-

Some lenders have a workaround for the Federal Housing Administration's suspension of reverse mortgage endorsements but fewer options exist in other instances.

October 9 -

"It's likely going to be in the thousands," White House press secretary Karoline Leavitt told reporters on Thursday, saying that the "entire team at the White House" was working to identify possible cuts.

October 2 -

As the government shutdown stalls key housing programs, lenders are shifting tactics to keep loans moving and preparing for bigger challenges ahead.

October 2 -

Department officials pushed back on criticism that a banner on its homepage violated a statute meant to curb partisanship in government operations.

October 1 -

The shutdown started with a flight into treasury bonds, putting downward pressure on financing costs, but several other developments slowed mortgage activity.

October 1 -

The stopgap funding bill paves the way for Republican lawmakers to pivot to signature border and tax bills they seek to pass in the coming months.

March 17 -

The National Flood Insurance Program would ideally be approved yearly, but instead it has gone through 29 reauthorizations since 2017.

March 22 -

The interim measure would finance some U.S. agencies — set to run out of money after Friday — through March 1 and others through March 8.

January 19 -

Frequent federal budget impasses increase insurance concerns and threaten to jack up financing costs that are already straining lenders.

November 14 -

The bipartisan deal struck Saturday temporarily allays concerns that would've required workarounds in parts of the lending process reliant on government agencies.

October 2 -

The House Financial Services Committee passed a bill that would exclude adverse credit information for consumers impacted by a government shutdown.

September 20 -

Economic growth will slow in 2019, but conditions will help home sales hold steady, with mortgage volume now being projected to rise over 2018, according to Fannie Mae.

April 18 -

Continued declines in new- and existing-home construction activity during January showed the housing slowdown was not easing and indicated possible broader economic problems to come, a BuildFax report said.

February 19 -

Charlotte's housing market got off to a slow start in 2019, and some experts say that the government shutdown is partially to blame.

February 13 -

If the government insists on forcing another shutdown, business owners are intent on letting Congress know how much the last one hurt.

February 11 -

Nonbank mortgage companies cut payrolls by 3,100 full-time employees in December, bringing the level of the hiring in the industry to its lowest point in more than two years.

February 1 -

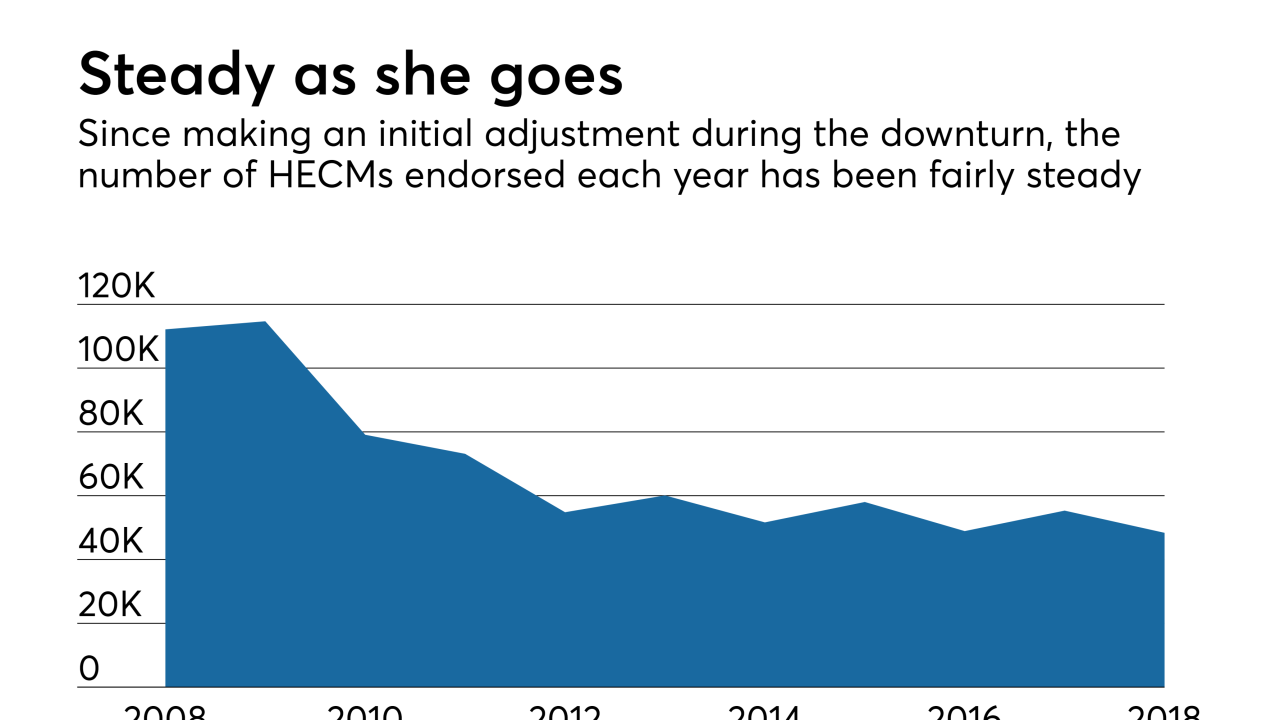

Home equity loans the Federal Housing Administration offers to older borrowers are in a better position now that the government shutdown has temporarily ended.

January 28 -

Across rural America, the government shutdown has eliminated one of the best options for low-to-middle income homebuyers, a zero down payment mortgage from the U.S. Department of Agriculture.

January 24 -

The 30-year fixed-rate mortgage remained unchanged for the third consecutive week, according to Freddie Mac, even with political uncertainty affecting the overall economic outlook.

January 24 -

In a slow mortgage market, construction loans are considered the most likely source of growth for lenders, according to a new study.

January 22