-

Like many regional banking companies, Huntington Bancshares casts itself as a community bank, albeit one with more than $100 billion in assets.

September 9 -

The pursuit of a more digital mortgage business always involves a balancing act between the drive for automation and the preference or need many consumers may have for some kind of personal touch.

August 16 -

Discover Bank is approaching $1 billion in home equity-related receivables, a milestone for the six-year-old home-loan division that aims to rework the lending process for both its customers and loan officers.

August 5 -

Mortgage servicer customer satisfaction levels are among the lowest of any industry as more companies prioritize cost-cutting, regulation and default management over their borrowers, according to J.D. Power.

August 1 -

Mandate for loan officers is to be able to inform on customers' specific financial needs in areas that extend well beyond the home loan.

July 9 -

Amazon's reputation is built on customer fulfillment and technology innovation, but are those enough to guarantee success in the mortgage business?

July 3 AI Foundry

AI Foundry -

Ally wants to increase productivity and improve the use of analytics to build on customer relationships.

June 13 -

A Western Union survey claims consumers are unable to tell the difference between humans and interactive voice response or artificial intelligence when needing customer or payment assistance, but their responses may say otherwise.

June 12 -

The Consumer Financial Protection Bureau received over a quarter-million complaints in 2018, according to analysis by an advocacy group that urged the agency to maintain public access to its database.

May 12 -

Only a fraction of mortgage borrowers return to their servicers to originate or refinance a mortgage loan, and it may be the industry's fault for not exhausting enough effort to keep them around.

February 27 -

The bank says it has restored access, but it hasn’t explained how a fire-suppression system at one facility could cause a nationwide outage across all of its channels, or how its system as a whole could have been left so vulnerable to the incident.

February 8 -

Customers reported being unable to access online banking, mobile banking or their debit cards.

February 7 -

Mortgage and real estate professionals are navigating new technology to support a better consumer experience and grow their customer base, but those who lose sight of the end goal are in danger, according to Remax CEO Adam Contos.

January 31 -

Current housing market conditions are sending the real estate and mortgage industries back to the drawing board to craft strategies ultimately in support of customer acquisition and retention at a time when competition is tight.

January 29 -

From Provo, Utah, to Dallas, here's a look at 10 housing markets with the youngest average consumer age.

November 21 -

-

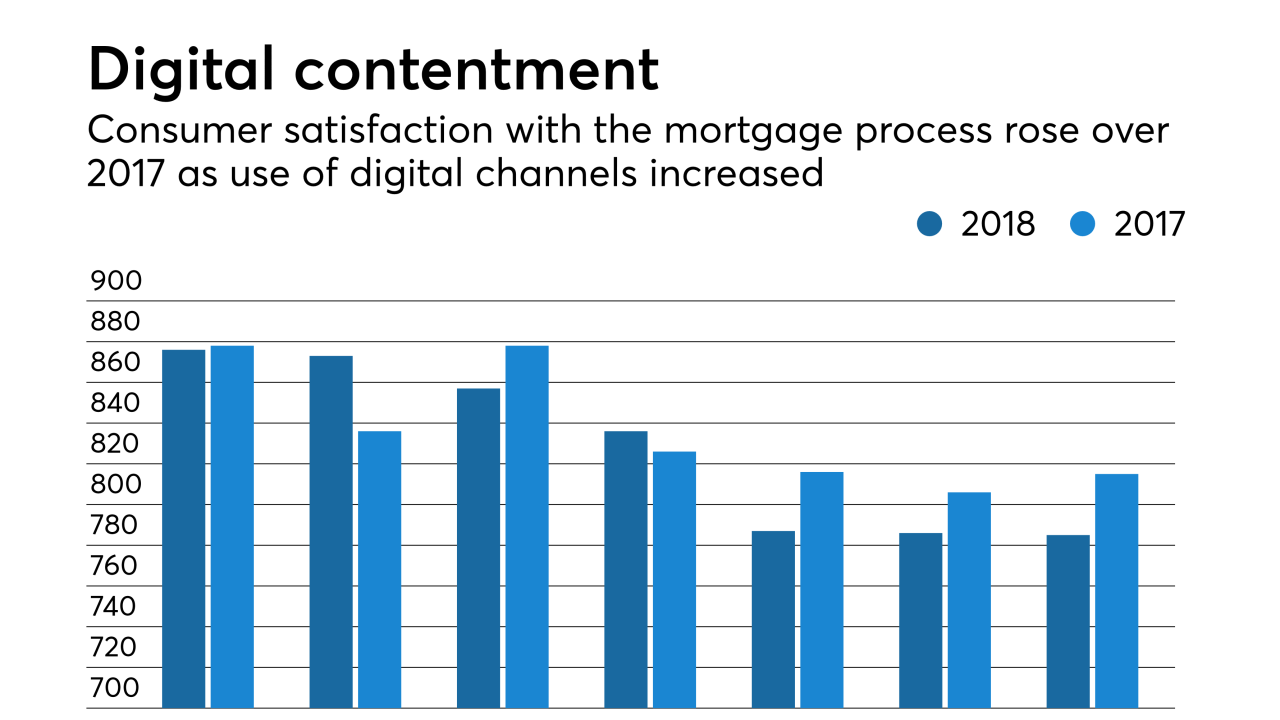

The growth of digital mortgage origination channels has improved customer satisfaction with the process, but consumers still want personal interaction at some point, according to J.D. Power.

November 8 -

Larger mortgage companies are paying less than other creditors when fraud occurs, but the expense is still detracting enough from their revenue to cause concern.

October 23 -

ReverseVision and Stratmor Group are building a benchmark for Home Equity Conversion Mortgages that could help determine how well these Federal Housing Administration loans serve seniors.

October 17 -