-

While distressed mortgage rates continued the fall’s short-term slide, serious delinquencies are three times higher than the year-ago total, according to CoreLogic.

January 12 -

About 4,400 loans started the foreclosure process in November, alongside 176,000 mortgages in active foreclosure.

December 22 -

The company was accused of sending borrowers erroneous loan modification information between 2014 and 2018.

December 21 -

The new bill ordering $600 stimulus checks and $25 billion in emergency rental assistance won't be enough to help millions of Americans struggling to make housing payments, according to industry watchers.

December 21 -

The company expects a good year ahead for mortgage insurers, assuming that rising employment, higher home prices and payment timing deferrals will help them to mitigate risk.

December 18 -

The percentage of seriously delinquent loans hit 5.8% in the third quarter, up from 1.5% a year earlier but down from 6.8% in the second quarter.

December 16 -

The November foreclosure rate represented an 80% decline from the year before, according to Attom Data Solutions.

December 10 -

While distressed mortgage rates crept down overall, serious delinquencies still tripled year-ago rates in September, according to CoreLogic.

December 8 -

Lower cure rates and possible rises in foreclosures and claims could force these companies to raise capital next year, Fitch Ratings said.

December 4 -

The Federal Housing Finance Agency said that Fannie Mae and Freddie Mac would extend the measures until “at least” Jan. 21, 2021.

December 3 -

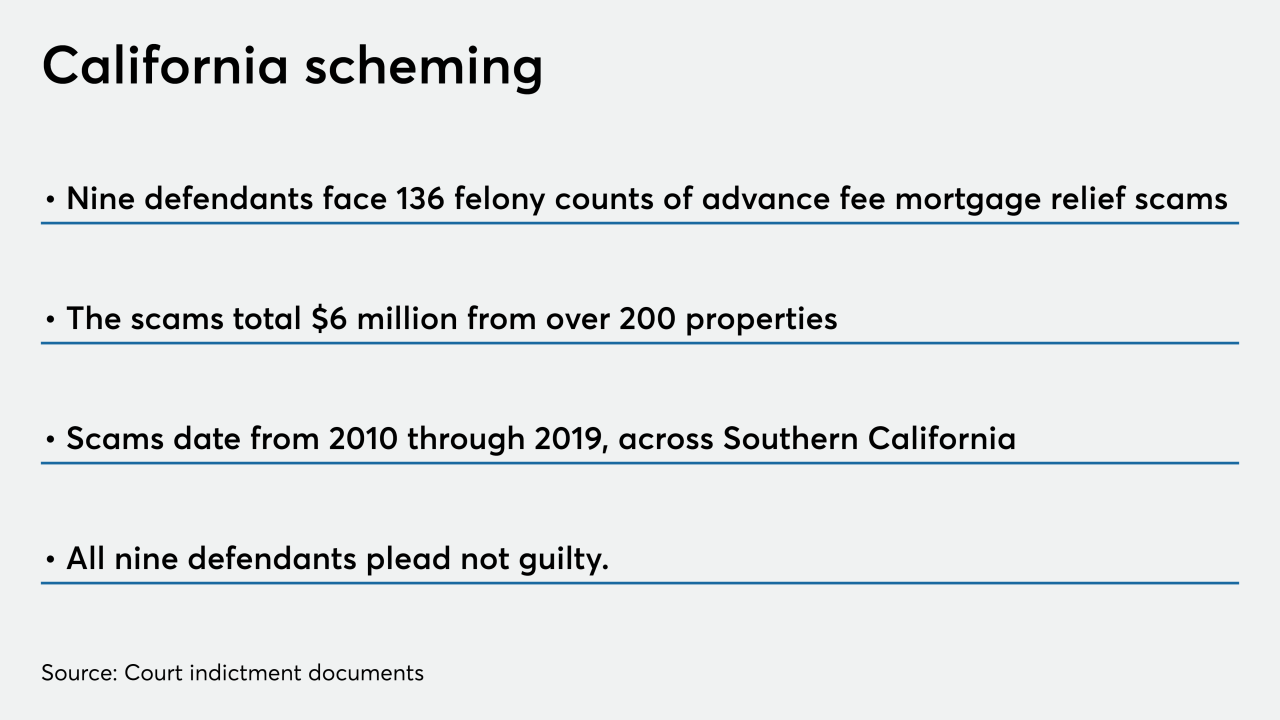

The nine arraigned individuals face 136 counts of felony charges for allegedly running an advance fee mortgage relief scheme over the last decade, totaling $6 million.

November 24 -

While sales increased 24% over August, they were still down 78% from the prior year, Auction.com reported.

November 24 -

Mortgage delinquencies dropped to the lowest level since March but, particularly at the seriously delinquent level, they're still much higher than pre-coronavirus rates, according to Black Knight.

November 23 -

The overall mortgage delinquency rate improved in the third quarter as the economy got healthier while late-stage delinquencies hit a decade high, according to the Mortgage Bankers Association.

November 11 -

While moratoria keep foreclosures low compared to last year's rates, October activity jumped 20% from September, according to Attom Data Solutions.

November 10 -

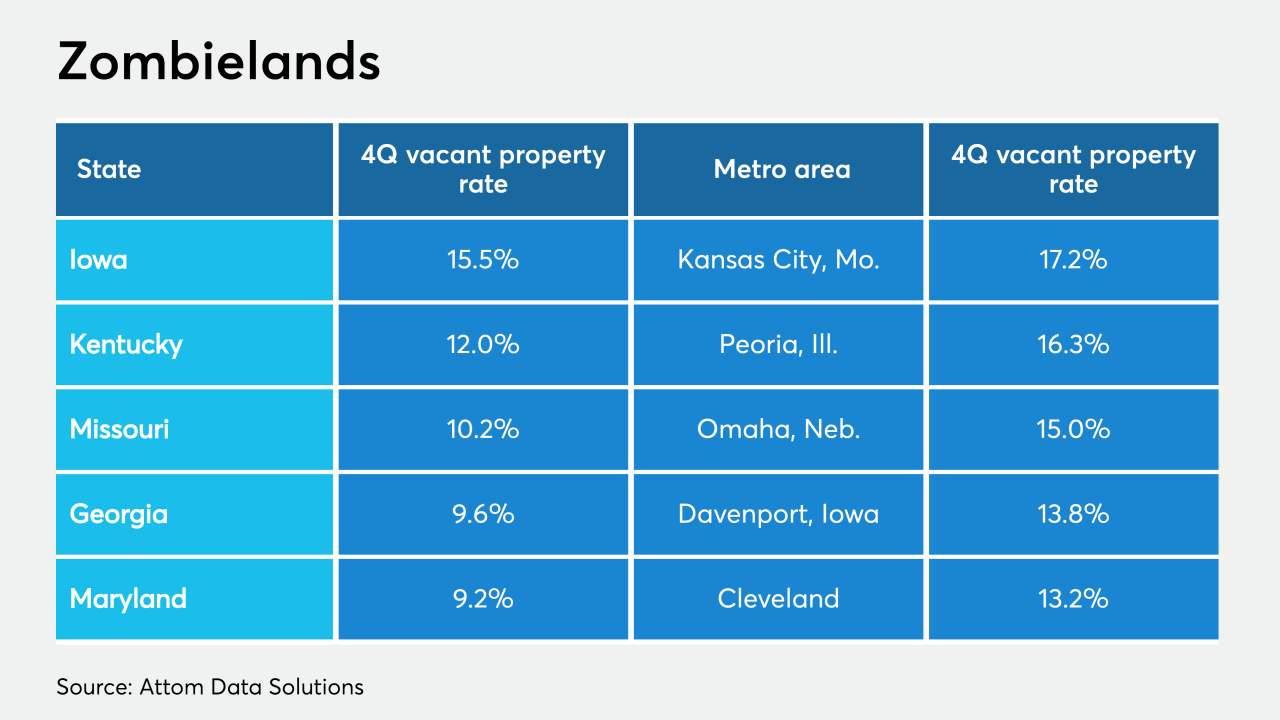

While the total foreclosures continued to fall with coronavirus moratoria in place, the share of zombie properties rose in the fourth quarter, according to Attom Data Solutions.

October 30 -

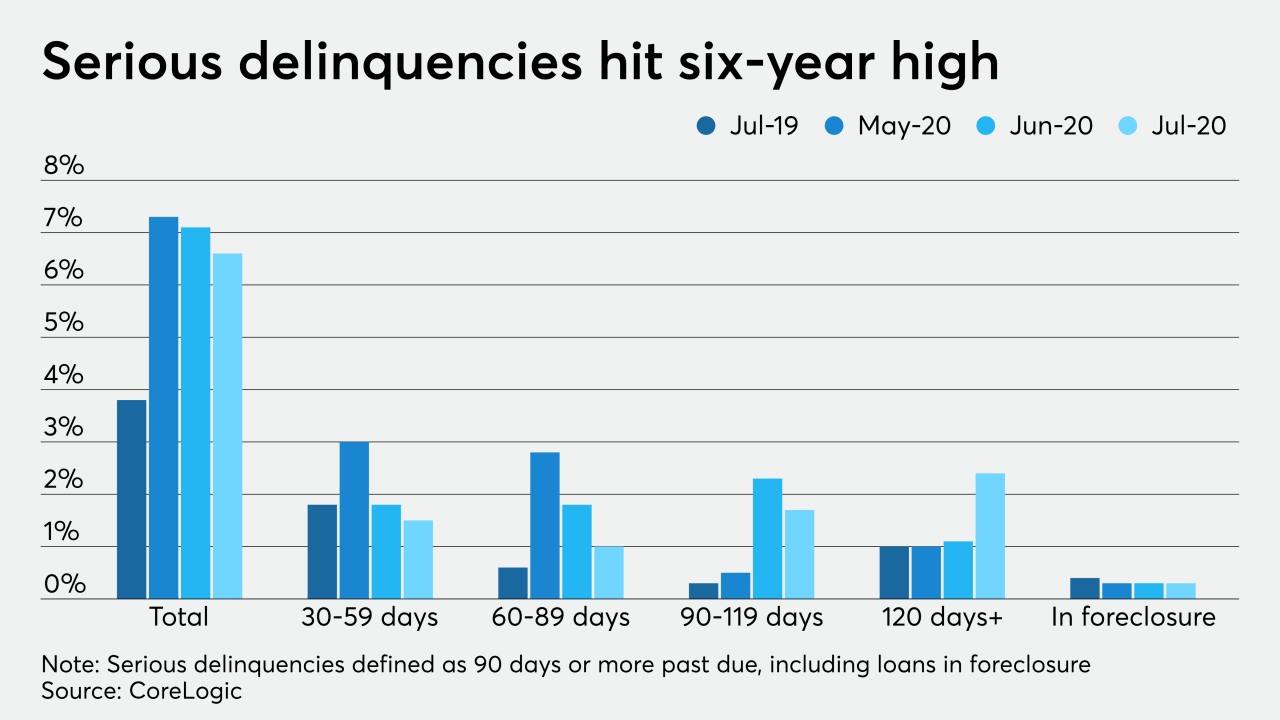

While overall mortgage delinquency rates slowly descend, serious delinquencies — especially loans past 120 days due — jumped in July, according to CoreLogic.

October 13 -

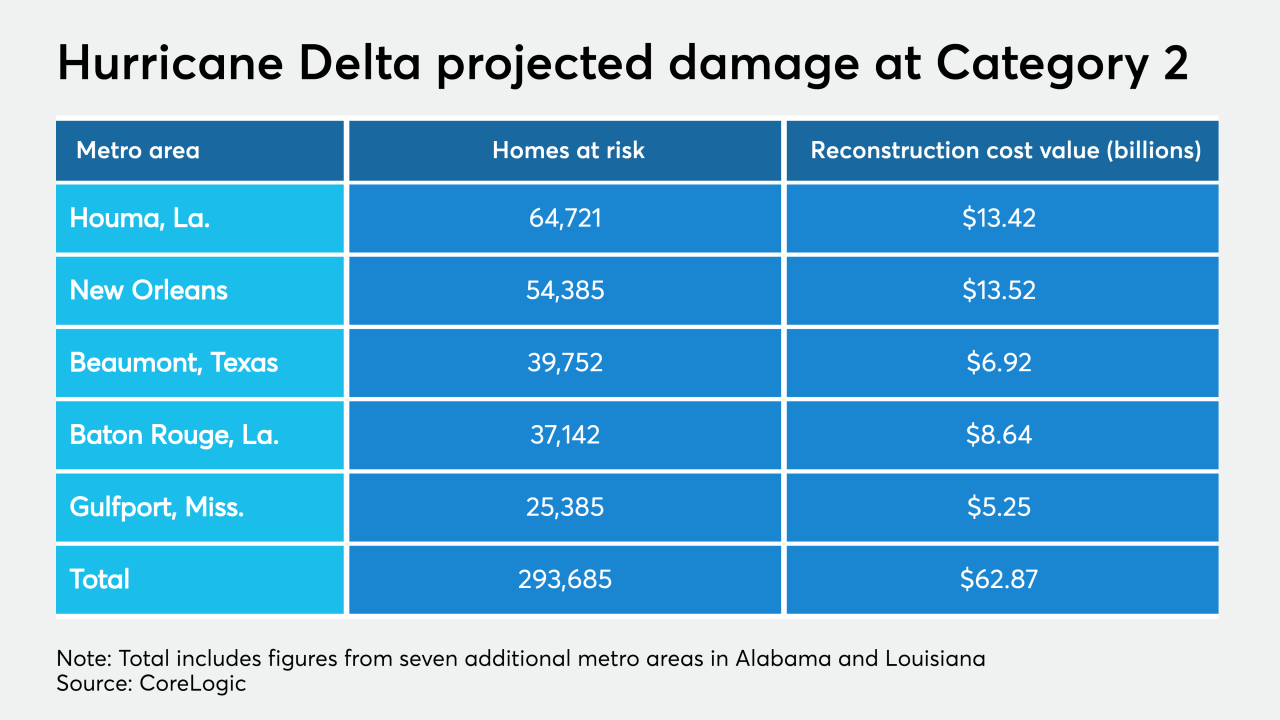

Expected to make landfall as a Category 2 storm, Hurricane Delta's surge is estimated to cause damage to 293,685 residential properties across Alabama, Louisiana, Mississippi and Texas, according to CoreLogic.

October 9 -

The metro areas surrounding New York, Washington, Philadelphia and Baltimore face the highest risk of impact from the pandemic based on home affordability, equity and foreclosures.

October 8 -

The class-action lawsuit claims the company used deceptive contracts, locking low-income Black homebuyers into disadvantageous long-term mortgages without proper lending disclosures.

October 1