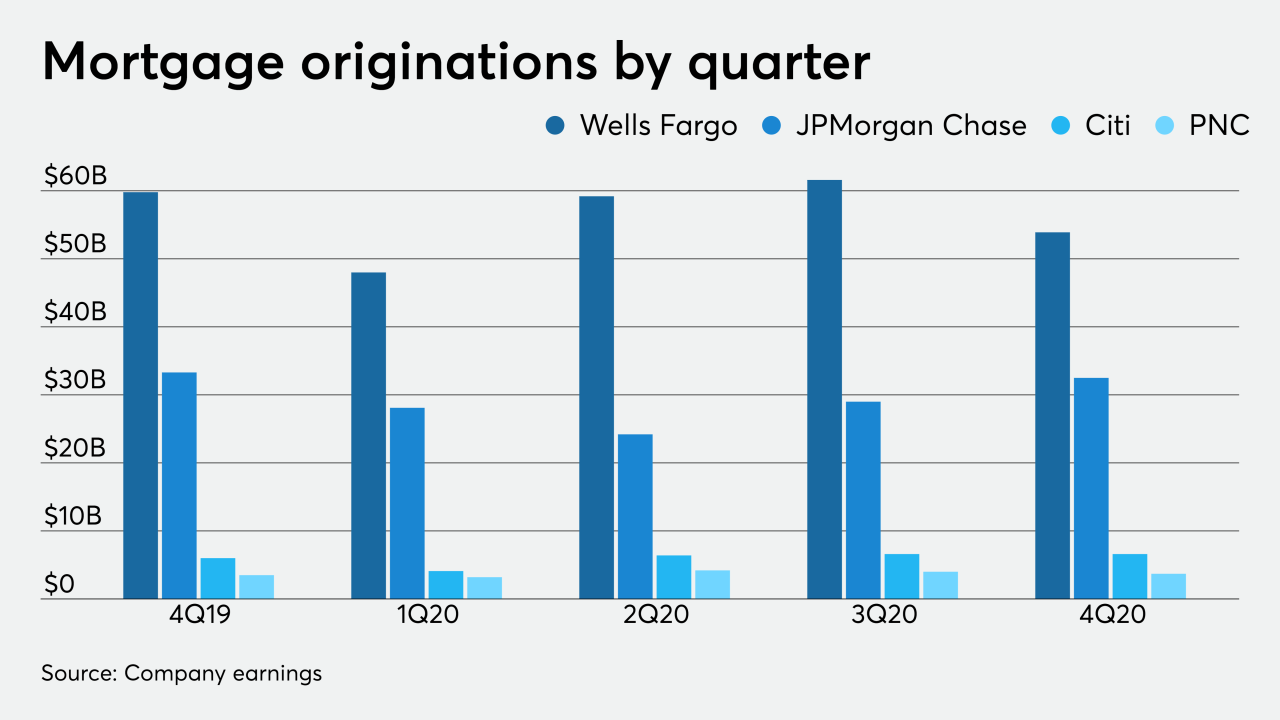

While some industry forecasts predicted origination volumes would fall 7% quarter-to-quarter in 4Q, early earnings numbers from Wells Fargo, JPMorgan Chase, Citi and PNC Bank show they were down just 3% when purchased loans are excluded.

January 15 -

After doubling its valuation in five months, Blend plans to use its latest funding to strengthen its digital lending experiences for banking and mortgages.

January 13 -

The volume of Ginnie securities issued in December marked the first time more than $80 billion has been issued in a month.

January 11 -

A new path forward for digital banks and their customers.

-

Industry watchers make their wildest guesses (more or less) about developments in real estate finance that could rock the industry in the upcoming months.

December 29 -

The availability of financing hasn’t been an issue to date, but it still could be.

December 23 -

Michael Gramins, who a jury convicted in 2017, was among more than a half-dozen traders charged by federal prosecutors in Connecticut with misrepresenting the prices of mortgage-backed securities to clients in order to increase their firm’s profits and their bonuses.

December 18 - LIBOR

The deadline for inclusion in Ginnie mortgage-backed securities has been extended and an exception will be made for some participations.

December 16 -

Last year, smaller lenders were put at a slight disadvantage in terms of what they were charged in guarantee fees when they sold loans for cash.

December 15 -

The problem in the sector boils down to a lack of portability of data, whether it’s digital or contained in documents, that can be trusted between parties, LoanLogics Chief Product Officer Dave Parker argues.

December 10 LoanLogics

LoanLogics -

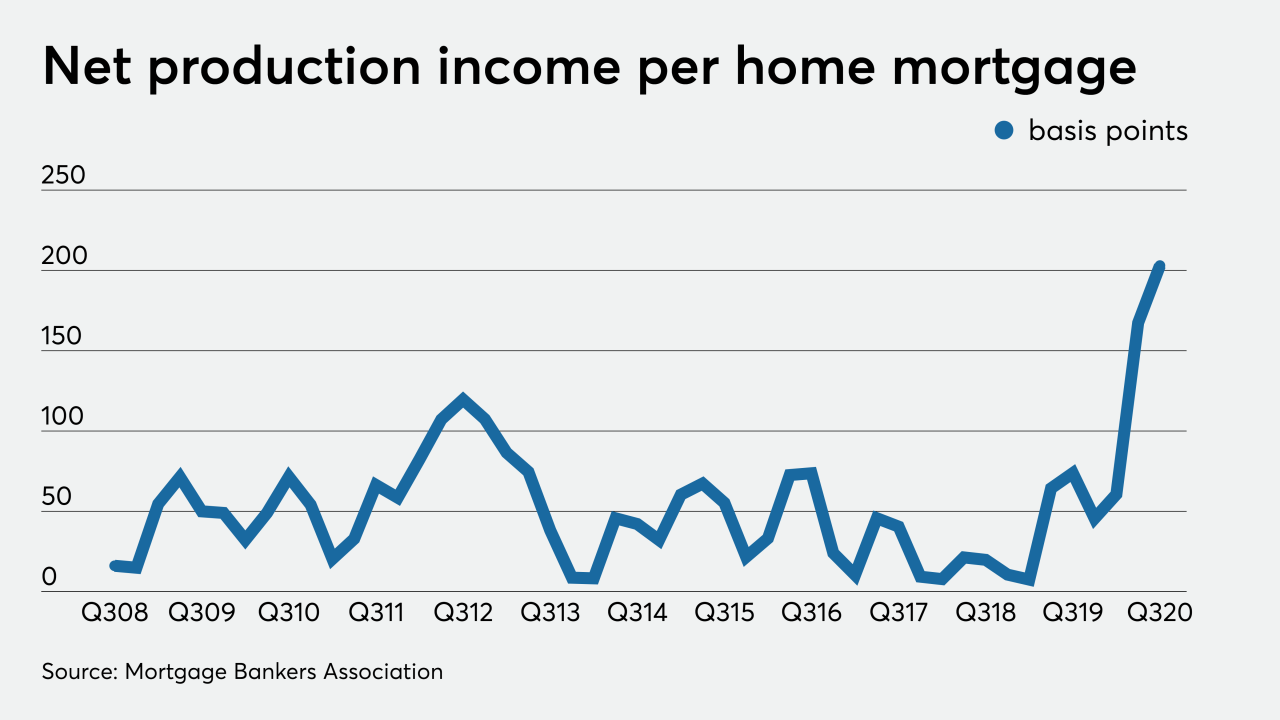

The average per-loan profit margin remains incredibly strong, but the share of senior executives expecting it to fall has risen markedly.

December 9 -

Whether Ginnie issuance increases in the future may depend in part on the extent to which the Biden administration wishes to tap the FHA to promote affordable housing and homeownership.

December 8 -

If CMBS litigation picks up in earnest in the aftermath of the pandemic, lessons gleaned from over a decade of RMBS litigation could pay dividends, Bilzen Sumberg lawyers Philip Stein and Kenneth Duvall say.

December 8 Bilzin Sumberg

Bilzin Sumberg -

The money lenders are making on each home loan hit another survey-record high in the third quarter, but it may not be quite as high going forward.

December 3 -

Even government-sponsored enterprise loans, which have seen forbearance rates drop for 24 weeks in a row, saw a slight uptick.

December 1 -

Experts in the field predict how some aspects of the market will develop in the coming year.

November 30 -

Bee Mortgage App will use blockchain and automation provided by Elphi to create "a COVID tool for real estate agents" to get fully digital mortgage approval in under three minutes.

November 25 -

The Structured Finance Association fears Treasury Secretary Steven Mnuchin may release the government-sponsored enterprises from conservatorship ahead of the change in administration, and that doing so could disrupt the mortgage-backed securities market.

November 24 -

To truly manage risk, banks must invest in more sophisticated modeling, reporting and analytics to track market movements and ultimately maximize profitability, Vice Capital Markets’ Christopher Bennett says.

November 19 Vice Capital Markets

Vice Capital Markets -

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

November 17