-

But an expected drop in refinancings as mortgage rates rise should more than cancel that out, resulting in declining overall volume through 2023.

October 21 -

Millennials continue to lock in the lowest average mortgage rates on record, keeping lenders busy and the housing market churning, according to Ellie Mae.

October 7 -

Whether low rates will continue to outweigh health and employment concerns for millennials and Generation Z remains to be seen.

October 2 -

From an increased interest in outdoor space to a need for a dedicated home office, the pandemic has created new drivers for refinancing, moving and other housing decisions, TD Bank found.

September 11 -

More than half of listings underwent bidding wars in August with some housing markets peaking above 65%, according to Redfin.

September 4 -

Millennials locked in the lowest mortgage rates on record and kept the summer housing market hot, according to Ellie Mae.

September 2 -

Driven by robust purchase demand and tight housing supply, housing price growth reached a two-year high in July, according to CoreLogic.

September 1 -

Despite a housing market that has remained solid during the COVID-19 outbreak, the hesitancy of potential sellers is contributing to one of the most acute shortages of available homes in decades.

August 11 -

About 54% of properties underwent bidding wars in July with some metro areas peaking at 75%, according to Redfin.

August 10 -

An industry coalition wants to ensure borrowers who took out certain types of loans to fund their education aren’t locked out of access to historically low mortgage rates.

August 5 -

With over 4 million millennials entering prime home buying age each year through 2023, purchase activity will be driven much higher, according to Ellie Mae.

August 5 -

Housing prices continued to grow in June, maintaining a streak in monthly increases that began in February 2012. But the trend could be reversed in 2021 with the resurgent effects of the coronavirus, according to CoreLogic.

August 4 -

Down payment assistance programs remain an important tool for increasing minority homeownership, but especially more so because of the pandemic.

July 14 Mountain Lake Consulting

Mountain Lake Consulting -

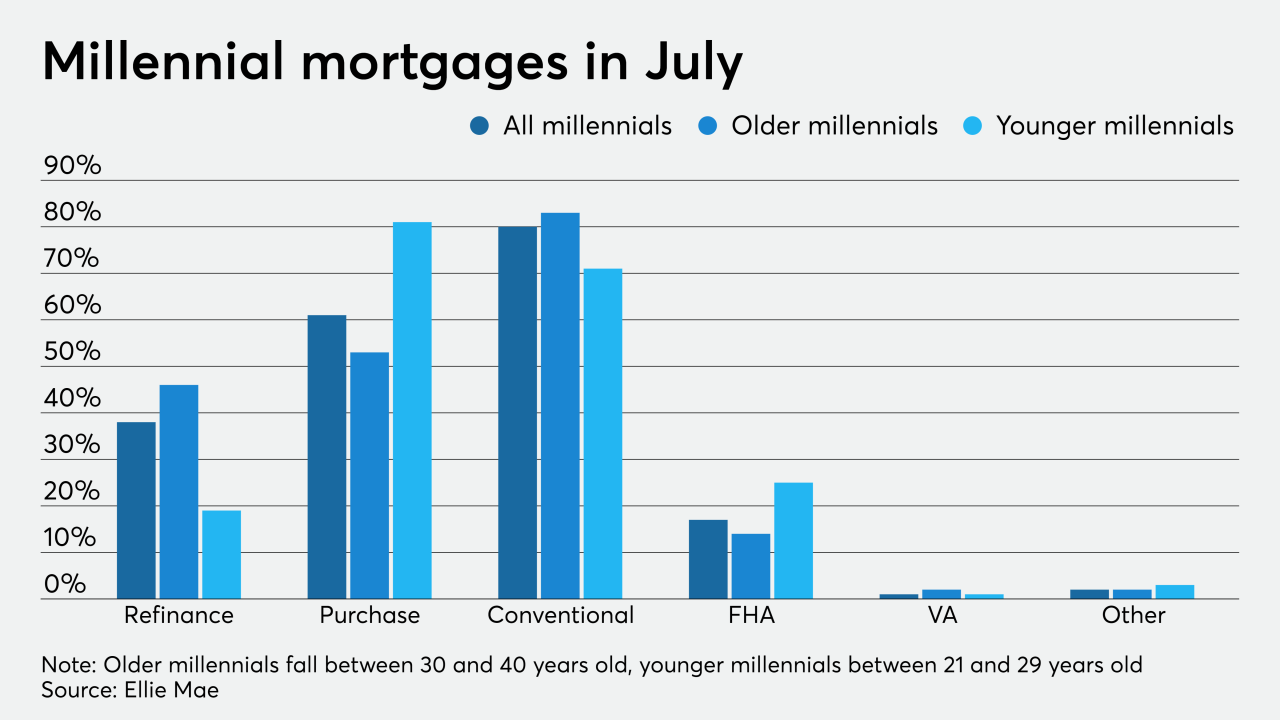

As the country wrestles economic volatility, millennial homeownership demand rises, fueled by historically low mortgage rates.

July 1 -

Millennial refinance activity hit a new high-water mark behind historically low mortgage rates, up 40 percentage points from the year before, according to Ellie Mae.

June 3 -

With would-be sellers too spooked to list their homes and would-be buyers held up due to social distancing orders, home price appreciation accelerated in April. And it could continue into the summer.

June 2 -

With mortgage rates plummeting, the refinance share of closed loans from millennial borrowers rose for the third straight month, to the highest level since Ellie Mae began tracking the data in 2016.

May 6 -

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

April 30 -

From the crossroads of America down to the bayou, here's a look at 12 housing markets where it's the most financially prudent to buy a home rather than rent, according to First American.

April 16 -

Consumer sentiment about home price growth during a potential recession flipped because of the coronavirus scare. Now, just one-third expect an increase in value, according to Redfin.

March 20