-

Many American homeowners count on the equity in their property to help fund their retirement years, but they might be overconfident by relying on that, according to Unison.

January 30 -

Finance of America Reverse has launched a revolving credit line product that allows borrowing power to increase over time by allowing 75% of funds to grow for future use.

December 18 -

Figure Technologies appears to be one of the few companies to find a viable use case for blockchain in the financial industry — cutting down the costs associated with loan origination.

December 13 -

The SoFi co-founder said Figure Technologies is working with national banks to employ its distributed ledger tech for loan originations.

December 13 -

Hometap, a fintech company providing an alternative to traditional home equity lending, secured $100 million in new financing as it looks to expand its geographic reach.

December 11 -

More than half of the third quarter refinance activity was the cash-out variety, with borrowers removing the most total equity from their homes in nearly 12 years, according to Black Knight.

December 9 -

Home loan originations rose by double digits in the third quarter while auto loan originations approached an all-time high, according to new household credit data from the New York Fed.

November 13 -

Prosper hopes to do for lines of credit what it did for unsecured personal loans, while BBVA hopes to provide a better experience for customers.

November 4 -

The once-popular loan Americans use to finance home renovations and college tuition is slowly dying, slashing a lucrative source of revenue for the nation's largest banks.

October 28 -

Bank of America's total first-mortgage originations rose while its home equity production decreased in the third quarter.

October 16 -

Most home sellers are stressed around issues involving time and money — two things they can't control — because those affect the purchase and financing of their next home, a Zillow survey found.

October 11 -

With housing affordability still a prominent hurdle to homeownership, prospective buyers — especially millennials — now get creative in order to find suitable homes, according to Chase and the Property Brothers.

October 4 -

The number of mortgage holders with refinancing potential dropped by 1.5 million as the average long-term rate for home loans continued to rise, according to Black Knight.

September 20 -

Home equity lenders expect origination activity to remain dreary through next year even though consumers can potentially access more proceeds now than in 2006, a Mortgage Bankers Association survey found.

September 3 -

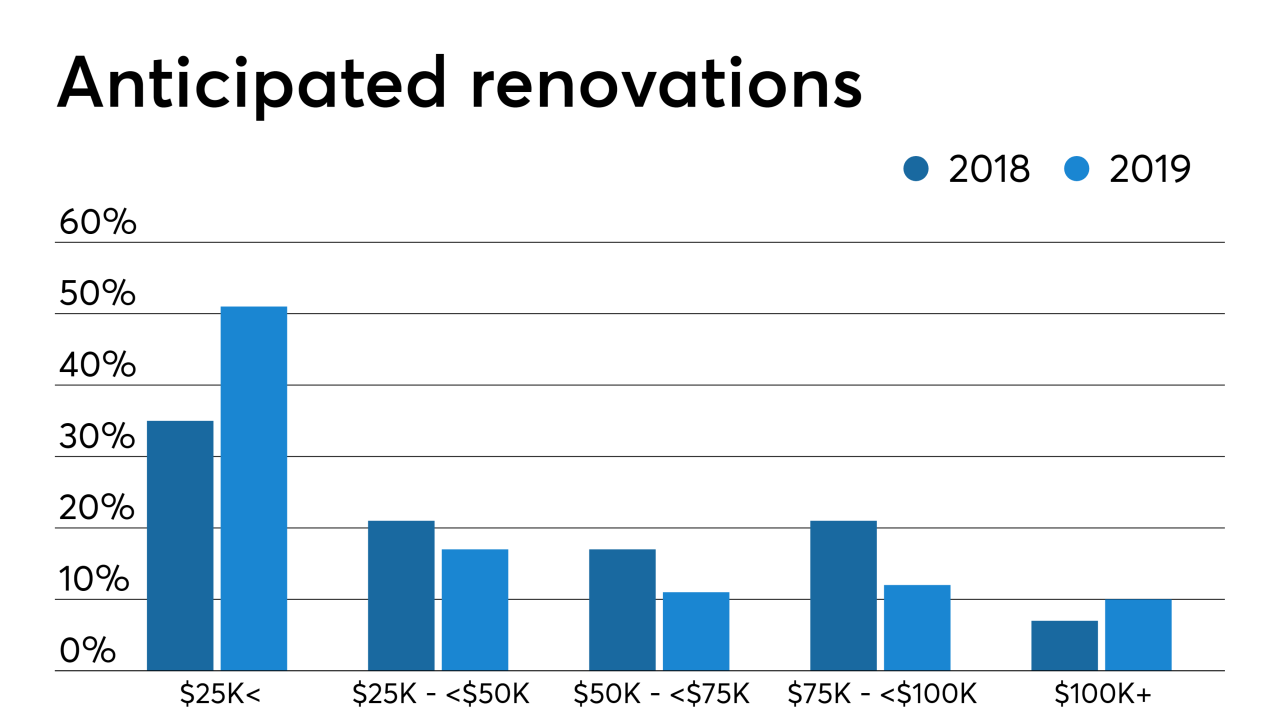

With nearly half of homeowners renovating in the next two years, HELOCs stand as the most likely form of lending sought out by consumers, according to TD Bank.

July 10 -

Cerberus affiliate FirstKey Mortgage will pool outstanding first- and second-lien loans totaling $277.7 million drawn from 1,732 seasoned and performing HELOCs.

June 14 -

It’s the one consumer loan category where balances continue to fall, and disruption from nimbler fintechs is a big reason why. To win back market share, banks will need to beat the upstarts at their own game.

June 7 -

The shift to nonbank lenders will put the breaks on non-qualified mortgage and home equity line of credit origination growth.

May 20 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Live Well Financial, a reverse and traditional mortgage lender that abruptly stopped originating on May 3, will lay off 103 employees, according to a Virginia Employment Commission filing.

May 7 -

The number of homeowners likely to qualify for a refinance nearly doubled in a single week following the largest mortgage rate decline since the housing bubble burst, according to Black Knight.

April 1