-

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

While there was a small uptick in missed payments for multifamily loans, the rate remained in the same area it's been at for the last year, according to the Mortgage Bankers Association.

June 3 -

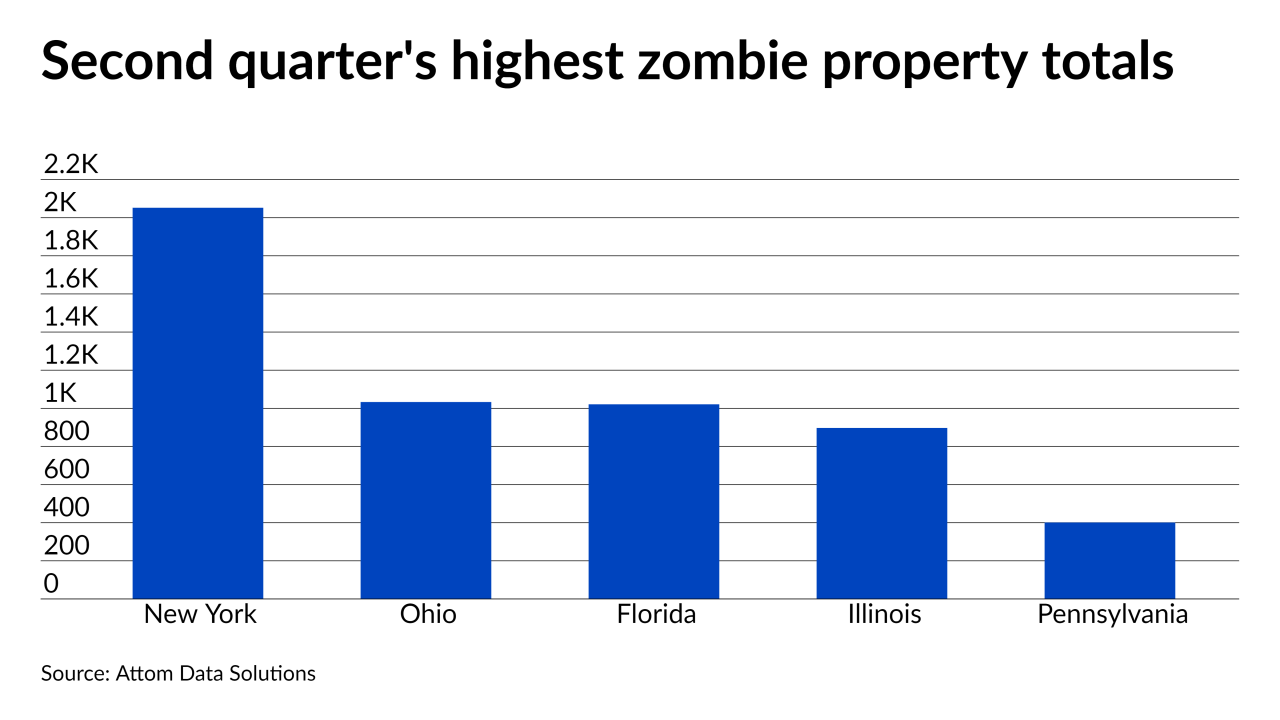

The ongoing CARES Act foreclosure moratoria may have led to distressed borrowers abandoning their homes, according to Attom Data Solutions.

May 27 -

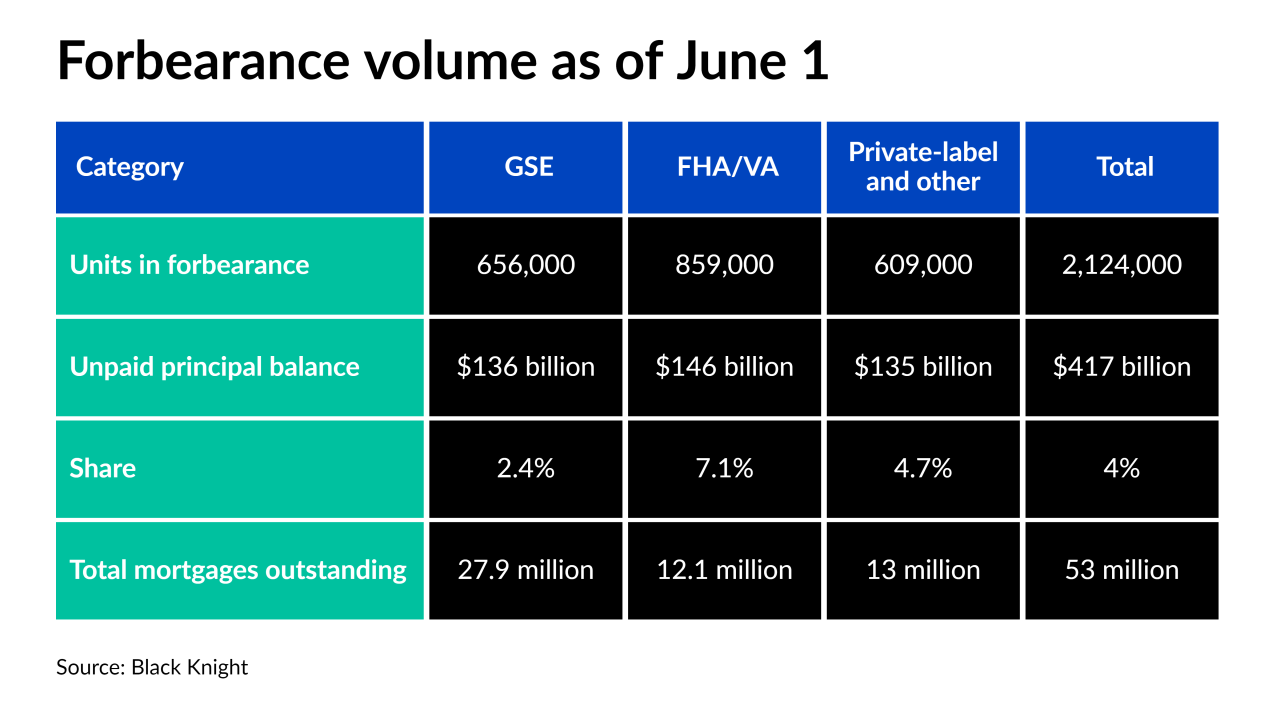

Mortgage forbearances rose for only the second week in the past three months but big drops in numbers could be on the horizon, according to Black Knight.

May 21 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

Issuance of capital market instruments aimed at protecting one government-sponsored enterprise from distressed mortgage credit events staged a relatively quick rebound in 2020, a new Federal Housing Finance Agency report shows.

May 18 -

The rate of new forbearance requests as a share of portfolio volume also dropped to its lowest point since March, the Mortgage Bankers Association reported.

May 18 -

Most of the activity covered vacant and abandoned properties or commercial loans, according to Attom Data Solutions.

May 12 -

Altisource Portfolio Solutions’ bottom line took a larger hit in the first quarter compared to Q4 2020, causing the company to cut costs.

May 10 -

Rents are soaring in many U.S. cities as the economy rebounds, squeezing the budgets of tenants who also face increased risk of eviction after courts overturned a pandemic-era ban from the Center for Disease Control.

May 5 -

Short-term late payment rates rose again and later stage delinquencies remain at elevated levels compared to those prior to the pandemic, the Mortgage Bankers Association said.

May 3 -

An economic rebound, stimulus payments and COVID-19 vaccinations contributed to new delinquencies dropping to an all-time monthly low with more recovery ahead, according to Black Knight.

May 3 -

While government protections currently shield most borrowers and delay process timelines, a growing backlog is likely to hit some areas of the country worse than others.

April 23 -

Thanks to a series of government measures, the pandemic did not cause the massive wave of distressed debt flooding the market that many expected, but certain property types remain vulnerable.

April 23 -

Though the government-sponsored enterprises have some of the lowest forbearance rates in the market, they expect to contend with a significant population of borrowers who face steep financial setbacks after the pandemic ends.

April 22 -

Also, even with bans in place, the total number of filings keeps inching up due to actions taken on vacant properties.

April 15 -

While the overall delinquency rate decreased for the fifth straight month, states with unemployment rates that were double and triple the national average had the most overdue loans, a CoreLogic report found.

April 13 -

The stabilizing economy drove one of the biggest mortgage recoveries on record, according to the Mortgage Bankers Association.

April 12 -

Servicers of loans not related to the government most often capitalized missed payments and converted them into a deferred, non-amortizing balance, said Vadim Verkhoglyad of dv01.

April 12 -

However, the decline in Black Knight’s numbers may stem from a previous deadline that policymakers have since extended.

April 9