-

Black borrowers locked in an average mortgage rate of 4.44% for conventional loans — 15 basis points higher than white borrowers, according to an analysis of HMDA data by the National Association of Real Estate Brokers.

October 28 -

But an expected drop in refinancings as mortgage rates rise should more than cancel that out, resulting in declining overall volume through 2023.

October 21 -

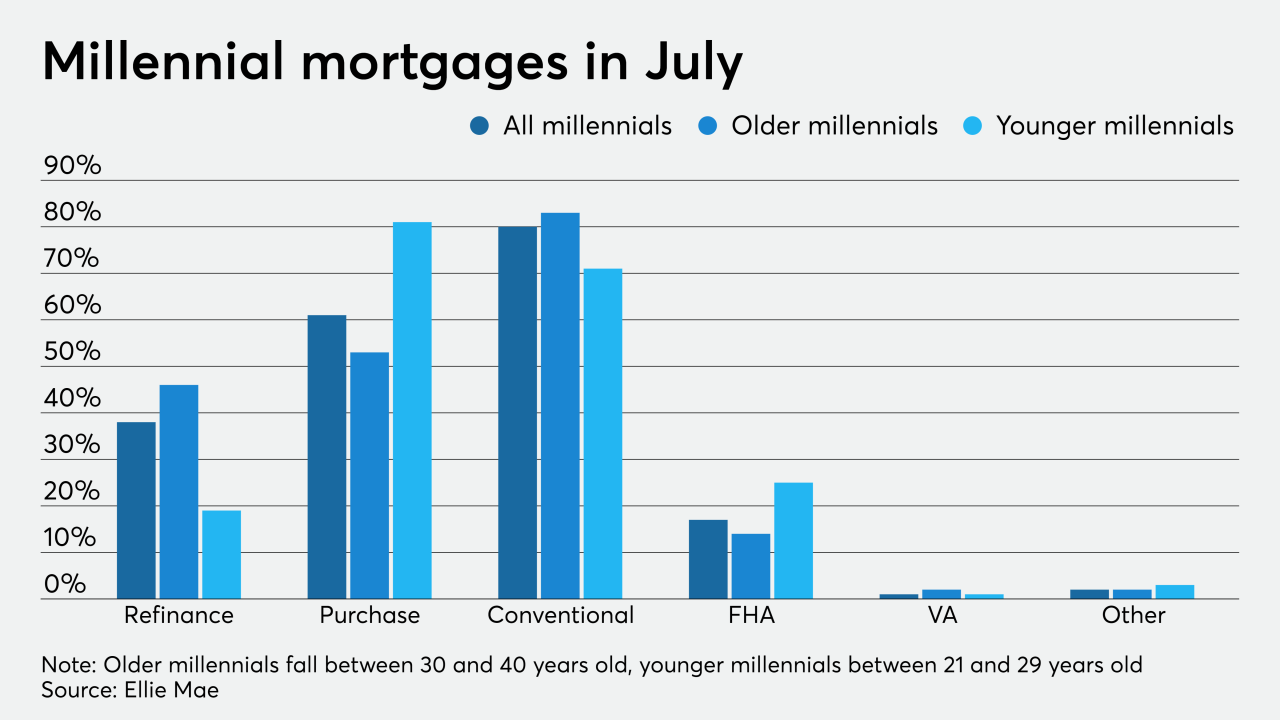

Millennials continue to lock in the lowest average mortgage rates on record, keeping lenders busy and the housing market churning, according to Ellie Mae.

October 7 -

Diversity initiatives for home appraisers would cut down the racism and bias within the valuation process.

October 7 -

Whether low rates will continue to outweigh health and employment concerns for millennials and Generation Z remains to be seen.

October 2 -

From an increased interest in outdoor space to a need for a dedicated home office, the pandemic has created new drivers for refinancing, moving and other housing decisions, TD Bank found.

September 11 -

More than half of listings underwent bidding wars in August with some housing markets peaking above 65%, according to Redfin.

September 4 -

Millennials locked in the lowest mortgage rates on record and kept the summer housing market hot, according to Ellie Mae.

September 2 -

Driven by robust purchase demand and tight housing supply, housing price growth reached a two-year high in July, according to CoreLogic.

September 1 -

Treasurer Ma has championed programs to give minority and women-owned businesses a seat at the table throughout her career. A mission of the Treasurer is increasing diversity to increase equitable outcomes.

August 20 -

Despite a housing market that has remained solid during the COVID-19 outbreak, the hesitancy of potential sellers is contributing to one of the most acute shortages of available homes in decades.

August 11 -

About 54% of properties underwent bidding wars in July with some metro areas peaking at 75%, according to Redfin.

August 10 -

While Black homeownership just rose to its highest level in 16 years, it's still the lowest of any racial demographic and 29 percentage points behind white people.

August 6 -

An industry coalition wants to ensure borrowers who took out certain types of loans to fund their education aren’t locked out of access to historically low mortgage rates.

August 5 -

With over 4 million millennials entering prime home buying age each year through 2023, purchase activity will be driven much higher, according to Ellie Mae.

August 5 -

Housing prices continued to grow in June, maintaining a streak in monthly increases that began in February 2012. But the trend could be reversed in 2021 with the resurgent effects of the coronavirus, according to CoreLogic.

August 4 -

Black homeownership grew for the fourth quarter in a row, hitting its largest percentage since 2004 despite disproportionate impacts of the coronavirus.

July 29 -

Down payment assistance programs remain an important tool for increasing minority homeownership, but especially more so because of the pandemic.

July 14 Mountain Lake Consulting

Mountain Lake Consulting -

As the country wrestles economic volatility, millennial homeownership demand rises, fueled by historically low mortgage rates.

July 1 -

How the mortgage and housing industries react to the current civil rights moment could shape policies and bridge the homeownership divide for the Black community.

June 19