-

Finance of America Reverse has launched a revolving credit line product that allows borrowing power to increase over time by allowing 75% of funds to grow for future use.

December 18 -

A larger share of Manhattan high-end residential property purchasers took out a mortgage during the third quarter rather than pay all cash for their condominium

December 16 -

Last month, brokers anticipated local residential markets swinging, if ever so slightly, to give buyers more bargaining power.

December 6 -

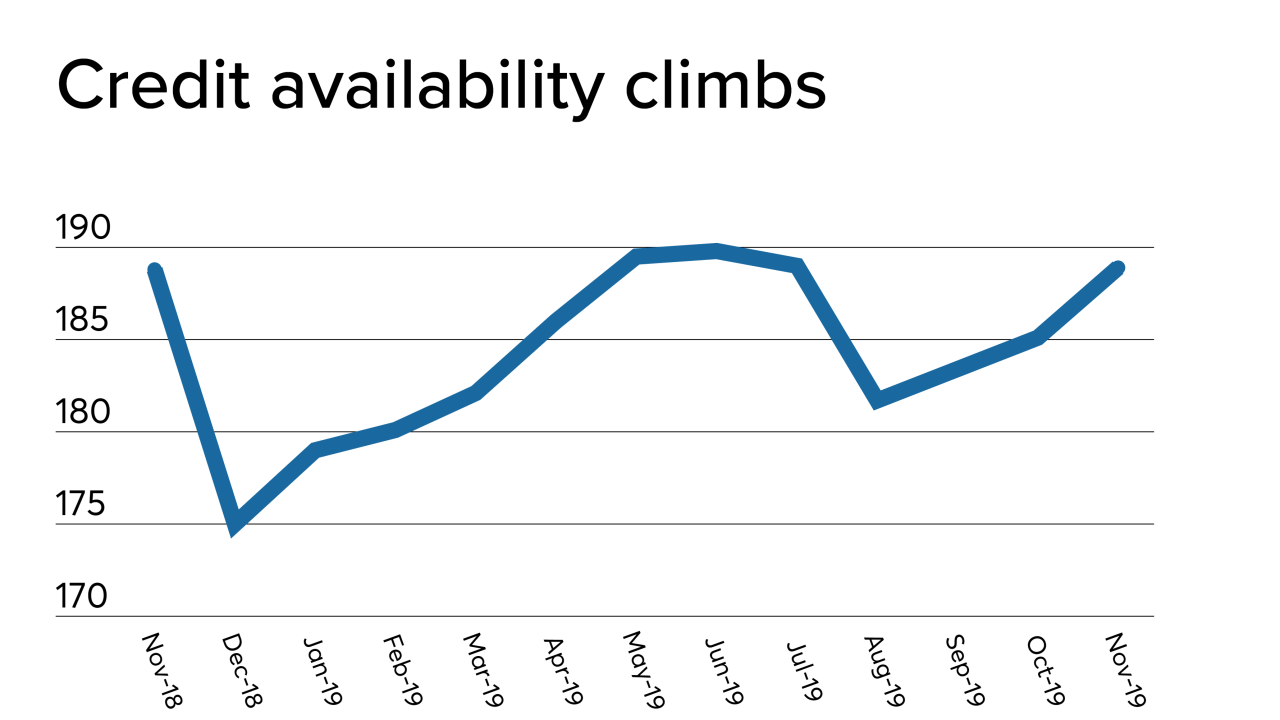

The availability of mortgage credit jumped in November from the previous month as jumbo activity and refinancing in the government market increased, according to the Mortgage Bankers Association.

December 5 -

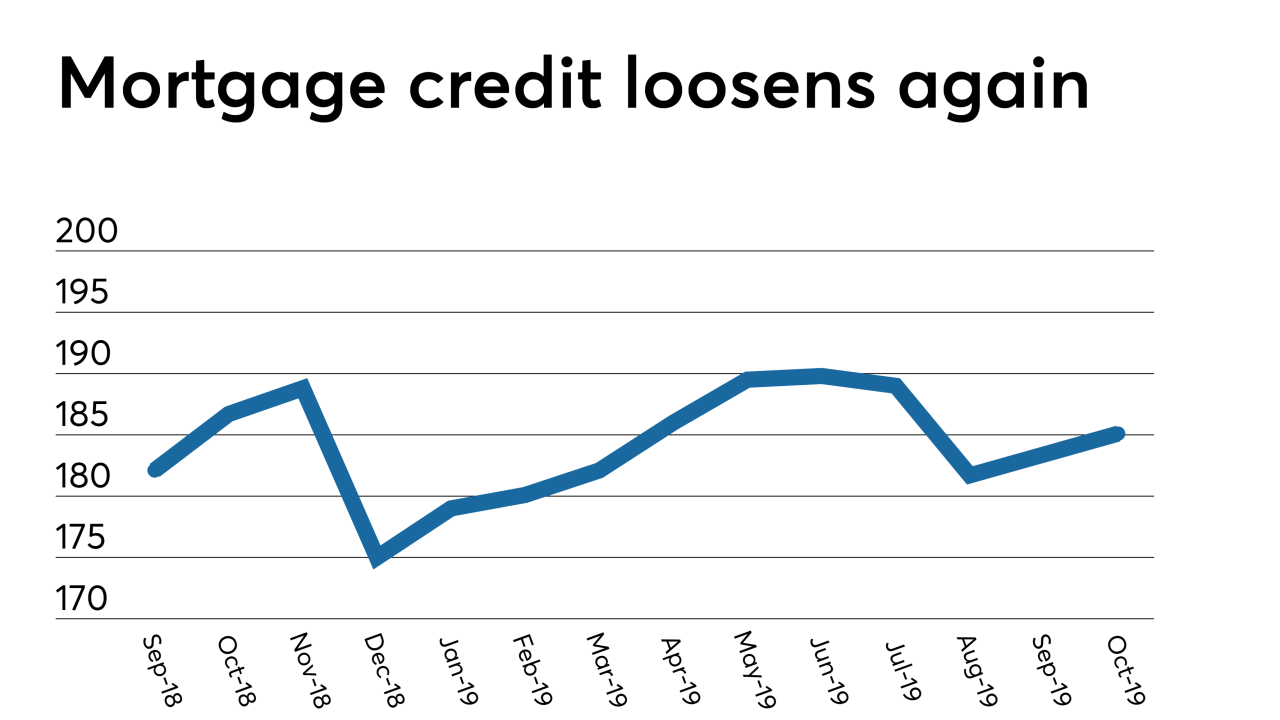

Mortgage credit availability increased in October from the previous month, as mortgage lenders increased their product offerings outside the government market, according to the Mortgage Bankers Association.

November 12 -

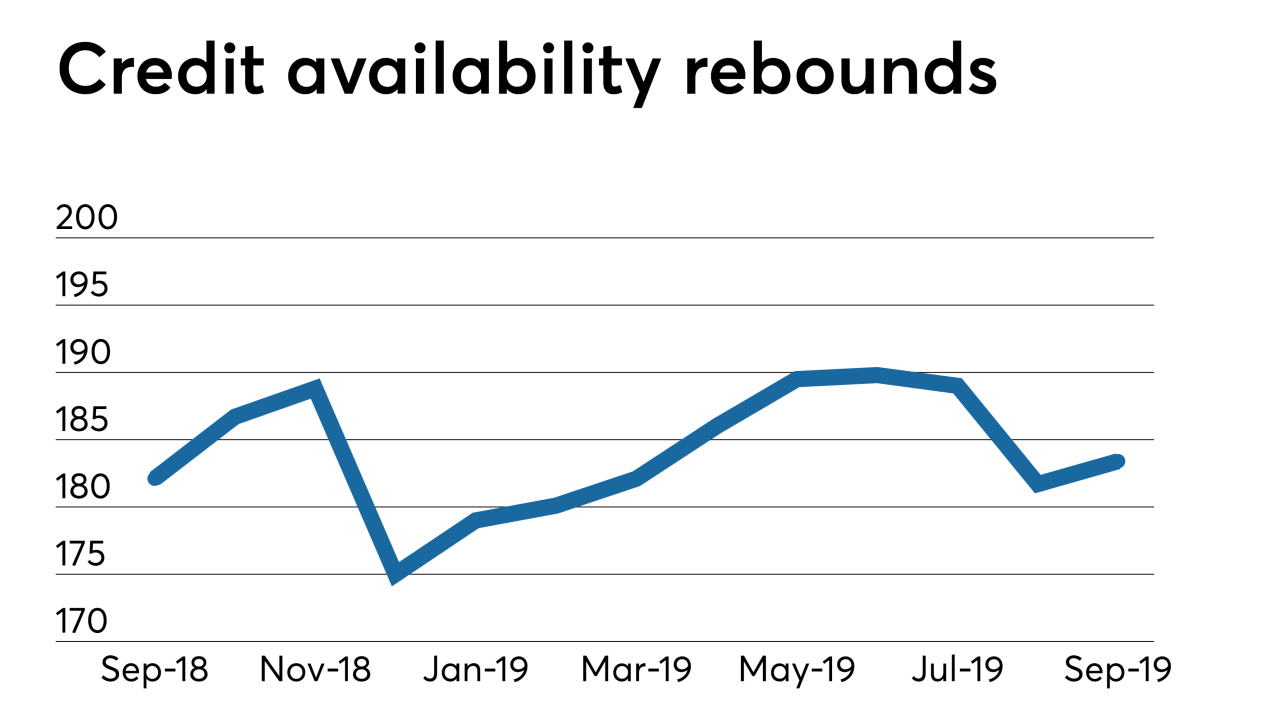

September's increase in mortgage credit availability was driven by the expansion of jumbo products to record levels, which overcame a retrenchment in both conforming and government programs, the Mortgage Bankers Association said.

October 8 -

Mortgage credit availability tightened in August by the most since the end of last year, even though falling interest rates sparked a strong uptick in refinancings, the Mortgage Bankers Association said.

September 12 -

A swell of refinance demand amid a low mortgage rate environment pushed lender profit margin outlooks to the highest level since the first quarter of 2015, according to Fannie Mae.

September 11 -

HSBC anticipates its mortgage underwriting volume ramping up significantly after recent initiatives to provide loan officers with more tools and time to address the complex needs of affluent customers, often from overseas.

August 8 -

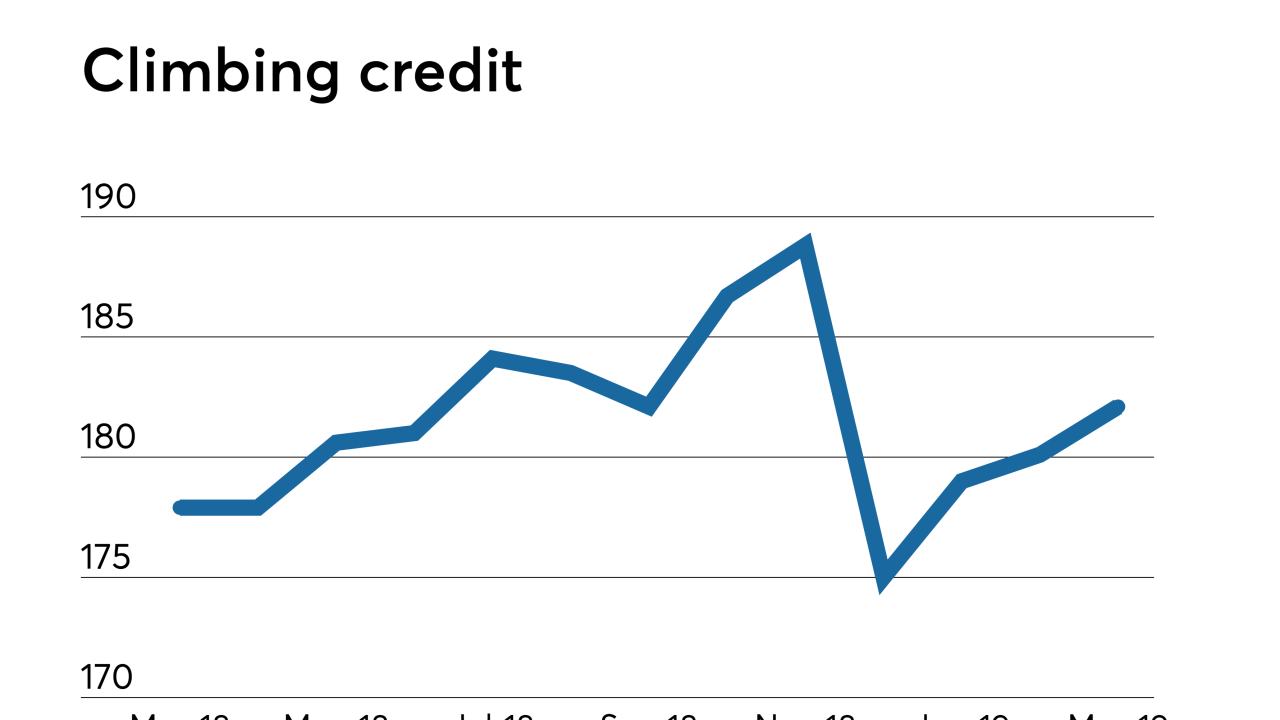

Jumbo loan product availability continued climbing and reached an all-time high in July, but it wasn't enough to stop overall credit standards from tightening, according to the Mortgage Bankers Association.

August 8 -

With affordability still an issue despite falling interest rates and harnessed home value growth, lenders further loosened credit standards in June, according to the Mortgage Bankers Association.

July 9 -

Large banks had huge losses from originating mortgages in 2018 as costs were three times higher than similar-sized independent lenders, according to research conducted by Stratmor and the Mortgage Bankers Association.

June 21 -

As purchase applications stall in the heart of home buying season despite mortgage rates nearing two-year lows, lenders continued to loosen credit standards in May, according to the Mortgage Bankers Association.

June 11 -

Plaza Home Mortgage has improved its pricing for certain jumbo loans that Fannie Mae's automated underwriting system approves, but categorizes as ineligible due to loan size.

May 28 -

The shift to nonbank lenders will put the breaks on non-qualified mortgage and home equity line of credit origination growth.

May 20 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Mortgage lending credit standards loosened a bit last month as investors displayed more interest in non-qualified mortgage and nonagency jumbo loans to stay competitive, according to the Mortgage Bankers Association.

May 9 -

Having a cash-out refinance program is important to greater share of originators in the West than it is in the United States as a whole, the Top Producers 2019 survey found.

May 1 -

Mortgage lending standards loosened in March, as a swell in jumbo credit helped drive an expansion in availability for the third straight month, according to the Mortgage Bankers Association.

April 4 -

Plaza Home Mortgage has expanded the guidelines of its wholesale and correspondent non-qualified mortgage program to allow using bank statements for documenting income.

April 3 -

The digital lender rebranded its mortgage business as SoFi Home Loans about four months after it took a step back from real estate finance to redesign its processes.

March 29