-

The meager increase suggests the largest boost in inventory possible would likely still leave the backlog of homes on the market at historic lows.

July 21 -

The return of more normalized numbers for two key players in the home loan market could be the lead-up to a wave that’s been anticipated since the coronavirus arrived.

July 14 -

Most troubled homeowners can avoid a long foreclosure process by selling and exiting with clean credit or even a profit, but a little under 2% may not have enough value in their property.

July 13 -

Identifying where payment stress is concentrated could help mortgage servicers and federal policymakers prepare for the broader range of loan workouts that will resume this summer.

July 8 -

The ruling confirms that a state precedent regarding forward mortgages also applies to home equity conversion loans.

July 1 -

The Federal Housing Finance Agency addressed the period between the end of the federal foreclosure moratorium and the beginning of new Consumer Financial Protection Bureau directives as home loan companies expressed relief that requested exemptions from some foreclosure waiting periods were included.

June 29 -

The Consumer Financial Protection Bureau issued a temporary final rule that allows mortgage servicers to initiate foreclosures on abandoned properties and certain delinquent borrowers, but it also outlined additional measures that shield distressed homeowners.

June 28 -

Experts expect only a small uptick in distressed mortgages, either through default or inability to refinance, which will create some opportunity for debt buyers

June 21 -

Although activity crept down in May from April, it posted “dramatic” increases from the year before, according to Attom Data Solutions.

June 15 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8 -

Hardly a day goes by where a Covius client doesn’t have a question about the timing of various federal and state deadlines, its vice president of compliance writes.

June 8 Covius

Covius -

The sooner troubled loans can be put on a more proactive servicing path, the more likely the distressed homeowners will be able to avoid foreclosure, writes the vice president of market economics at Auction.com.

June 4 Auction.com

Auction.com -

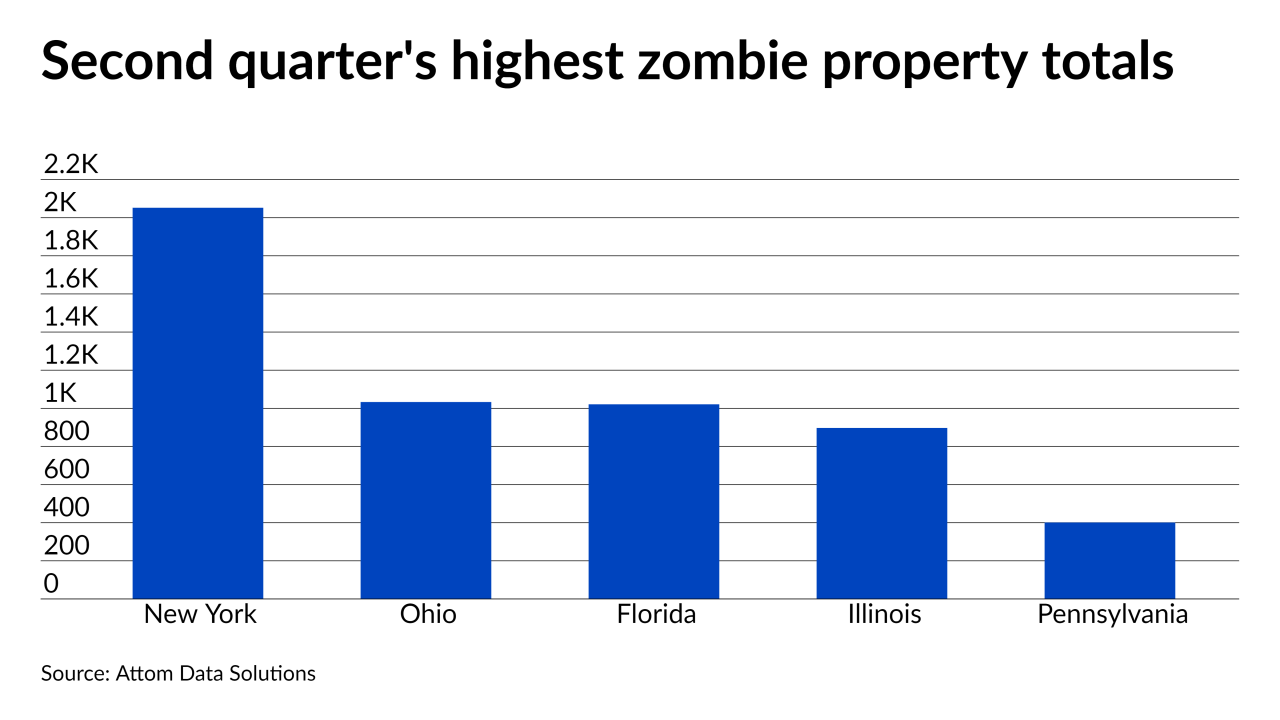

The ongoing CARES Act foreclosure moratoria may have led to distressed borrowers abandoning their homes, according to Attom Data Solutions.

May 27 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

May 19 -

Most of the activity covered vacant and abandoned properties or commercial loans, according to Attom Data Solutions.

May 12 -

Altisource Portfolio Solutions’ bottom line took a larger hit in the first quarter compared to Q4 2020, causing the company to cut costs.

May 10 -

The agreement, which is extended for five years, also expands upon the delinquent mortgages services Altisource will provide to Ocwen.

May 6 -

An economic rebound, stimulus payments and COVID-19 vaccinations contributed to new delinquencies dropping to an all-time monthly low with more recovery ahead, according to Black Knight.

May 3 -

While government protections currently shield most borrowers and delay process timelines, a growing backlog is likely to hit some areas of the country worse than others.

April 23