M&A

M&A

-

HomeStreet Bank will attempt to sell its stand-alone mortgage business and portfolio of servicing rights, a move that comes amid growing pressure from an activist investor to exit home lending and concerns about declining demand and regulatory challenges.

February 15 -

The private equity acquisition of the fintech vendor Ellie Mae will give it some breathing room in a declining originations market because it will have a more patient and strategic investor than its myriad shareholders as a public company.

February 13 -

The mortgage loan origination system developer Ellie Mae is going private, agreeing to be acquired by the private equity firm Thoma Bravo in an all-cash transaction valued at $3.7 billion.

February 12 -

Ditech Holding Corp. is refiling for bankruptcy almost a year after emerging from it in order to facilitate a restructuring agreement with lenders holding more than 75% of its term loans.

February 11 -

Why now? Will it work? How will their rivals respond? The megadeal between the two East Coast regionals offers up plenty of grist for speculation.

February 8 -

House Financial Services Chairwoman Maxine Waters said the merger is a direct result of a regulatory relief bill that was signed into law in May.

February 7 -

SunTrust’s merger with BB&T is the largest bank deal since the financial crisis, and mortgages will play a critical role in the execution of this transaction.

February 7 -

The merged bank would set up an innovation and technology center in Charlotte as part of its bid to compete better against the largest institutions and fintech startups.

February 7 -

The combined bank will move into a more demanding supervisory class under the Fed’s regime, but analysts also see a regulatory upside from the deal.

February 7 -

The industry's largest acquisition in more than a decade will create the sixth-biggest bank in the country, with assets of more than $442 billion.

February 7 -

The New York Department of Financial Services disapproved the merger between Fidelity National Financial and Stewart Information Services, regulatory filings from both title insurance underwriters said.

February 4 -

China Oceanwide's acquisition of Genworth has been postponed until March, prolonging uncertainty about the fate of the acquired company's U.S. private mortgage insurance unit that could be resolved by the deal.

January 31 -

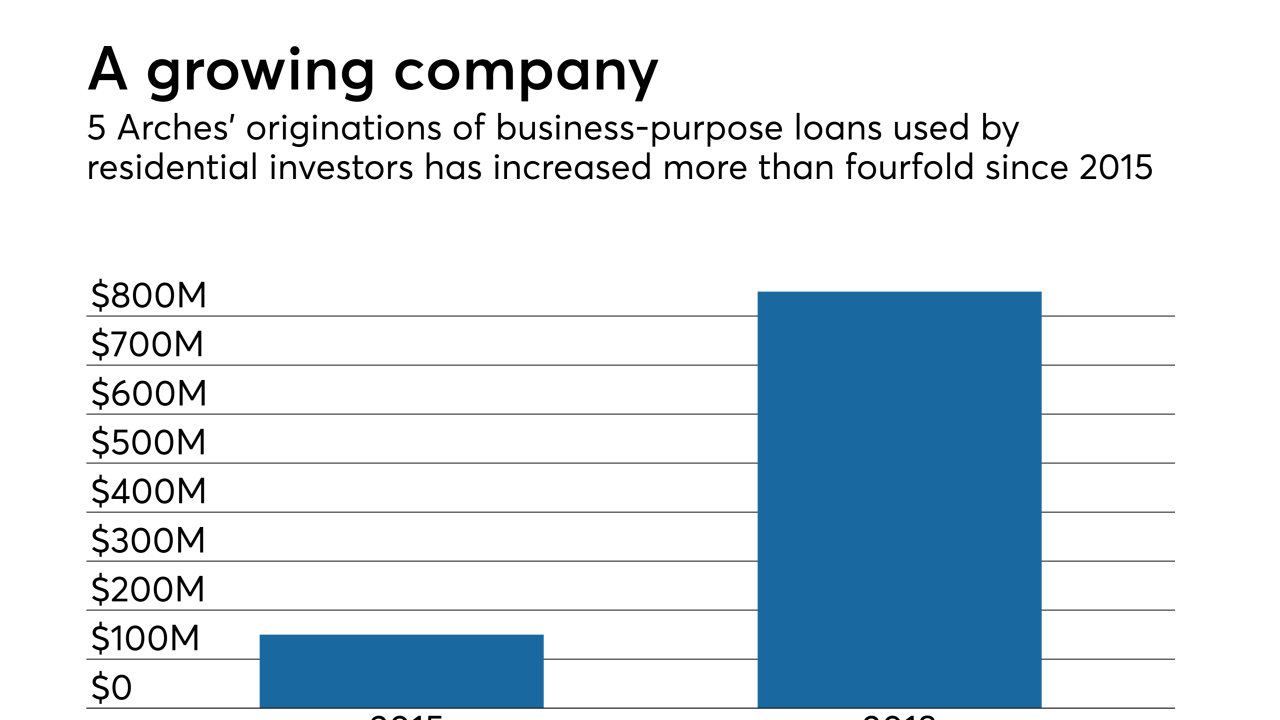

Redwood Trust has exercised its option to expand its minority stake in 5 Arches to 100%, increasing Redwood's exposure to loans used for house flipping and other types of residential investment.

January 23 -

Ditech Holding Corp. fired its chief operating officer after nine months, and entered into a forbearance agreement for a debt payment that was due in December, it said in a regulatory filing.

January 17 -

Radian Group has acquired Five Bridges Advisors, further cementing the new focus of its mortgage and title services business.

January 16 -

Due diligence firm American Mortgage Consultants has purchased Meridian Asset Services as part of its continuing efforts to expand through acquisition or organic growth.

January 10 -

Movement Mortgage is purchasing the entire retail production division of Lennar's Eagle Home Mortgage subsidiary, although the homebuilder will still have a home finance business on its books.

January 9 -

Fintechs must be held to the same standards as regulated financial institutions, a letter from the National Association of Federally-Insured Credit Unions stated that used Zillow's entrance into the mortgage business as an example.

January 9 -

Private equity firm Lovell Minnick Partners has purchased mortgage and property information provider Attom Data Solutions from Renovo Capital and Rosewood Private Investments.

January 8 -

Mr. Cooper Group is buying servicing rights on $24 billion in mortgages, a subservicing contract for an additional $24 billion in home loans and the Seterus platform from IBM.

January 3