-

A federal judge denied the Office of the Comptroller of the Currency's motion to have the case thrown out, saying concerns about the agency's rulemaking process to reform the Community Reinvestment Act have merit.

February 1 -

The company also reported a large fourth-quarter loss that reflected a significant increase in its loan-loss provision.

February 1 -

The CFPB’s allegations are similar to unresolved accusations Connecticut first levied against the company in 2018.

January 15 -

The new complaint filed by the lender in the state’s Superior Court is aimed at compelling a January decision on the 2018 allegations.

January 13 -

The complaint unsealed Monday alleges three individuals and several companies they owned or controlled engaged in False Claims Act violations involving short sales of properties that had Federal Housing Administration-insured mortgages.

January 5 -

The CFPB issued two rulemakings in 2020 that the financial services industry and consumer advocates hoped would finally clarify key issues over how collectors contact debtors and deal with legacy debts. But both sides want the incoming Biden administration to make further changes.

January 5 -

A real estate firm focused on gentrifying neighborhoods is showing cracks after a group of its apartment buildings in New York’s Upper West Side and Harlem filed for bankruptcy.

December 30 -

The three-year loan will boost the hotel-centered REIT's dwindling cash reserves battered by the COVID-19 global impact on travel.

December 28 -

The agency's rule outlines steps collectors must take to inform consumers about an outstanding debt, and prohibits companies from pursuing lawsuits after a statute of limitations has ended.

December 18 -

If CMBS litigation picks up in earnest in the aftermath of the pandemic, lessons gleaned from over a decade of RMBS litigation could pay dividends, Bilzen Sumberg lawyers Philip Stein and Kenneth Duvall say.

December 8 Bilzin Sumberg

Bilzin Sumberg -

The three companies agreed to pay a total of $74 million in remediation.

December 7 -

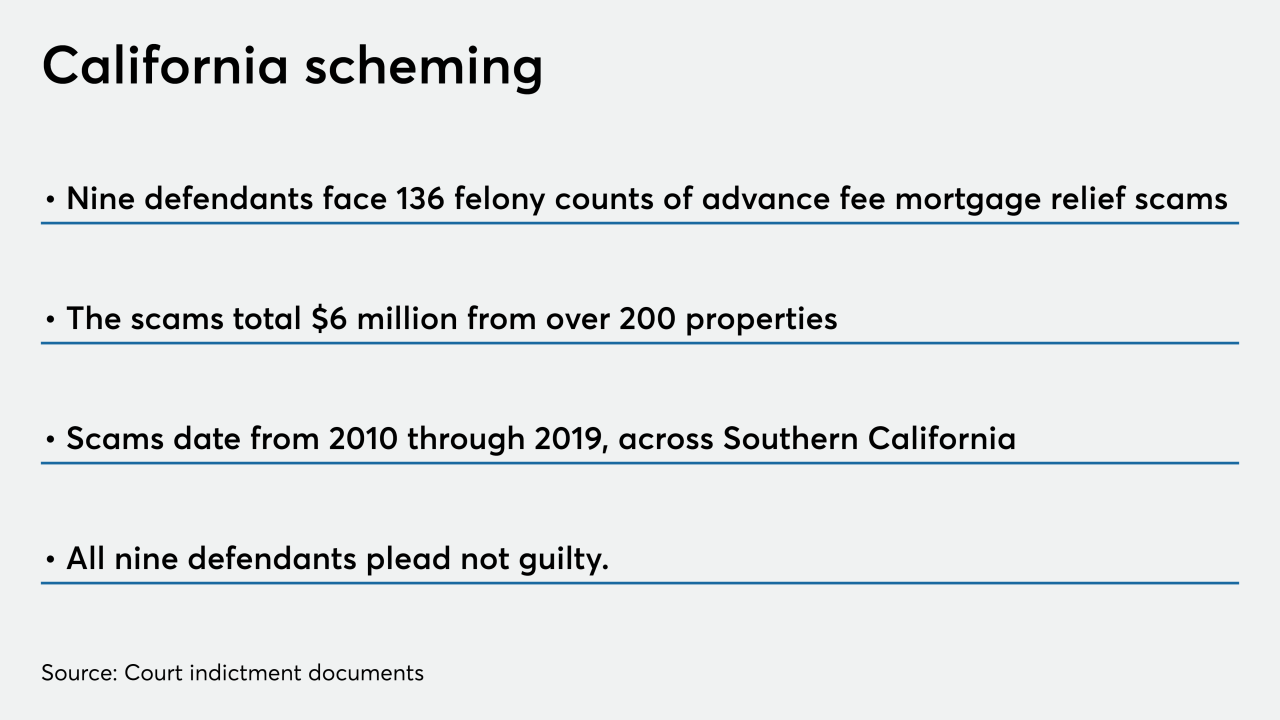

The nine arraigned individuals face 136 counts of felony charges for allegedly running an advance fee mortgage relief scheme over the last decade, totaling $6 million.

November 24 -

The president-elect has legal backing to fire Director Kathy Kraninger thanks to a recent court ruling, but Republicans are prepared to challenge his ability to choose her successor.

November 23 -

The agency’s final rule modernizing the Fair Debt Collection Practice Act limits calls to seven per week, but collectors won stronger protections from liability claims and other key changes to the original proposal.

October 30 -

The agency’s consolidation of supervision and enforcement policy into one office could compromise the independence of those deciding when to investigate alleged wrongdoing by banks and others, critics of the move say.

October 22 -

The Buffalo, N.Y., bank will pay a $546,000 penalty, which will be passed on to the National Flood Insurance Program to help offset costs.

October 15 -

If the tally included loans with some form of payment relief, the rate would be close to 8%.

October 5 -

The class-action lawsuit claims the company used deceptive contracts, locking low-income Black homebuyers into disadvantageous long-term mortgages without proper lending disclosures.

October 1 -

A former home mortgage consultant with the company alleges she was subjected to a lower compensation structure, awards and benefits compared to her male counterparts.

August 12 -

Democrats Elizabeth Warren of Massachusetts and Brian Schatz of Hawaii have sent a letter to CEO Charlie Scharf demanding a response to news reports that the bank has been placing borrowers into forbearance plans without their consent.

July 30