-

The House Financial Services Committee passed a bill that would exclude adverse credit information for consumers impacted by a government shutdown.

September 20 -

Economic growth will slow in 2019, but conditions will help home sales hold steady, with mortgage volume now being projected to rise over 2018, according to Fannie Mae.

April 18 -

Continued declines in new- and existing-home construction activity during January showed the housing slowdown was not easing and indicated possible broader economic problems to come, a BuildFax report said.

February 19 -

Charlotte's housing market got off to a slow start in 2019, and some experts say that the government shutdown is partially to blame.

February 13 -

If the government insists on forcing another shutdown, business owners are intent on letting Congress know how much the last one hurt.

February 11 -

Nonbank mortgage companies cut payrolls by 3,100 full-time employees in December, bringing the level of the hiring in the industry to its lowest point in more than two years.

February 1 -

Home equity loans the Federal Housing Administration offers to older borrowers are in a better position now that the government shutdown has temporarily ended.

January 28 -

Across rural America, the government shutdown has eliminated one of the best options for low-to-middle income homebuyers, a zero down payment mortgage from the U.S. Department of Agriculture.

January 24 -

The 30-year fixed-rate mortgage remained unchanged for the third consecutive week, according to Freddie Mac, even with political uncertainty affecting the overall economic outlook.

January 24 -

In a slow mortgage market, construction loans are considered the most likely source of growth for lenders, according to a new study.

January 22 -

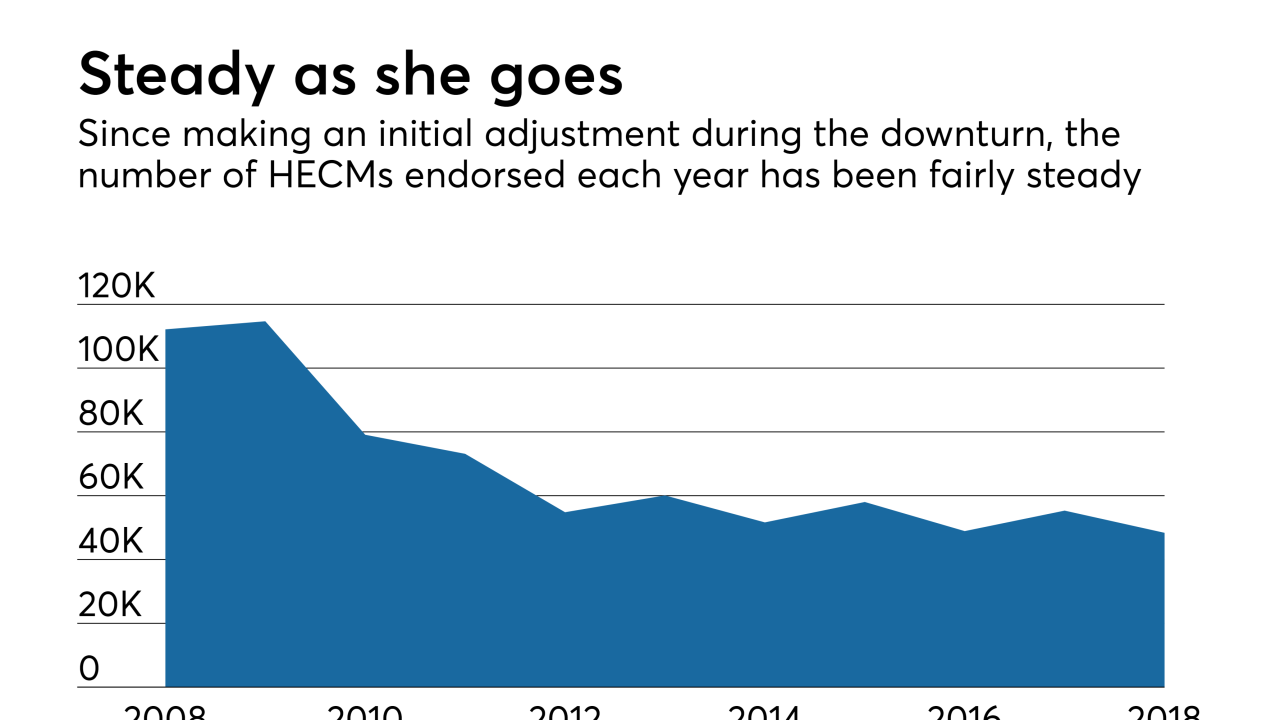

While most single-family Federal Housing Administration lending is somewhat insulated from the government shutdown, the impasse is doing more to hurt funding in niches like nursing home loans and reverse mortgages.

January 18 -

Better Mortgage has launched a mortgage refinance program to help federal government employees affected by the shutdown utilize their home equity for living expenses.

January 18 -

Fannie Mae and Freddie Mac are adding another round of new underwriting requirements and a workaround for employment verification in response to the prolonged government shutdown.

January 17 -

Mortgage rates remained flat after dropping for six consecutive weeks as negative economic news was balanced with a more positive outlook on housing, according to Freddie Mac.

January 17 -

The impasse has halted grant and loan applications and frozen many farm subsidies just weeks ahead of planting season.

January 14 -

With a number of affected borrowers, Freedom Mortgage has assembled a team dedicated to providing assistance for homeowners struggling to make mortgage payments.

January 14 -

Many federal agencies have been closed for more than three weeks, making it the longest shutdown in U.S. history. With no end in sight, here's how it's affecting banks, credit unions and mortgage lenders.

January 13 -

The tricky part: raising awareness without appearing to take advantage of borrowers at a time when agencies like the SBA are out of commission.

January 11 -

The American Bankers Association has called for an end to the government shutdown, saying it has prevented customers from securing loans and threatens even more damage.

January 11 -

A lapse in rental-assistance funding, an understaffed FHA and other effects of the government shutdown are causing real harm to families, said the chair of the House Financial Services Committee.

January 11