-

Home loan originations rose by double digits in the third quarter while auto loan originations approached an all-time high, according to new household credit data from the New York Fed.

November 13 -

The number of mortgage holders with refinancing potential dropped by 1.5 million as the average long-term rate for home loans continued to rise, according to Black Knight.

September 20 -

Home equity lenders expect origination activity to remain dreary through next year even though consumers can potentially access more proceeds now than in 2006, a Mortgage Bankers Association survey found.

September 3 -

Discover Bank is approaching $1 billion in home equity-related receivables, a milestone for the six-year-old home-loan division that aims to rework the lending process for both its customers and loan officers.

August 5 -

The Federal Housing Administration is aiming to limit the share of borrowers who have been withdrawing money from the value of their homes.

August 1 -

Liberty Home Equity, a subsidiary of Ocwen Financial, is offering a new private-market alternative to Federal Housing Administration-insured reverse mortgages.

July 22 -

An important traditional tool of monetary policy has been diminished and may even become counterproductive in the future.

July 17 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

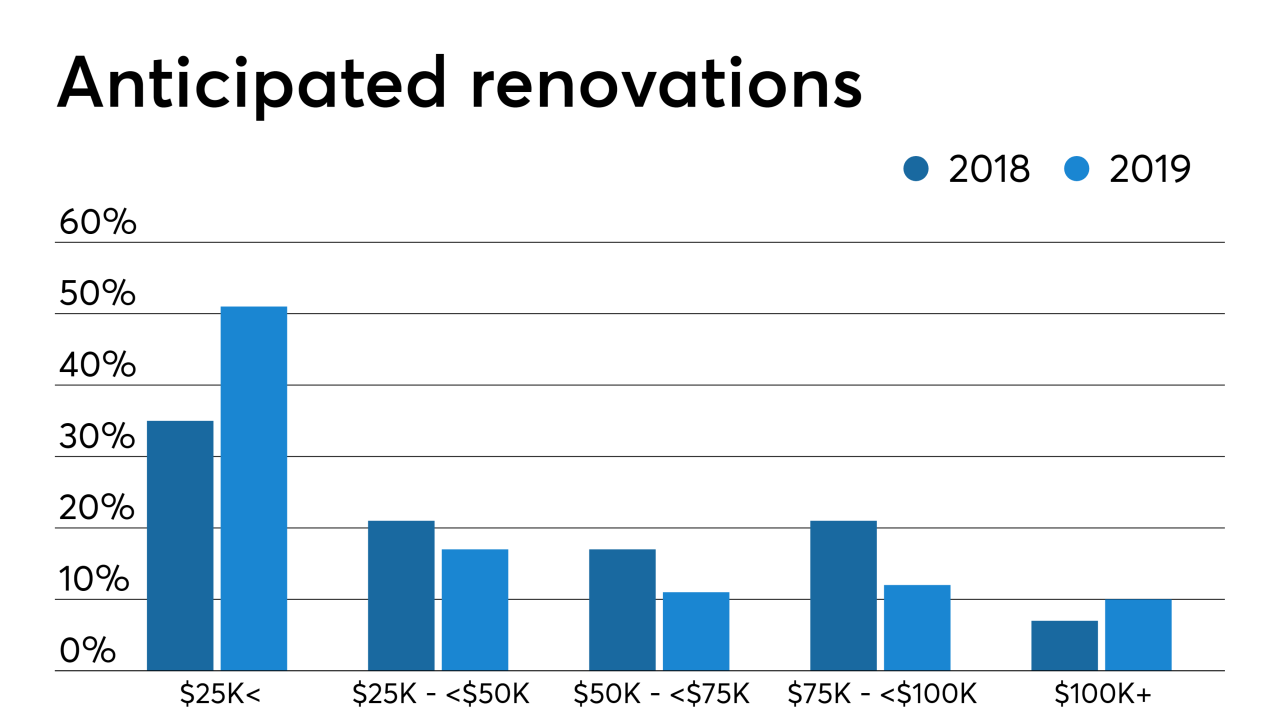

With nearly half of homeowners renovating in the next two years, HELOCs stand as the most likely form of lending sought out by consumers, according to TD Bank.

July 10 -

The CFPB is giving trade groups and consumer advocates another three months to comment on its proposal to change what data is collected under the Home Mortgage Disclosure Act.

June 27 -

It’s the one consumer loan category where balances continue to fall, and disruption from nimbler fintechs is a big reason why. To win back market share, banks will need to beat the upstarts at their own game.

June 7 -

Live Well Financial, a reverse and traditional mortgage lender that abruptly stopped originating on May 3, will lay off 103 employees, according to a Virginia Employment Commission filing.

May 7 -

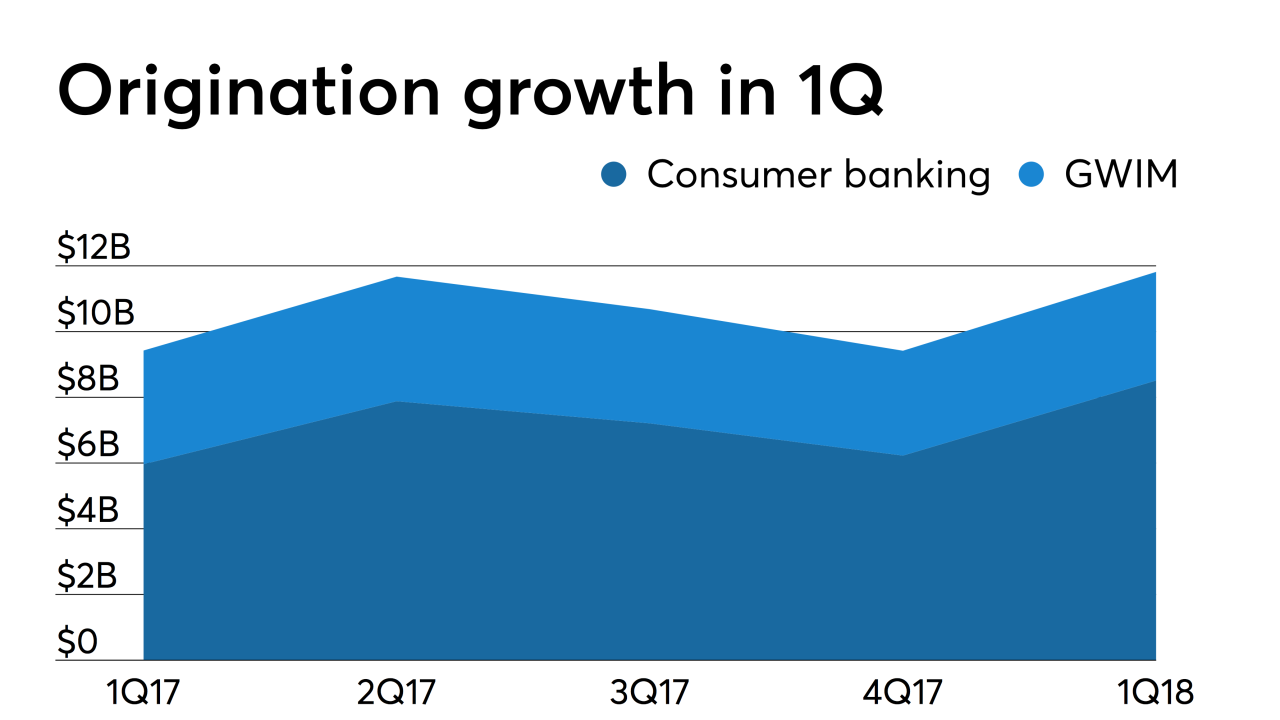

Lower interest rates increased Bank of America's first-quarter residential mortgage volume by 21% over the previous year, while home equity dropped by 25%.

April 16 -

Point, which provides an alternative to traditional home equity lending products, has raised $122 million in new capital from eight investors to expand its reach.

March 20 -

Home equity is at an all-time high, but consumers aren't taking advantage of this financing option, according to LendingTree.

March 19 -

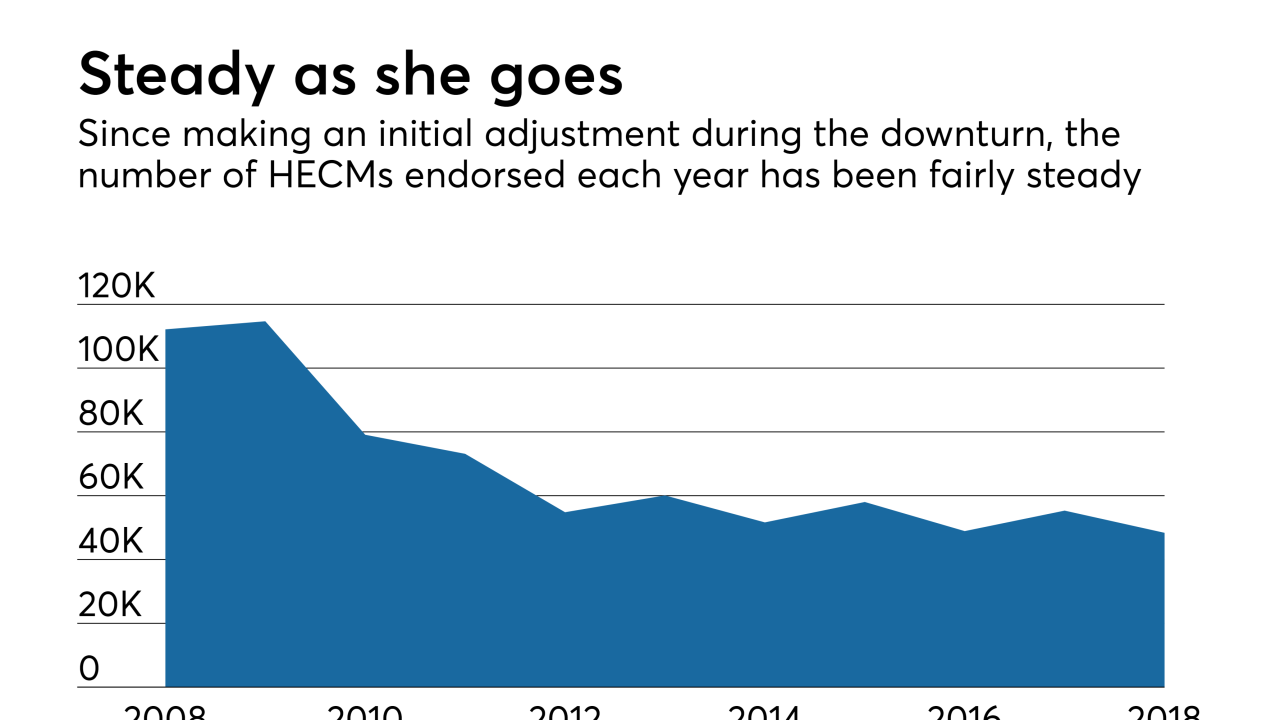

A pair of professors with industry ties say reverse mortgages deserve a second look, partly because of a series of federal reforms in recent years designed to protect taxpayers and consumers.

March 13 -

While millennials comprise the largest cohort of homebuyers, the aging baby boomer generation has created 7.86 million more homeowners and 2.82 million renters age 60 and older — growth rates higher than any other demographic.

March 4 -

Figure, the startup headed by Mike Cagney, uses blockchain technology to provide home equity loans in as little as five days. It intends to use the newly raised funds to offer other services, including wealth management.

February 27 -

Home equity loans the Federal Housing Administration offers to older borrowers are in a better position now that the government shutdown has temporarily ended.

January 28 -

Better Mortgage has launched a mortgage refinance program to help federal government employees affected by the shutdown utilize their home equity for living expenses.

January 18 -

Bank of America's first-mortgage production dropped almost 26% year-over-year in the fourth quarter of 2018, but it experienced a less severe 10% decline in home equity lending during the same period.

January 16