-

Most home sellers are stressed around issues involving time and money — two things they can't control — because those affect the purchase and financing of their next home, a Zillow survey found.

October 11 -

With housing affordability still a prominent hurdle to homeownership, prospective buyers — especially millennials — now get creative in order to find suitable homes, according to Chase and the Property Brothers.

October 4 -

The number of mortgage holders with refinancing potential dropped by 1.5 million as the average long-term rate for home loans continued to rise, according to Black Knight.

September 20 -

Home equity lenders expect origination activity to remain dreary through next year even though consumers can potentially access more proceeds now than in 2006, a Mortgage Bankers Association survey found.

September 3 -

With nearly half of homeowners renovating in the next two years, HELOCs stand as the most likely form of lending sought out by consumers, according to TD Bank.

July 10 -

Cerberus affiliate FirstKey Mortgage will pool outstanding first- and second-lien loans totaling $277.7 million drawn from 1,732 seasoned and performing HELOCs.

June 14 -

It’s the one consumer loan category where balances continue to fall, and disruption from nimbler fintechs is a big reason why. To win back market share, banks will need to beat the upstarts at their own game.

June 7 -

The shift to nonbank lenders will put the breaks on non-qualified mortgage and home equity line of credit origination growth.

May 20 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Live Well Financial, a reverse and traditional mortgage lender that abruptly stopped originating on May 3, will lay off 103 employees, according to a Virginia Employment Commission filing.

May 7 -

The number of homeowners likely to qualify for a refinance nearly doubled in a single week following the largest mortgage rate decline since the housing bubble burst, according to Black Knight.

April 1 -

Point, which provides an alternative to traditional home equity lending products, has raised $122 million in new capital from eight investors to expand its reach.

March 20 -

Home equity is at an all-time high, but consumers aren't taking advantage of this financing option, according to LendingTree.

March 19 -

Having an all-digital process results in lower customer satisfaction for home equity line of credit providers than an all in-person or a mix of methods, a J.D. Power survey found.

March 14 -

Strong loan performance continued into December as all delinquency stages fell annually behind equity gains and the sustained rise of home prices, according to CoreLogic.

March 12 -

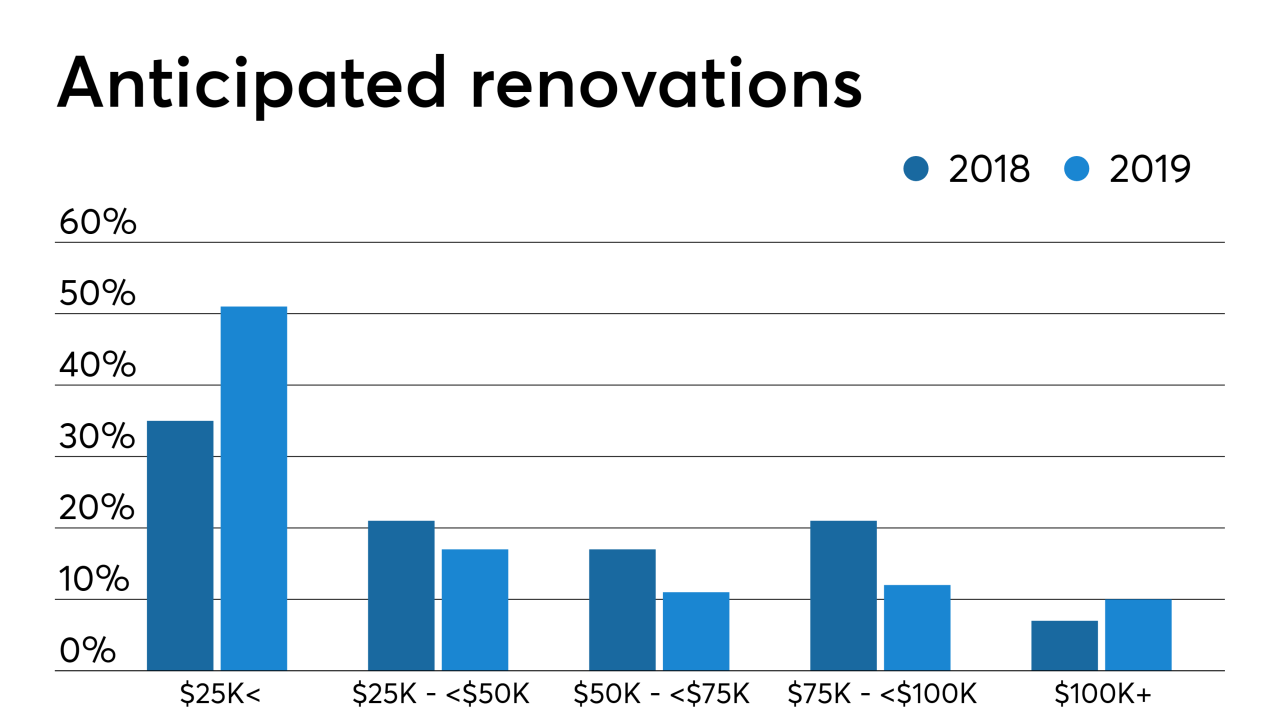

Homeowners are stepping up their renovation game this year, which could be good news for home improvement financing, but bad news for the overall housing market as consumers age in place.

March 6 -

While student, auto and credit card balances are at or near record levels, housing debt is shrinking, credit quality is weakening a bit and lending standards, at least in some sectors, are tightening.

February 19 -

Mortgage loan performance remained strong in November as serious delinquencies fell to their lowest reported level since before the housing bubble burst, according to CoreLogic.

February 12 -

Ellie Mae's latest update to the Encompass loan origination system includes templates to help mortgage lenders with Americans with Disabilities Act compliance.

February 11 -

Toronto-Dominion Bank is seeking to win back customers with home-equity loans — even as concerns grow over elevated consumer debt amid a slowing Canadian economy.

January 29 -

Better Mortgage has launched a mortgage refinance program to help federal government employees affected by the shutdown utilize their home equity for living expenses.

January 18