-

The vast majority of Americans, especially those that could be downsizing into a smaller property, would rather renovate their current home than save for a down payment, a Zillow survey found.

October 12 -

Home price index swaps, treated as a second lien on a property, will be used to reduce the default risk associated with low down payment mortgages, one of the program's creators said.

October 10 -

Millennials are targeting homeownership within the next few years, but many are buying into certain house-purchasing myths, according to Bank of America.

October 10 -

Homebuyers put about 15% toward a down payment on house, spend $40,000 in one-time fees and thousands in closing costs, presenting an opportunity for lenders to leverage education and product offerings to prepare them for a purchase.

October 2 -

Homebuyers saving for a down payment contributed to the slowest rate of August price appreciation in nearly two years; and the market could have even less momentum by next summer.

October 2 -

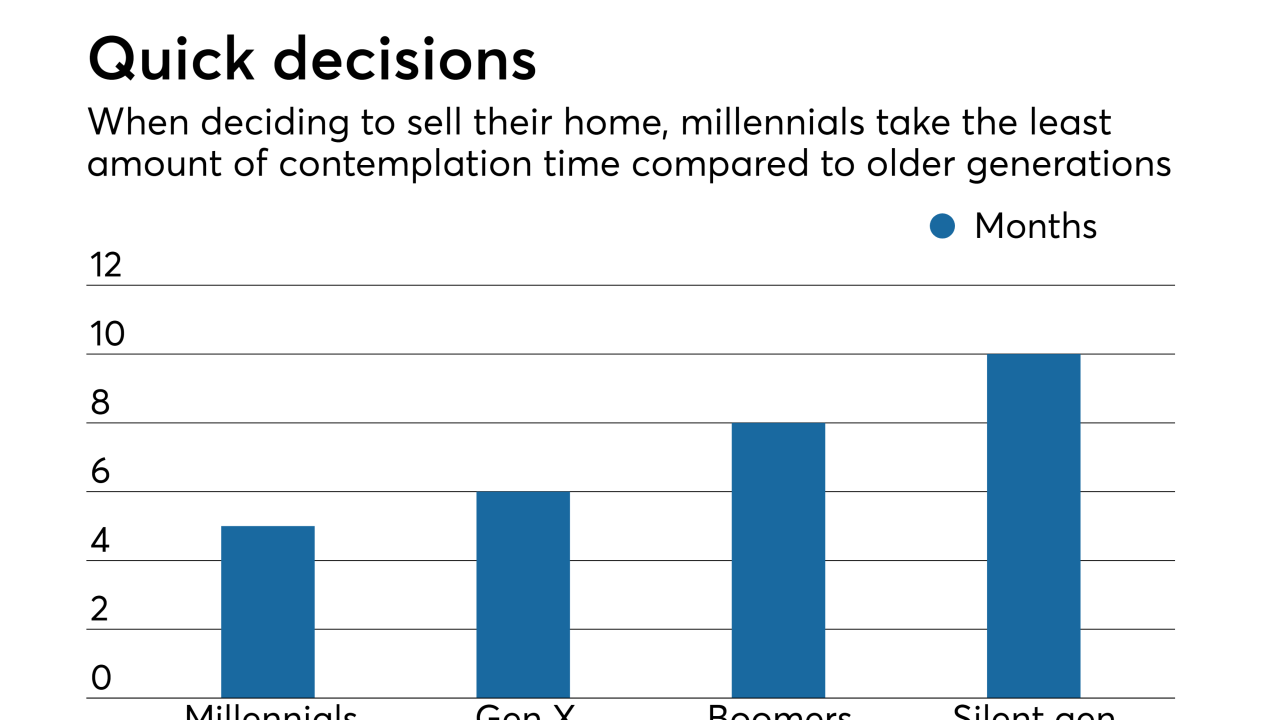

Millennials make up the largest constituent group for both homebuyers and sellers, which could put a squeeze on lending and eventually shift the market.

September 28 -

As home prices continue to rise, a record-high 77% of people surveyed think it's currently a strong time to sell a house, according to the National Association of Realtors.

September 26 -

NMI Holdings is laying the groundwork for President Claudia Merkle to replace CEO Bradley Shuster next year.

September 14 -

Mortgage origination volume continues to decline as homebuyers receiving loans bring more money to the closing table.

September 13 -

How affordable is Tampa Bay? One test is whether someone earning the median income can afford the median priced home.

September 4 -

Private mortgage insurance was the largest source of credit enhancement for new homeowners in the second quarter making a low down payment for the first time ever, according to Genworth Mortgage Insurance.

August 29 -

The typical Portland-area home is out of reach for a median-wage family, new home-sale figures show.

August 27 -

The percentage of low down payment loans using private mortgage insurance continues to grow, and should continue as more first-time homebuyers get conforming loans, according to Keefe Bruyette & Woods.

August 14 -

The Bay Area continues to lead the state in shattered homeownership dreams.

August 14 -

Housing affordability has hit a 10-year low throughout most of California, new data show, as three out of four state residents can no longer afford sky-high median homes prices.

August 9 -

National MI deliberately dropped some of its customers in the second quarter, resulting in flat new insurance growth compared with the first quarter and a lower increase versus one year prior.

August 3 -

The fees that Fannie Mae and Freddie Mac charge for low down payment mortgages disproportionately reflect their risk exposure and make homeownership more difficult for underserved borrowers.

July 23 Milken Institute Center for Financial Markets

Milken Institute Center for Financial Markets -

From Cleveland to Pittsburgh, here's a look at 12 markets offering favorable costs for housing, helping turn renters into potential homebuyers by quickly saving for a down payment.

July 13 -

A Fannie Mae test to handle the private mortgage insurance process for lenders may raise concerns that it's going outside the scope of its secondary market mission. But the effort reflects its mandate to explore new credit-risk transfer alternatives, a company executive said.

July 10 -

Americans selling homes in the nation's hottest market last year made enough to turn around and buy a place for cash — and still have spare change for a Tesla.

June 26