-

Foreclosure starts dropped to their lowest level in 18 years, and properties foreclosed on but not yet sold fell to a 14-year low in August, according to Black Knight.

September 23 -

The percentage of Tampa Bay homeowners late on their mortgage payments continues to fall.

September 23 -

Removing Federal Housing Administration-insured mortgages with natural-disaster forbearance from the agency's delinquency tracking database would give investors a less-distorted view of loan performance, according to the Community Home Lenders Association.

July 29 -

Economic strength bolstered the performance of loans included in commercial mortgage-backed securities with delinquencies improving for the seventh consecutive quarter, according to the Mortgage Bankers Association.

June 10 -

An institution that services housing finance authority loans is putting $2.65 billion in servicing rights from Washington state up for bid through the Mortgage Industry Advisory Corp.

May 16 -

Freddie Mac's latest nonperforming mortgage auction will include one pool targeted to smaller investors like nonprofit organizations.

April 12 -

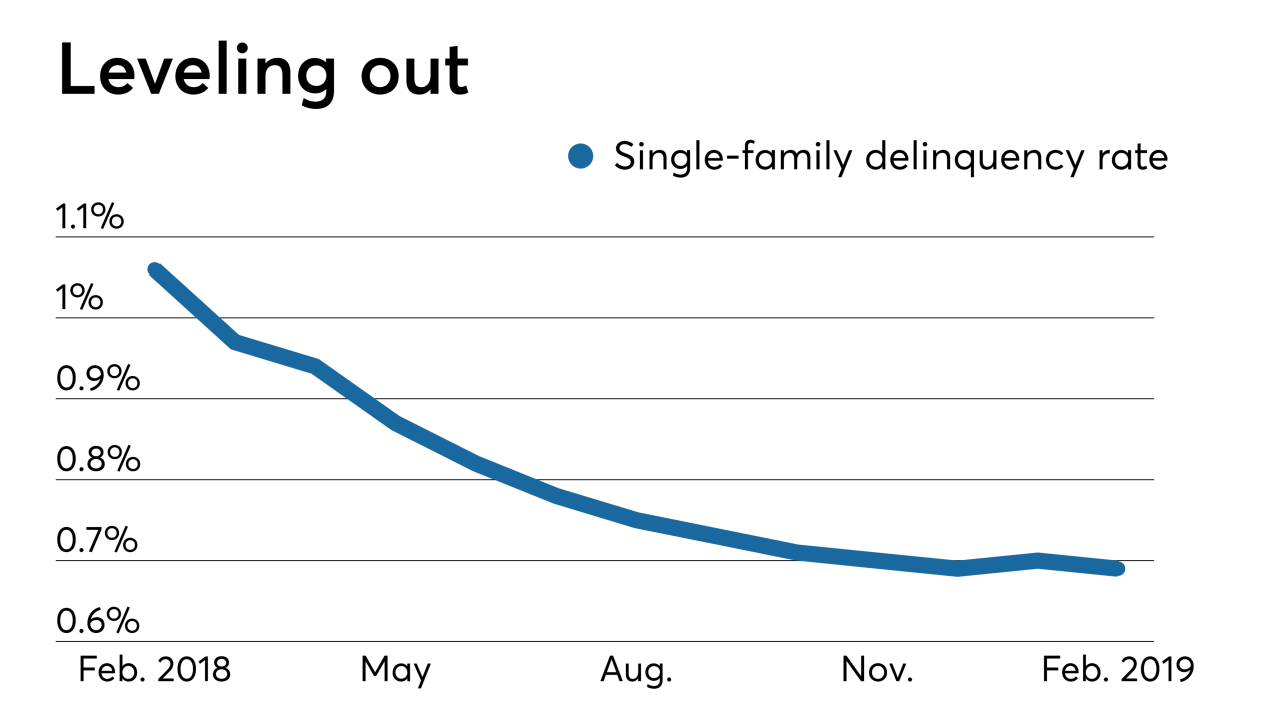

Late payments on single-family home mortgages changed direction and started falling again in Freddie Mac's latest monthly report.

March 26 -

Servicers that fail to give borrowers access to digital collection methods are missing out on a chance to improve delinquency rates and lower costs.

March 19 Visa Inc.

Visa Inc. -

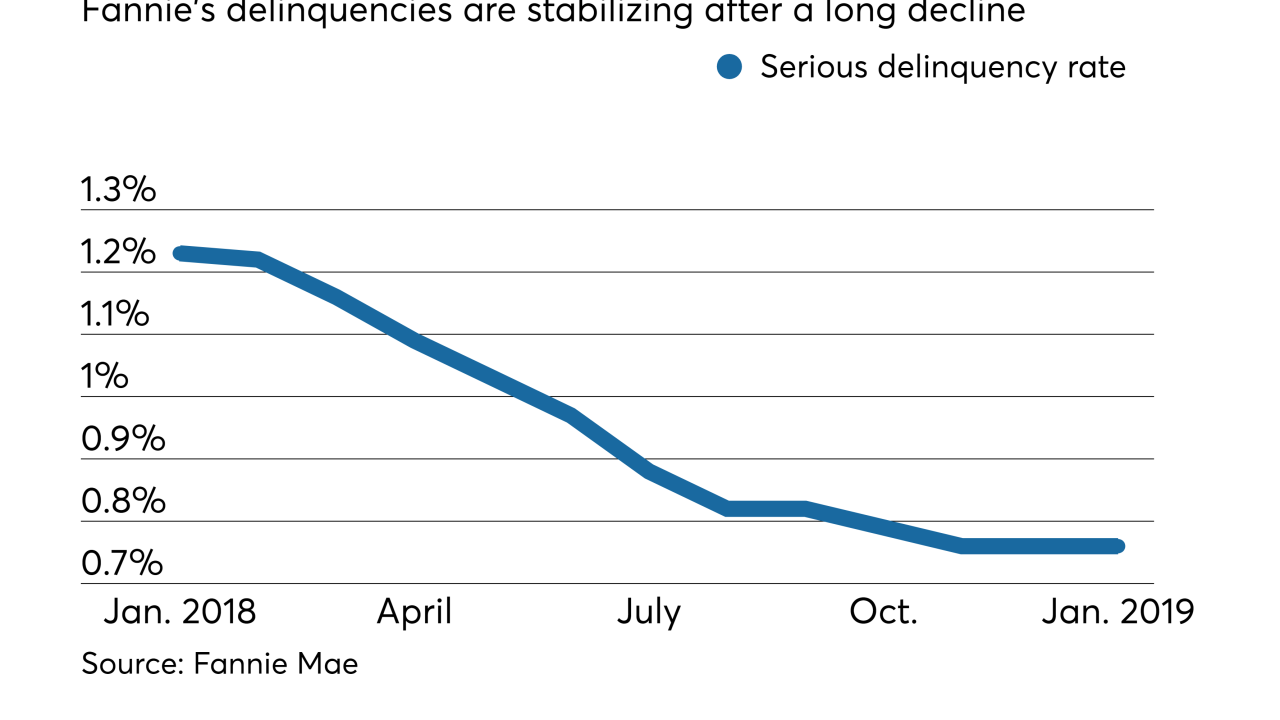

Fannie Mae's serious delinquency rate stood firm for the third month running, adding to evidence that it has hit a floor after dropping for most of the past year.

March 1 -

Recent data from the Federal Reserve suggests lenders are growing pessimistic about the credit environment. But is that a sign of trouble ahead, or just sound risk management?

February 18 -

Refinance volume slipped following growth in mortgage rates, and loans refinanced through the Home Affordable Housing Program barely made a dent in overall volume, according to the Federal Housing Finance Agency.

February 15 -

Mortgage delinquencies in the fourth quarter were at their lowest level in nearly 19 years, helped by wage growth, low household debt and low unemployment, the Mortgage Bankers Association said.

February 15 -

The government-sponsored enterprises are going through a transition period. From proposals for rebuilding their capital cushions to tackling shortages in affordable housing, Fannie Mae and Freddie Mac face a number of key challenges with wide-ranging consequences this year.

February 14 -

Late payments on loans backing commercial mortgage bonds continued falling at the start of the year, due to strong new issuance volume and continued resolutions for precrisis loans by special servicers, according to Fitch Ratings.

February 11 -

Better credit quality and the influx of refinancing during the low interest rates of the last few years pushed mortgage performance to the highest levels since the turn of the century, according to Black Knight.

February 4 -

Risk aversion, economic momentum and the multidecade nadir of unemployment rates helped push delinquencies to the lowest year-end measure of the 21st century, according to Black Knight.

January 23 -

Continual declines in the refinance share of mortgage originations led to prepay rates dropping to their lowest levels since 2009, according to Black Knight.

January 9 -

More consumers fell behind on their loans in the third quarter of 2018, even as average wages rose and the unemployment rate fell to a 50-year low.

January 8 -

The strong economic headwinds from last fall facilitated a declining loan delinquency rate across the country, though areas hit by natural disasters had increased defaults, according to CoreLogic.

January 8 -

Fannie Mae's overall single-family serious delinquency rate dropped another notch in November, according to its most recent report, but the current government shutdown raises questions about whether that trend will continue.

December 31