-

When the economy inevitably slides, leaders with a culture based on the mantra, "Treat people like family, and the money will take care of itself," won't need a miracle to survive.

October 6 Incenter

Incenter -

Mortgages taken out to fund business operations can now be modified in bankruptcy. That’s a relief to borrowers — particularly with business failures expected to increase as the pandemic drags on — but a possible headache for banks and investors that hold the loans.

July 20 -

Closing loans is just one way BMO Harris and other banks are looking to use online notarization. But there are obstacles to overcome before it becomes standard practice.

May 14 -

Wells Fargo will temporarily stop accepting applications for home equity lines of credit, following a similar move by rival JPMorgan Chase.

April 30 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

The nation's largest bank is temporarily reducing its exposure to the mortgage market amid rising unemployment and estimates that home prices could drop by 10%.

April 16 -

The worsening economy brought on by the coronavirus pandemic has big banks rethinking who they will lend to.

April 2 -

First mortgage volumes continue to rise at credit unions, but home equity lines of credit have fallen dramatically in recent years.

December 20 -

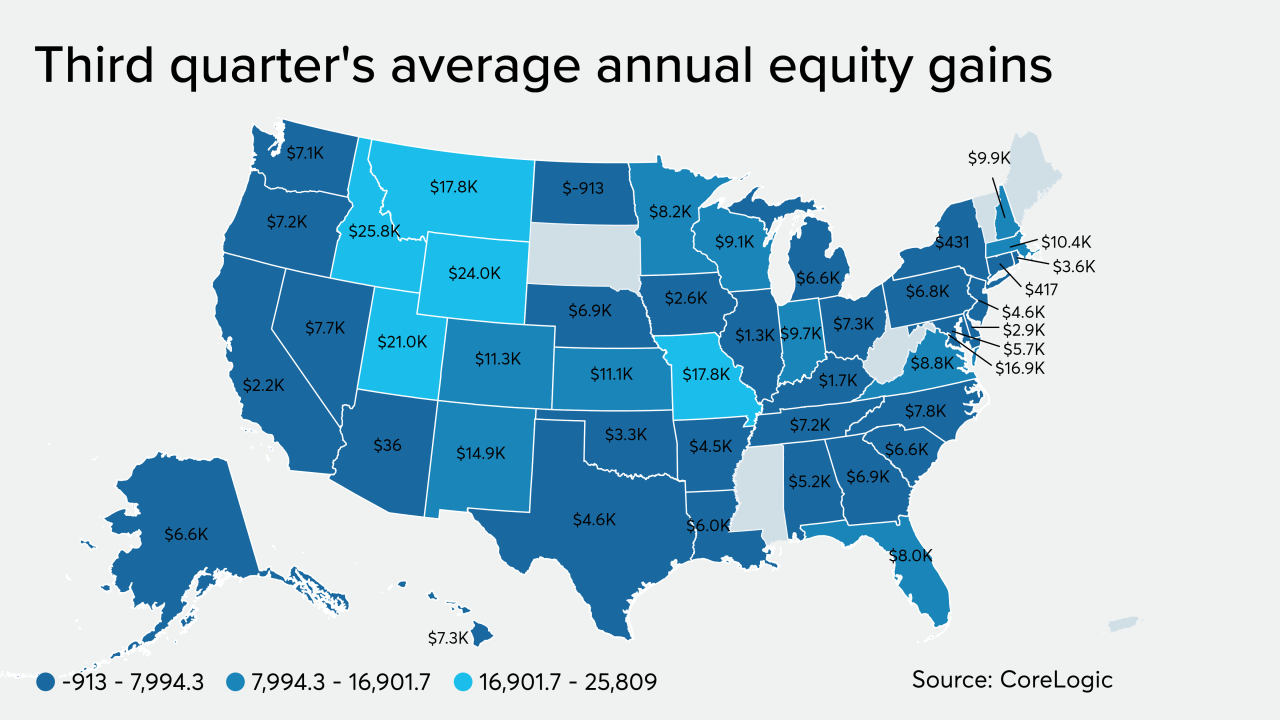

As home value appreciation keeps churning, the share of those upside down on their mortgage grows smaller than ever, according to CoreLogic's Home Equity Report.

December 13 -

Nationstar’s next securitization of defaulted or inactive home equity conversion mortgages will have a higher-than-average exposure to properties with steep leverage, as well as ties to judicial foreclosure states.

November 21 -

Home loan originations rose by double digits in the third quarter while auto loan originations approached an all-time high, according to new household credit data from the New York Fed.

November 13 -

The number of mortgage holders with refinancing potential dropped by 1.5 million as the average long-term rate for home loans continued to rise, according to Black Knight.

September 20 -

Home equity lenders expect origination activity to remain dreary through next year even though consumers can potentially access more proceeds now than in 2006, a Mortgage Bankers Association survey found.

September 3 -

Discover Bank is approaching $1 billion in home equity-related receivables, a milestone for the six-year-old home-loan division that aims to rework the lending process for both its customers and loan officers.

August 5 -

The Federal Housing Administration is aiming to limit the share of borrowers who have been withdrawing money from the value of their homes.

August 1 -

Liberty Home Equity, a subsidiary of Ocwen Financial, is offering a new private-market alternative to Federal Housing Administration-insured reverse mortgages.

July 22 -

An important traditional tool of monetary policy has been diminished and may even become counterproductive in the future.

July 17 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

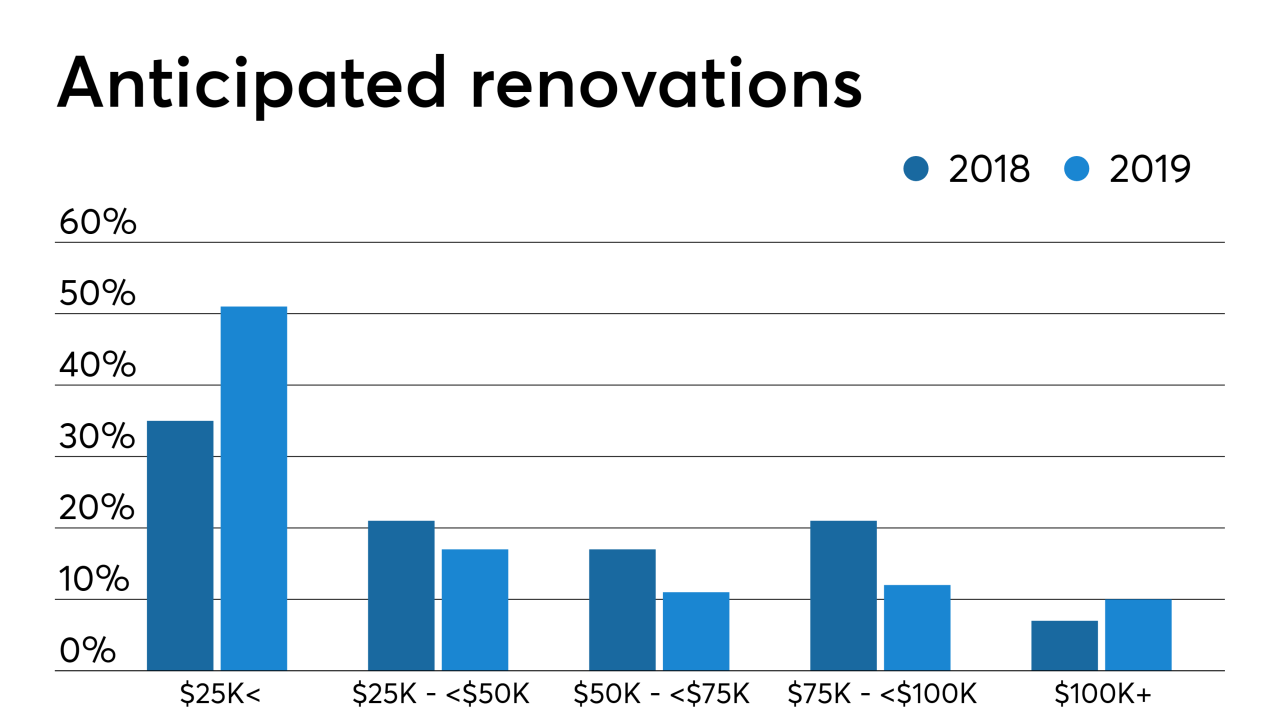

With nearly half of homeowners renovating in the next two years, HELOCs stand as the most likely form of lending sought out by consumers, according to TD Bank.

July 10 -

The CFPB is giving trade groups and consumer advocates another three months to comment on its proposal to change what data is collected under the Home Mortgage Disclosure Act.

June 27 -

It’s the one consumer loan category where balances continue to fall, and disruption from nimbler fintechs is a big reason why. To win back market share, banks will need to beat the upstarts at their own game.

June 7