-

The ongoing CARES Act foreclosure moratoria may have led to distressed borrowers abandoning their homes, according to Attom Data Solutions.

May 27 -

Most of the activity covered vacant and abandoned properties or commercial loans, according to Attom Data Solutions.

May 12 -

The agreement, which is extended for five years, also expands upon the delinquent mortgages services Altisource will provide to Ocwen.

May 6 -

While cash-out refinances were a “significant driver” of risky loans leading to the Great Recession, those mortgages pose less of a threat due to tighter underwriting standards, according to Milliman.

May 5 -

While the overall delinquency rate decreased for the fifth straight month, states with unemployment rates that were double and triple the national average had the most overdue loans, a CoreLogic report found.

April 13 -

Inventories should keep shrinking, which is likely to drive higher returns on equity and reduce their loss ratios, a BTIG report said.

April 8 -

As an improving job market aided financial stability for borrowers, 2020 ended with drops in delinquent home loans, a CoreLogic report found.

March 9 -

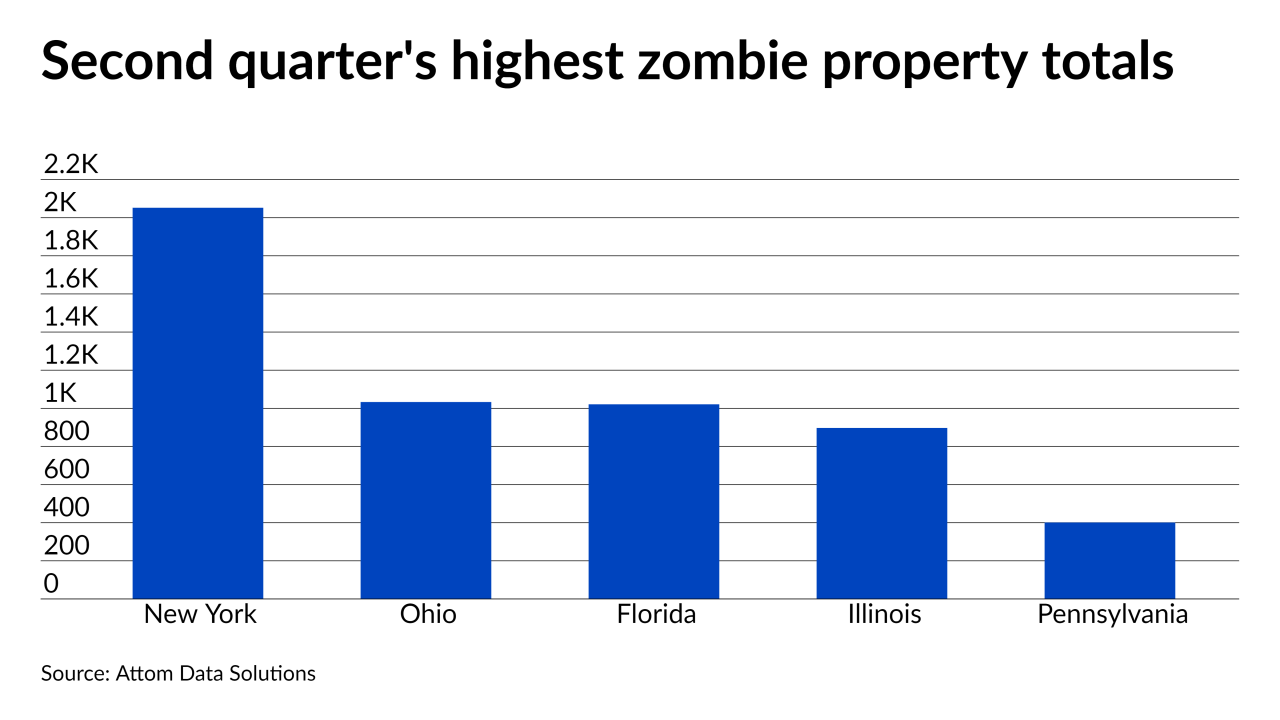

While foreclosure moratoria keep the overall numbers down, zombie foreclosure rates jumped in the majority of states, according to Attom Data Solutions.

February 25 -

With President Biden extending the moratorium, foreclosures hit an all-time low at the start of 2021 as millions of delinquent borrowers avoided entering the process, according to Attom Data Solutions.

February 11 -

Gains in consumer financial stability helped to decrease the rates of distressed home loans, but job creation is needed to make recovery sustainable, a CoreLogic report found.

February 9 -

Meanwhile at Essent, more loans exited the inventory in January than in December.

February 8 -

The housing market’s boom led to more borrowers building home wealth but the pandemic’s negative impact brings concern for underwater owners, according to Attom Data Solutions.

February 5 -

While distressed mortgage rates continued the fall’s short-term slide, serious delinquencies are three times higher than the year-ago total, according to CoreLogic.

January 12 -

For some, including National MI and Essent, the improvement is taking place faster than expected.

January 11 -

Economic instability during the quarter drove the increase in findings regarding income and employment, Aces Quality Management reported.

December 16 -

The largest concerns are with pandemic risk and defaults, along with business resilience and adaptability, according to a Wolters Kluwer survey.

December 14 -

While distressed mortgage rates crept down overall, serious delinquencies still tripled year-ago rates in September, according to CoreLogic.

December 8 -

Lower cure rates and possible rises in foreclosures and claims could force these companies to raise capital next year, Fitch Ratings said.

December 4 -

The Federal Housing Finance Agency said that Fannie Mae and Freddie Mac would extend the measures until “at least” Jan. 21, 2021.

December 3 -

Troubled Veteran’s Administration “no-bid” loans could bankrupt servicers in the near future, says Morgan Snyder of CAllc Research Publications.

December 2 CAllc Research Publications

CAllc Research Publications