M&A

M&A

-

First American Financial, a title insurance underwriter and settlement services provider, is acquiring mortgage document firm Docutech for $350 million in cash.

February 13 -

Whether a deal involves a minority stake or a whole company carve-out, buyers and sellers should be aware of five issues that may pose transaction risk in the mortgage market.

February 11 -

Simon Property Group agreed to buy rival shopping-mall operator Taubman Centers for about $3.6 billion, a combination that comes as e-commerce continues to roil brick-and-mortar retail.

February 10 -

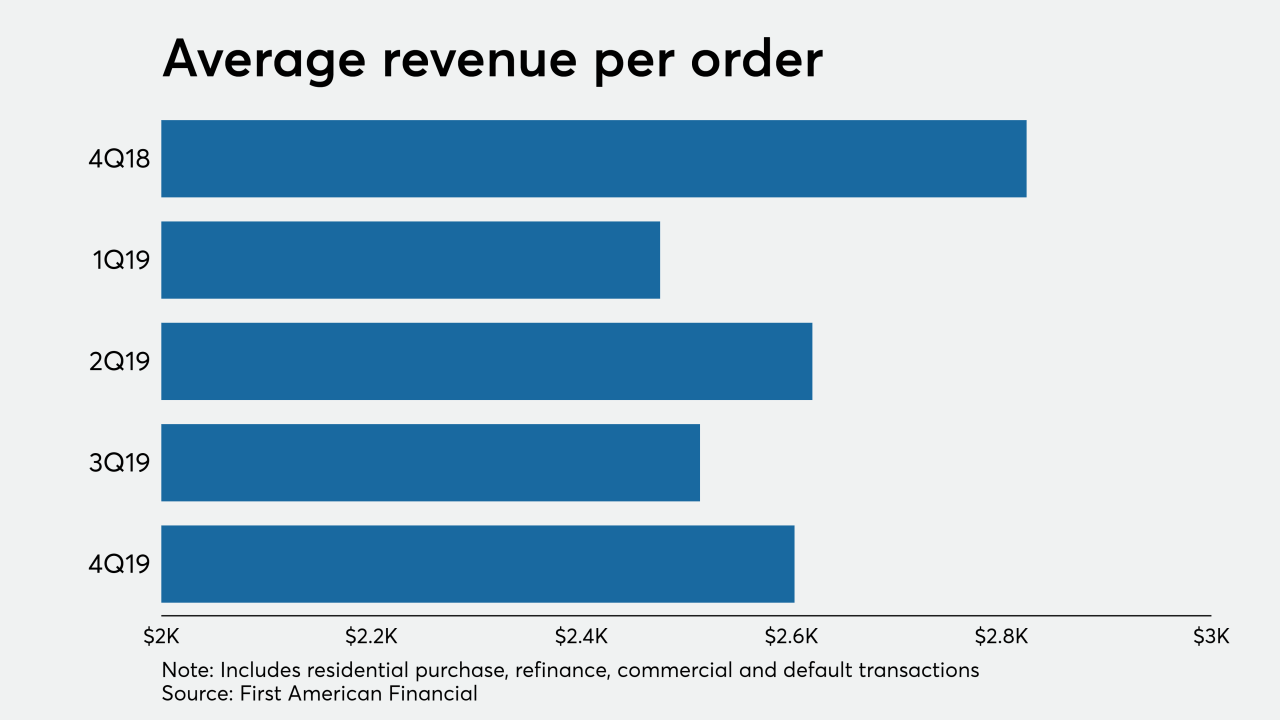

The strong refinance market in the fourth quarter propelled earnings at three different mortgage-related business that also were dealing with merger and acquisition activity during and after the period.

February 6 -

The U.S. mortgage insurance business remained a bright spot for Genworth Financial, as fourth quarter adjusted operating income increased 29% and new insurance written rose nearly 95% over the prior year.

February 5 -

A 10-basis-point year-over-year increase in gross margin on loans sold, along with a nearly 30% increase in origination volume, helped Waterstone Mortgage turn around its fourth-quarter results.

January 31 -

Howard Bancorp is transferring its mortgage business, along with VAMortgage.com, to a limited liability company formed by former managers in the division

January 24 -

Provident Bank in Amesbury, Mass., has entered warehouse lending after buying a business from People’s United Financial in Bridgeport, Conn.

January 22 -

Radian Group sold Clayton Services, a due diligence company it acquired in the 2014 purchase of Clayton Holdings, to Covius Holdings.

January 22 -

Sagent Lending Technologies has agreed to buy ISGN Corp. in a deal that would enlarge the company's loan servicing division.

December 24 -

The deadline for China Oceanwide to complete its acquisition of Genworth Financial was extended for a 13th time, following completion of the sale of Genworth MI Canada to Brookfield Business Partners.

December 23 -

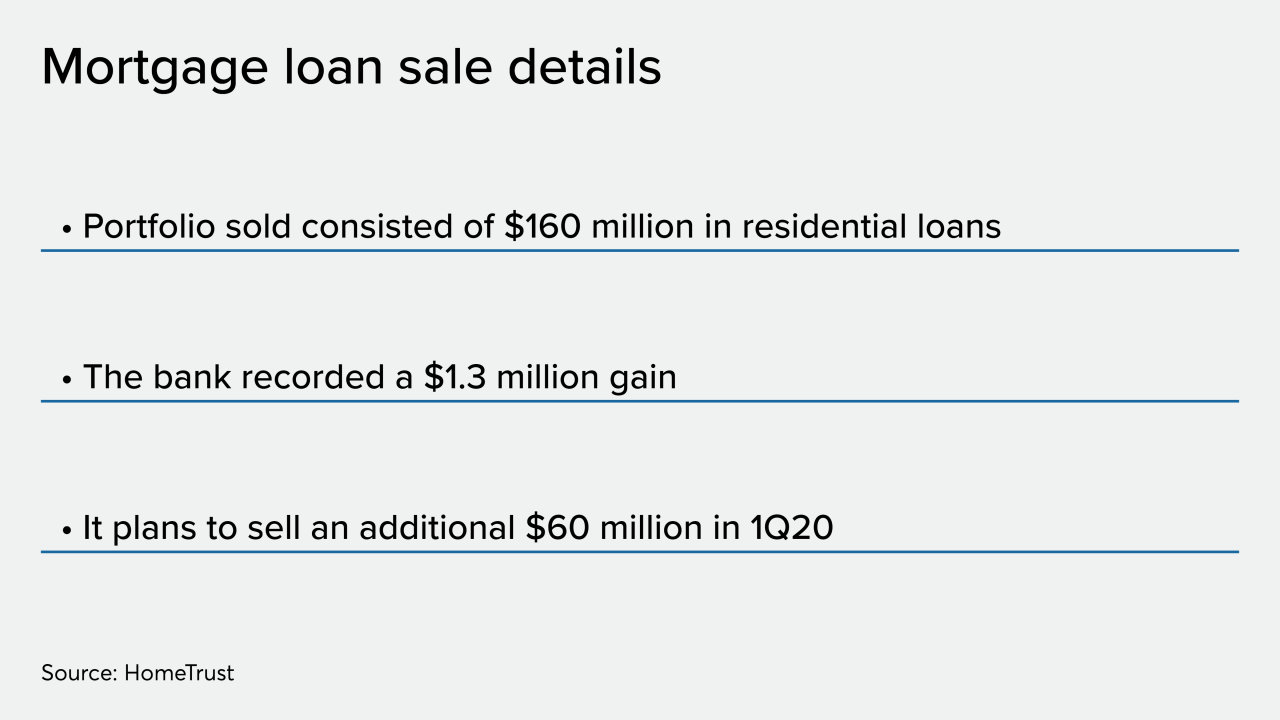

HomeTrust Bancshares in Asheville, N.C., sold a portfolio of residential mortgages as part of a balance sheet restructuring, with plans to sell more.

December 20 -

Florida-based depository Capital City Bank has struck a deal to purchase a 51% share in regional lender BrandMortgage.

December 11 -

Taylor Morrison Home Corp. has agreed to buy William Lyon Homes in a deal that would combine the two companies' in-house mortgage divisions and make the resulting entity the fifth-largest U.S. homebuilder.

November 6 -

Ocwen Financial's cost-cutting initiatives are bearing fruit toward returning to profitability, management said, although the company's third-quarter loss was slightly higher than the same period one year ago.

November 5 -

Orix Corp. has agreed to buy U.S. commercial real estate lender Hunt Real Estate Capital, its latest acquisition in the field.

November 4 -

CIT Group has agreed to lend and invest the money mostly in California as well as in the eight states where Mutual of Omaha Bank has branches.

November 1 -

More private mortgage insurers reported significant year-over-year gains in new business during the third quarter, mainly driven by the increase in refinance volume.

October 31 -

Record originations helped Mr. Cooper Group generate its first full-quarter profit since its formation through a merger between WMIH and Nationstar last year.

October 31 -

Loan origination system provider Ellie Mae has agreed to purchase mortgage technology firm Capsilon, citing the growing appeal of artificial intelligence-driven automation and interest in becoming more active as an acquirer.

October 29