-

Continued diversification of its business lines and better margins in its securitization activities helped Redwood Trust overcome steep mortgage origination declines and post nearly 14% annual growth in net income during the third quarter.

November 8 -

The amount of mortgage credit available to consumers increased to a post-crisis high in October in reaction to more first-time homebuyers entering the market, the Mortgage Bankers Association said.

November 6 -

Although forecasts anticipate a continuing drop in overall originations, private-label residential mortgage-backed securitizations backed by newer loans are expected to keep increasing through next year, according to Bank of America.

November 5 -

Lenders offered fewer government-guaranteed mortgage programs in September, leading to an overall decline in mortgage credit availability, according to the Mortgage Bankers Association.

October 4 -

Finance of America Reverse is offering a new second-lien alternative to the Federal Housing Administration's Home Equity Conversion Mortgage that can be placed on a property with a pre-existing first-lien loan.

September 26 -

Increased competition among non-qualified mortgage lenders leading to lower starting interest rates for borrowers should result in fewer of these loans prepaying within one year of origination, said Standard & Poor's.

September 24 -

Mortgage credit accessibility dropped for the first time in four months as jumbo loan products took a step back, according to the Mortgage Bankers Association.

September 11 -

Moody's Investors Service downgraded JPMorgan Chase's prime jumbo mortgage originator assessment to its second-highest rating, citing the bank's growing reliance on correspondents with delegated underwriting authority and shortcomings in its technology infrastructure.

August 24 -

Private-label versions of the Federal Housing Administration's Home Equity Conversion Mortgage have spread to the point where a widely-used loan origination system has added technology to handle the product.

August 24 -

New investor appetite for mortgages over $1 million is motivating more nonbank lenders to offer super jumbo loans, often with weaker credit terms than traditional banks.

August 20 -

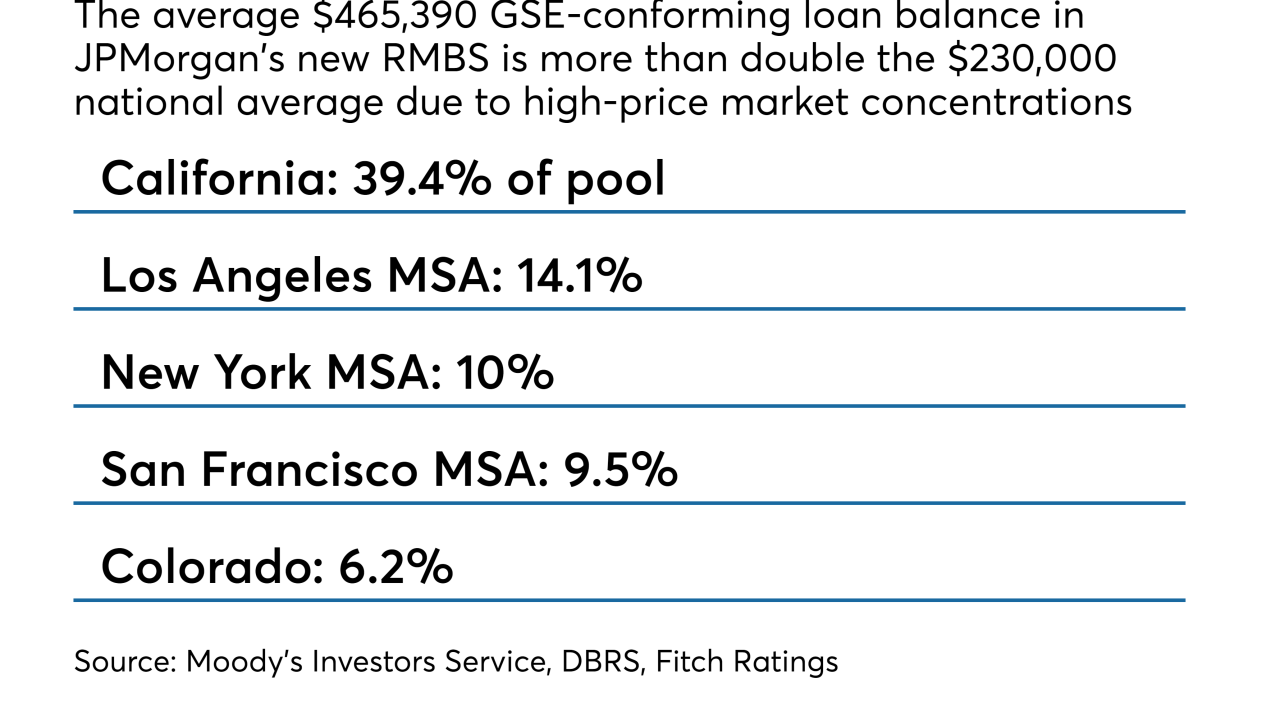

Nearly half the loans were derived outside J.P. Morgan's retail channel, a level not seen in its conforming and prime jumbo securitizations since 2017.

August 15 -

Quicken Loans subsidiary One Reverse Mortgage is rolling out a private-label alternative to the Federal Housing Administration's Home Equity Conversion Mortgage that offers higher loan limits and more flexible underwriting terms.

August 8 -

Redwood Trust's net income was down 30% from the prior quarter as mortgage banking activities earnings fell by 60%.

August 8 -

Mortgage credit accessibility kept climbing in July, mostly thanks to an expansion of jumbo loan products offered, pushing that index to its historical high point, according to the Mortgage Bankers Association.

August 7 -

Some collateral attributes, such as non-full documentation and a high percentage of non-QM and HPQM loans, fall slightly outside the credit box seen in other recent prime transactions, according to Fitch.

July 26 -

Redwood Trust has priced a new stock offering that is aimed at increasing funding to new initiatives like investments in the single-family rental and multifamily sectors as well as routine business.

July 25 -

American Mortgage Consultants has acquired the right to hire 50 employees from The Barrent Group and will add 150 more in response to increased private-label securitization.

July 24 -

As property values continue appreciating, Caliber Home Loans added a jumbo loan product to its portfolio lending suite to support borrower needs in a climate of higher home prices.

July 17 -

Optimal Blue is expanding its reach in the secondary mortgage market by acquiring Resitrader, a whole-loan trading marketplace that has integrations with Fannie Mae and Freddie Mac.

July 10 -

Access to mortgage credit inched up in June, as competition for jumbo loans resulted in looser underwriting, but government lending standards got more restrictive, the Mortgage Bankers Association said.

July 10