-

SunTrust’s yields have improved as it has increased its credit-card and student lending and made more online personal loans through its LightStream subsidiary.

October 20 -

Total loans fell 1.6% at the North Carolina-based regional bank, which has been scaling back in key segments such as residential mortgages and auto. Wider margins offset that reduction, but earnings were flat and revenue growth small.

October 19 -

The nonbinding guidance, which followed a nearly yearlong inquiry about industry practices, said consumers should have greater ability to obtain information about their financial data, among other principles.

October 18 -

Mortgage defaults keep rising and are getting much nearer to where they were in 2016 as damage from natural disasters continues to add to slight upward pressure on credit.

October 17 -

Mortgage delinquencies in cities where the economy is dependent upon the oil industry are on the upswing, even as nationwide default rates remain near 10-year lows, CoreLogic said.

October 10 -

The sale of the struggling Financial Freedom unit to an undisclosed buyer would continue CIT's strategy of shedding noncore business lines.

October 6 -

Four neighborhoods hit hardest by Hurricane Harvey have limited resources and are in most need of federal, state and local assistance for property repair and rehabilitation costs.

October 6 -

A change in the formula that banks use to calculate borrowers’ debt-to-income ratios, announced by Fannie Mae in April, appears to be spurring more lending.

October 6 -

While disappointed with the CFPB's actions in recent years, bankers said they want to see a campaign platform before making a decision on the agency's director.

October 5 -

At 1.56%, the delinquency rate on consumer loans remains well below historic averages, the American Bankers Association said Thursday.

October 5 -

Ginnie Mae is giving expanded loan buyout authority to certain issuers in order to help them remove loans affected by Hurricanes Irma and Harvey from securitized mortgage pools.

September 26 -

In a new book, Mehrsa Baradaran argues that the same forces of poverty that African-American banks were supposed to alleviate are now holding them back.

September 25 -

Mortgage delinquencies in areas affected by Hurricane Harvey last month were 16% higher than in July, according to Black Knight Financial Services.

September 21 -

Default rates for first-lien mortgages rose slightly higher in August and remain lower year-over-year, but recent hurricanes could intensify loan performance concerns.

September 20 -

The Equifax breach has millions of Americans now thinking about freezing their credit to guard against identity theft. But those who act could be cutting themselves off from the nation's vast credit economy.

September 19 -

Mortgage investors want Freddie Mac to align its policy with Fannie Mae's when it comes to how delinquencies related to Hurricane Harvey affect credit risk transfer deals.

September 19 -

Investor demand for mortgage bonds is strong; the only limiting factors are consumer awareness of the product and loan officers' willingness to offer them.

September 19 -

The online lender has accelerated its search for a permanent CEO and is said to be seeking someone with a history of success in banking.

September 15 -

Mike Cagney’s eventual successor will have to decide whether to continue his focus on rapid growth. Also on the table are strategic decisions about when to go public and whether to pursue a bank charter.

September 12 -

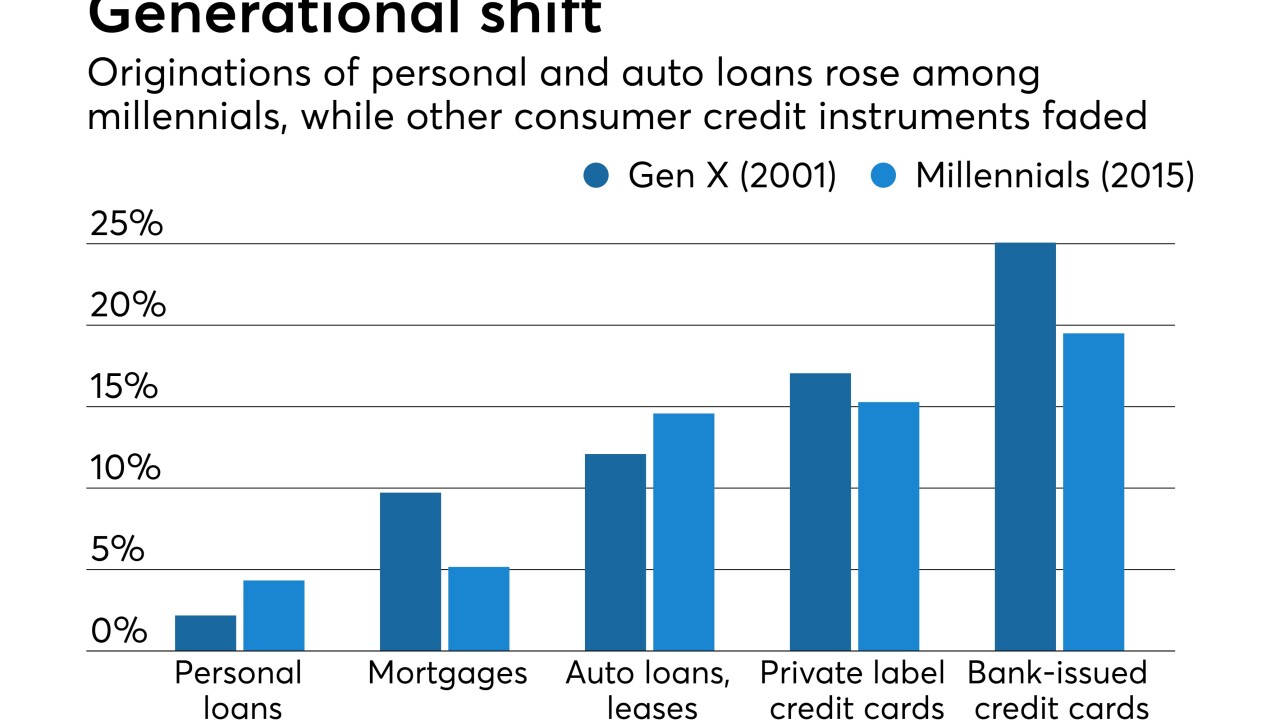

Millennials — many of whom joined credit unions in recent years as the movement's membership expanded — are relying more heavily on personal loans than their Gen X predecessors while paring back on credit cards and mortgages.

September 11