-

Five MBS pools of predominantly non-QM mortgages have been launched into the market by originators and loan aggregators, according to ratings agency presale reports published since Monday.

February 13 -

Whether a deal involves a minority stake or a whole company carve-out, buyers and sellers should be aware of five issues that may pose transaction risk in the mortgage market.

February 11 Mayer Brown

Mayer Brown -

The unsuccessful scheme has become the focus of a legal battle involving two former Federal Home Loan Bank of San Francisco employees against that government-sponsored enterprise, which fired them in 2018.

February 11 - LIBOR

The government-sponsored enterprises’ plan to cease accepting loans pegged to the London interbank offered rate a year ahead of its scheduled expiration is expected to hasten action in securitized markets.

February 10 -

To paint nonbanks as a source of systemic risk, particularly given the track record of commercial banks in causing the 2008 subprime mortgage fiasco, seems absurd.

February 7 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

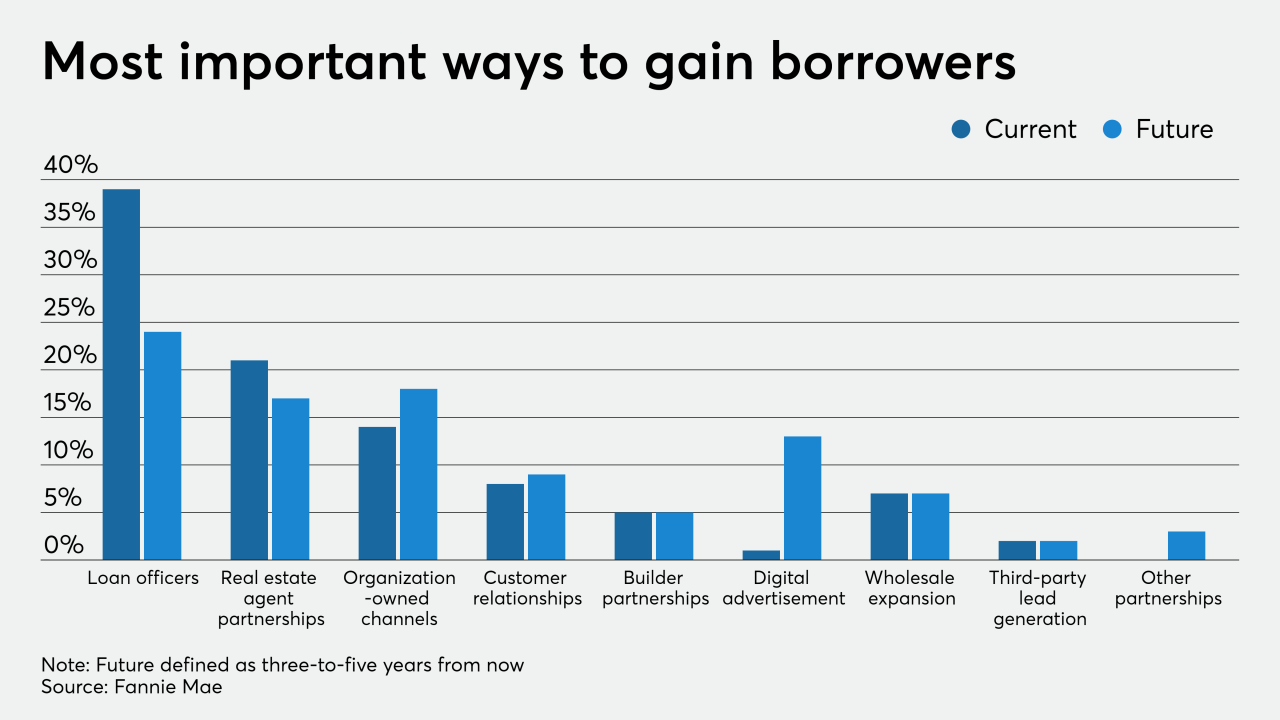

While loan officers will remain mortgage lenders' leading business development tool in the future, those originators believe business will come from a more diversified source pool, a Fannie Mae survey found.

February 7 -

Debt-to-income doesn't perfectly measure a borrower's likelihood of making timely mortgage payments, but it shouldn't be replaced as the ability-to-repay rule evolves, it should be made more flexible instead.

February 5 Platinum Home Mortgage Corp.

Platinum Home Mortgage Corp. -

The Federal Housing Finance Agency plans to increase liquidity standards for nonbank conforming loan servicers, and at the same time raise the net worth requirements for those that also perform the function for Ginnie Mae.

February 5 -

In letters to Freddie Mac and Fannie Mae, six Democrats asked how the mortgage giants are factoring extreme weather into their risk modeling.

February 4 -

With policymakers focused on ending Fannie Mae and Freddie Mac’s conservatorship, their regulator is reorganizing key units and adding staff to position itself for the long term.

February 4 -

The regulator said the investment bank and financial services company will help in the process of strengthening Fannie Mae and Freddie Mac’s capital standing for their eventual exit from conservatorship.

February 3 -

The mortgage securitization market can expect some changes, particularly in the specified pool and to-be-announced markets, alongside a continuation of trends in other areas.

January 31 Vice Capital Markets

Vice Capital Markets -

The number of large-scale natural disasters continued to proliferate in 2019, creating new situations where local mortgage delinquency rates could stay inflated for the following 12 months, according to CoreLogic.

January 29 -

Lower rates spurred a lot of unexpected mortgage business in 2019 but credit unions need to prepare themselves for what happens once the boom ends.

January 28 -

FICO plans to release a new suite of scores that could reduce defaults on newly originated mortgages by 17%, but home lenders may not use it unless the government-sponsored enterprises do.

January 23 -

Trade associations representing mortgage lenders and securities market participants are asking the Federal Housing Finance Agency to rethink a plan to restrict pooling options for loans sold into uniform mortgage-backed securities.

January 22 -

With interest rates expected to stay low while wages and the overall economy grow in conjunction, Fannie Mae again boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

January 22 -

The Federal Housing Finance Agency is considering bringing back the idea of imposing stricter criteria for purchasing mortgages in areas where residential Property Assessed Clean Energy financing is available.

January 21 -

Mortgage lenders' uptake of innovations in artificial intelligence, big data and other technologies has been relatively slow. It's an approach that may not be tenable in 2020.

January 16 -

A former Fannie Mae employee is facing more than six years in federal prison for participating in a scam involving discount sales of properties owned by the government-sponsored enterprise.

January 15