-

1st Alliance Lending CEO John DiIorio explains why the mortgage lender turned down a consent order with the Connecticut Department of Banking and the high cost of fighting what he sees as an overreach of regulators' enforcement power.

January 17 1st Alliance Lending

1st Alliance Lending -

Fintechs must be held to the same standards as regulated financial institutions, a letter from the National Association of Federally-Insured Credit Unions stated that used Zillow's entrance into the mortgage business as an example.

January 9 -

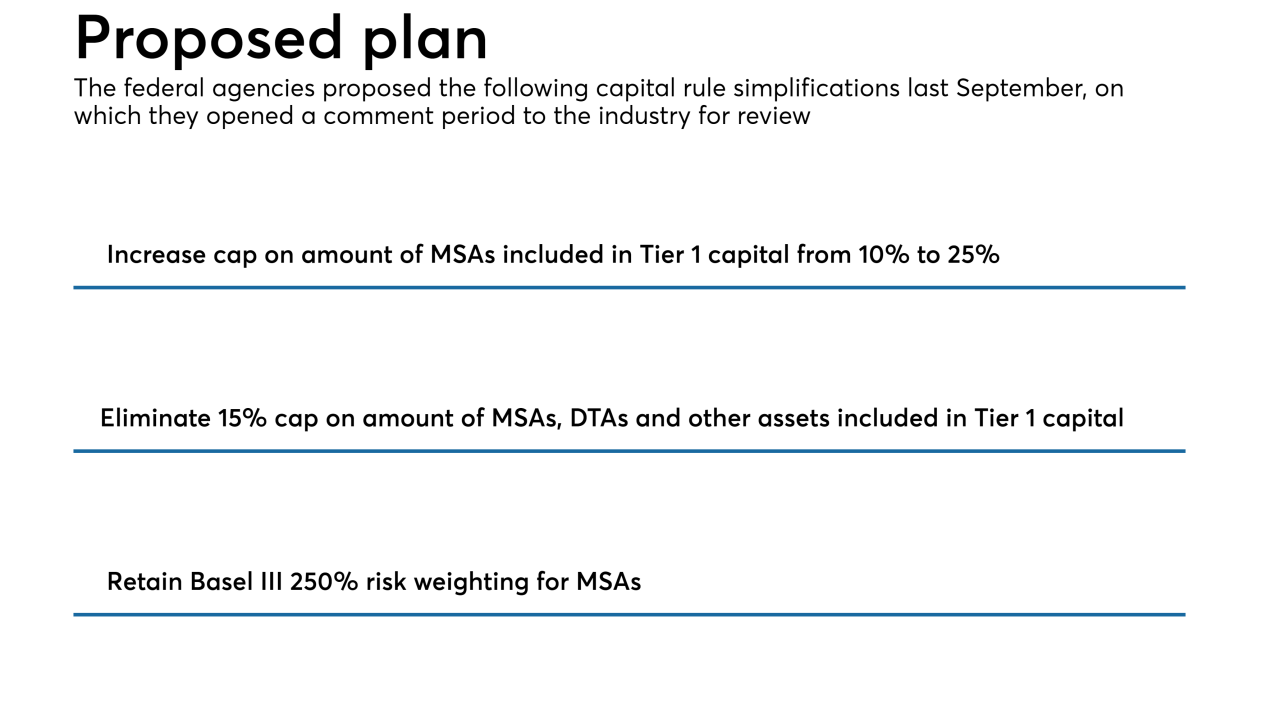

A proposal issued over a year ago by federal banking agencies to simplify risk-based capital rules and ease compliance burdens for community banks has still not been finalized, and mortgage brokers and bankers are calling on them to do just that.

December 18 -

While the foreclosure crisis is over and federal regulators are being less assertive on enforcement actions, mortgage servicers must remain vigilant about compliance, as state agencies are stepping up their own oversight, according to Standard & Poor's.

November 6 -

New York's Department of Housing Preservation and Development has released a "Speculation Watch List" of rent-regulated homes sold that the agency said could potentially put tenants at risk.

November 1 -

Under the Federal Housing Finance Agency's plan, small Home Loan banks would face a new housing benchmark and a volume threshold for meeting the goals would be eliminated.

October 29 -

Lennar's mortgage banking unit agreed to settle False Claims Act allegations for $13.2 million, a smaller amount than other lenders paid to the government prior to the end of fiscal year 2017.

October 22 -

The Office of the Comptroller of the Currency lowered the $14 billion-asset thrift in Cleveland to “needs to improve” from "satisfactory."

October 3 -

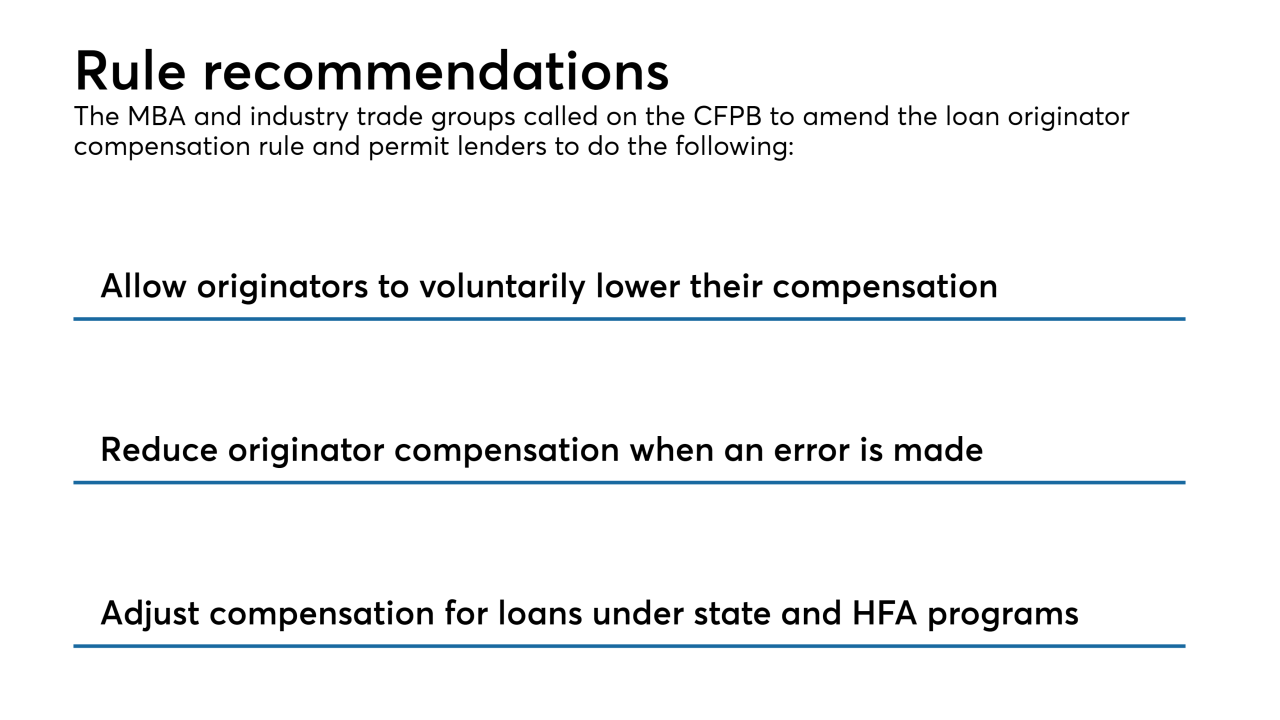

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

Gov. Jerry Brown signed a bill Sunday to streamline housing development around BART stations and ease the Bay Area's epic affordable housing problem at the expense of local officials' decision-making powers over land use.

October 1 -

1st Alliance Lending plans to cut up to 35 employees in Connecticut and terminate efforts to expand its East Hartford headquarters in order to prepare for an expected increase in regulatory costs.

September 19 -

Early adopters took digital mortgages from concept to reality. What will it take for everyone else to catch up?

September 10 -

From origination to servicing and everything in between, here's a sneak peek at the companies and products presenting demos at the 2018 Digital Mortgage Conference.

September 10 -

Computershare Loan Services has agreed to acquire a loan fulfillment and secondary marketing unit owned by LenderLive Holdings in order to broaden its services along the full mortgage lifecycle.

August 20 -

The Department of Housing and Urban Development took the very rare step of filing a secretary-initiated fair housing complaint — only three were made in the last two fiscal years — against Facebook.

August 20 -

The Michigan company had been operating under the supervisory agreement since 2010.

August 17 -

Zillow Group is moving from being a mortgage marketer to originating loans with its acquisition of Mortgage Lenders of America, in an effort to support its home-flipping business.

August 6 -

Revisions to the TILA/RESPA integrated disclosure that go into effect this fall drove the changes Ellie Mae made in its latest update to the Encompass loan origination system.

August 6 -

-

The agreement was likely the last of the big cases to be cleared by the Justice Department, and Wells paid less than its peers did to resolve the lingering mortgage probes stemming from the meltdown.

August 1