-

Despite concerns with the COVID-19 pandemic, the area real estate market saw activity in June that was consistent with June 2019.

July 21 -

The measures currently ensuring mortgage companies have sufficient cash to cover advances aren't necessarily sustainable, warns Ted Tozer, a senior fellow at the Milken Institute and a former government official.

July 21 -

The number of loans going into coronavirus-related forbearance dropped for the fifth straight week, as the growth rate plummeted 38 basis points between July 6 and July 12, according to the Mortgage Bankers Association.

July 20 -

The Federal Housing Finance Agency will extend the same GSE benchmarks of the past three years into 2021.

July 20 -

Mortgages taken out to fund business operations can now be modified in bankruptcy. That’s a relief to borrowers — particularly with business failures expected to increase as the pandemic drags on — but a possible headache for banks and investors that hold the loans.

July 20 -

After taking a deep dive in March and April due to the pandemic, housing sales throughout the Twin Cities rebounded in May, coming back strong to even make up lost ground.

July 20 -

Ocwen Financial's preliminary second-quarter results put it back in the black, and it is positioning its growing distressed-servicing expertise and pandemic-induced exposures as a net positive.

July 17 -

A strong housing market prior to the pandemic and the subsequent coronavirus-related moratorium helped to pull foreclosure activity down to historic lows in the first half of 2020, though that could all change soon, according to Attom Data Solutions.

July 17 -

The South Florida luxury housing market suffered headwinds in the second quarter. The number of sales dropped up to 55.6% year-over-year in one neighborhood.

July 17 -

Buyers in metro Denver who expected to have an easier time snagging a discounted home given all the economic turmoil may need to recalculate.

July 17 -

The coronavirus relief law allows forbearance plans for up to a year on federally backed mortgages, but House Democrats say homeowners have had difficulty getting relief.

July 16 -

The surge of COVID-19 cases in much of the nation put a hold on reopening the economy, adding risk to the housing market, First American said.

July 16 -

After two months of declines in the coronavirus pandemic, the Boise, Idaho, area housing market rebounded in June with a 3.4% increase in homes sold compared with June 2019.

July 16 -

The Pittsburgh bank says fewer borrowers are asking for help and that many borrowers who received assistance are making payments again. But with the coronavirus pandemic still raging in much of the country, CEO William Demchak and other bankers are tempering their optimism.

July 15 -

The Minneapolis company said 75% transactions have been handled online since the pandemic hit.

July 15 -

The rise in late and suspended payments following the coronavirus outbreak in the United States may have helped the FHA realize it's high time to improve the process.

July 14 -

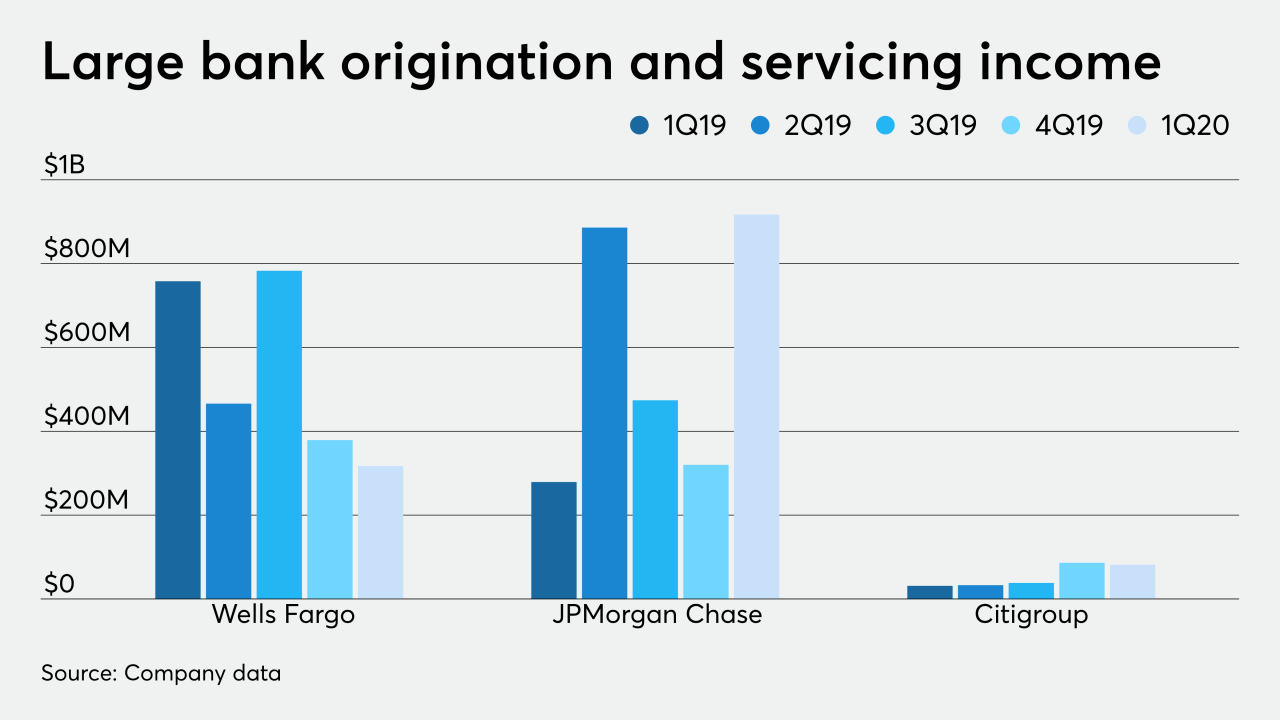

The banks logged strong year-over-year growth in gain-on-sale margins for mortgage loans.

July 14 -

Down payment assistance programs remain an important tool for increasing minority homeownership, but especially more so because of the pandemic.

July 14 Mountain Lake Consulting

Mountain Lake Consulting -

The share of Dallas-Fort Worth area homeowners who are behind on their mortgage payments is spiking with the pandemic.

July 14 -

The number of loans going into coronavirus-related forbearance fell for the fourth consecutive week, as the growth rate plummeted 21 basis points between June 29 and July 5, according to the Mortgage Bankers Association.

July 13