M&A

M&A

-

The New York Department of Financial Services disapproved the merger between Fidelity National Financial and Stewart Information Services, regulatory filings from both title insurance underwriters said.

February 4 -

China Oceanwide's acquisition of Genworth has been postponed until March, prolonging uncertainty about the fate of the acquired company's U.S. private mortgage insurance unit that could be resolved by the deal.

January 31 -

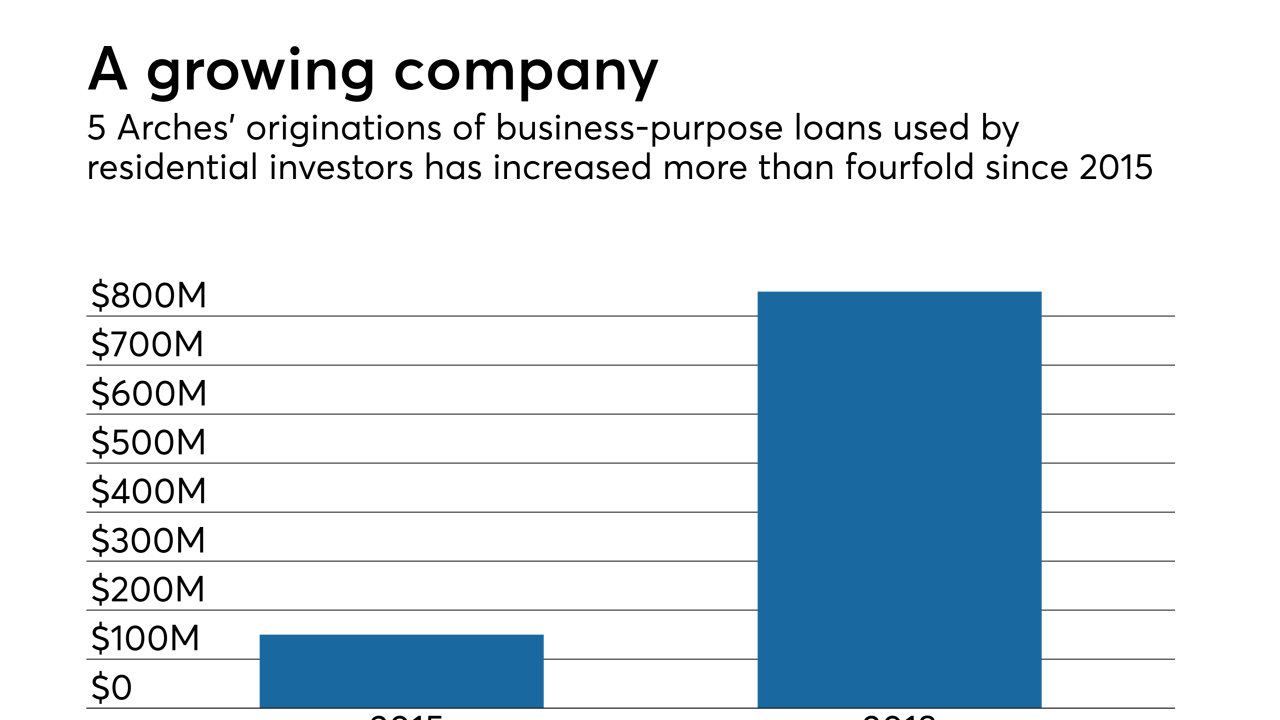

Redwood Trust has exercised its option to expand its minority stake in 5 Arches to 100%, increasing Redwood's exposure to loans used for house flipping and other types of residential investment.

January 23 -

Ditech Holding Corp. fired its chief operating officer after nine months, and entered into a forbearance agreement for a debt payment that was due in December, it said in a regulatory filing.

January 17 -

Radian Group has acquired Five Bridges Advisors, further cementing the new focus of its mortgage and title services business.

January 16 -

Due diligence firm American Mortgage Consultants has purchased Meridian Asset Services as part of its continuing efforts to expand through acquisition or organic growth.

January 10 -

Movement Mortgage is purchasing the entire retail production division of Lennar's Eagle Home Mortgage subsidiary, although the homebuilder will still have a home finance business on its books.

January 9 -

Fintechs must be held to the same standards as regulated financial institutions, a letter from the National Association of Federally-Insured Credit Unions stated that used Zillow's entrance into the mortgage business as an example.

January 9 -

Private equity firm Lovell Minnick Partners has purchased mortgage and property information provider Attom Data Solutions from Renovo Capital and Rosewood Private Investments.

January 8 -

Mr. Cooper Group is buying servicing rights on $24 billion in mortgages, a subservicing contract for an additional $24 billion in home loans and the Seterus platform from IBM.

January 3 -

New Fed Mortgage's pending acquisition of Commonwealth Mortgage LLC will allow it to expand its geographic footprint outside of New England.

January 2 -

These days, no wedding is complete without a hashtag combining the happy couple's names. It got us thinking: Why not give mortgage industry M&A deals the same treatment?

December 26 -

A year ago, National Mortgage News made five predictions regarding how the mortgage industry would fare in 2018 — and we got four of them right.

December 21 -

Selling $1.6 billion in mortgages, and paying off a similar amount of wholesale borrowings, will allow the company to expand its net interest margin in 2019.

December 21 -

New American Funding expects to add $1 billion to its annual production next year by purchasing Marketplace Home Mortgage.

December 19 -

Class Valuation, a Troy, Mich.-based appraisal management company, acquired Landmark Network, which specializes in providing valuation services for reverse mortgages.

December 18 -

D.R. Horton Inc. is planning to buy Terramor Homes' building operations for $60 million in cash, expanding the potential customer base for the larger company's in-house lending unit.

December 11 -

Merchants has agreed to buy NattyMac, a company it has been in business with since 2014.

December 6 -

Clayton Properties Group, a builder specializing in prefabricated modular and manufactured homes, acquired Mungo Homes in a move to bolster the scale of its site-built housing.

December 3 -

Hometown Lenders Inc. will acquire TotalChoice Mortgage in a move to expand its geographic footprint and meet its goal of growing annual originations from $1 billion to $5 billion.

November 30