-

Quicken Loans, which has a history of advertising its Rocket Mortgage digital application with high-profile Super Bowl promotions, is doubling down on its ties to the National Football League event.

January 7 -

Canadian Imperial Bank of Commerce expects its growth in domestic mortgages to be more “market-like” in 2020, after last year’s contraction in home-loan balances, Chief Executive Officer Victor Dodig said.

January 7 -

Consumer attorneys are filing more Telephone Consumer Protection Act lawsuits than ever and if a piece of follow-up legislation becomes law, the peril to mortgage lenders will grow.

December 27 Jornaya

Jornaya -

Roostify is working with Level Access — a software provider enabling disabled people access to technology — to offer Americans with Disabilities Act compliant websites and mobile applications.

November 15 -

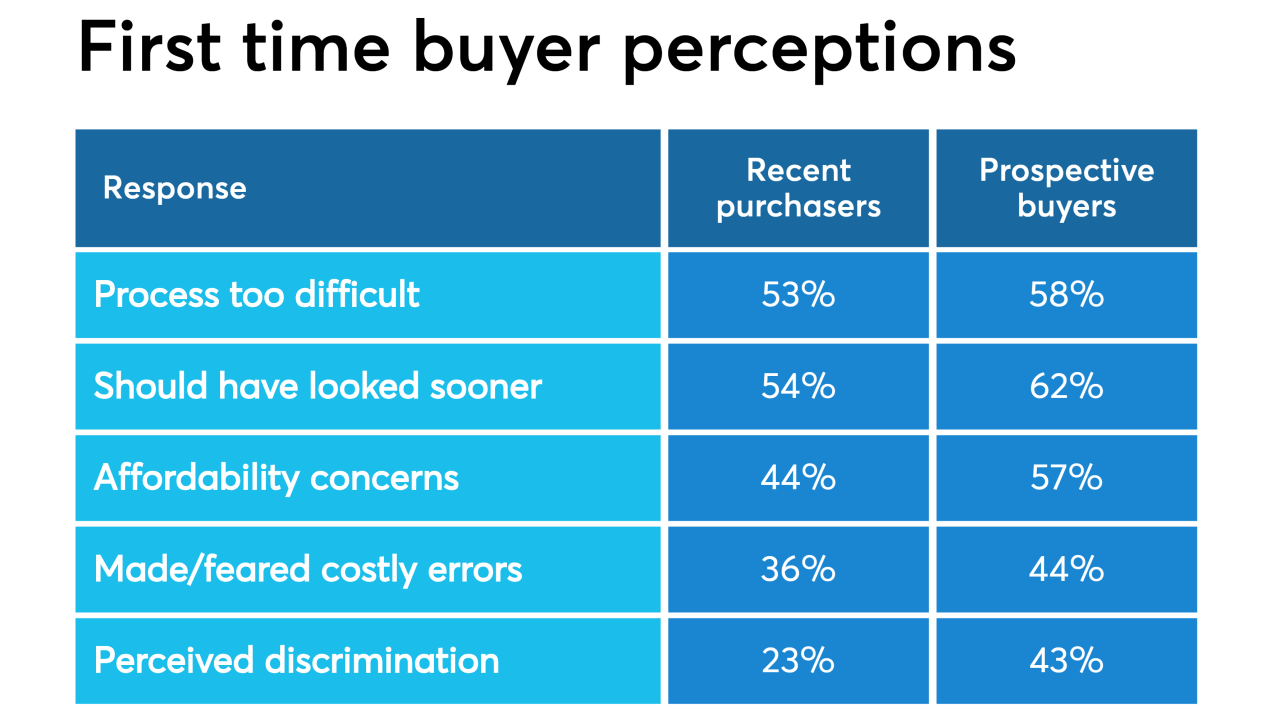

More than half of recent, as well as prospective, first-time homebuyers said purchasing a house was more difficult than it should be, according to a survey for Framework.

September 25 -

The most successful mortgage originators will use artificial intelligence and machine learning to enhance and enable their people to have better, more meaningful engagements with customers.

September 20 Total Expert

Total Expert -

Seven real estate companies are now facing age-discrimination complaints over allegations they used advertisements posted on Facebook to filter out potential clients over a certain age.

September 19 -

Like many regional banking companies, Huntington Bancshares casts itself as a community bank, albeit one with more than $100 billion in assets.

September 9 -

The bucket of homeowners in the money to refinance includes anyone who bought a home in the last 18 months, and lenders are on the phone calling them.

September 3 -

Long Island foreclosure sales doubled over the last five years as the county courts made a priority of clearing bust-era cases.

August 27 -

The pursuit of a more digital mortgage business always involves a balancing act between the drive for automation and the preference or need many consumers may have for some kind of personal touch.

August 16 -

Angel Oak is now offering mortgage brokers and correspondent loan sellers a prequalification tool to determine borrower eligibility for non-qualified mortgages.

August 14 -

HSBC anticipates its mortgage underwriting volume ramping up significantly after recent initiatives to provide loan officers with more tools and time to address the complex needs of affluent customers, often from overseas.

August 8 -

Zillow Group shares were poised to fall to a six-week low after its results and updated forecasts suggested its entire "portfolio is faltering" at a critical time for the company looking to pivot its business, analysts said.

August 8 -

Before signing a home purchase contract, the vast majority of potential homebuyers already selected their mortgage lender in order to compete with investors, a Fannie Mae survey found.

August 5 -

Removing Federal Housing Administration-insured mortgages with natural-disaster forbearance from the agency's delinquency tracking database would give investors a less-distorted view of loan performance, according to the Community Home Lenders Association.

July 29 -

Investments in proprietary front-end software to mark next phase of mortgage initiative.

July 12 -

Homebuilders that team with mortgage lenders get higher levels of borrower satisfaction with the finance process, according to a loanDepot study. This comes as more consumers are evaluating financing options first, highlighting an opportunity to reach them earlier on.

June 28 -

Real value comes from the wholesaler using a hands-on approach to ensure that a mortgage broker's customers are treated to the best experience for the life of the loan.

June 21 Home Point Financial

Home Point Financial -

As Amazon looms over the mortgage industry, expert views differ on the retail monolith claiming its stake in the sector.

June 18