-

Millennials make up the largest constituent group for both homebuyers and sellers, which could put a squeeze on lending and eventually shift the market.

September 28 -

When it comes to attracting millennials, mortgages could be the key to capturing this demographic for the long haul – provided CUs are willing to put in the work.

September 26 -

A new study from Pentagon Federal Credit Union finds a sizable portion of consumers will be shopping for a mortgage within two years, but it also revealed some major misconceptions surrounding the process.

September 18 -

Nearly half of July's millennial homebuyers were single, a sign that they are not waiting for certain milestones like marriage before deciding to become homeowners, according to Ellie Mae.

September 5 -

An improved economy, a healthy labor market and the large population of millennials should have accelerated home sales much higher, but all hope for more transactions this year is not yet lost, according to the NAR.

August 20 -

As housing affordability continues eroding on growing property values and mortgage rates, nearly a quarter of millennials believe they need to delay having children to afford a home purchase.

August 15 -

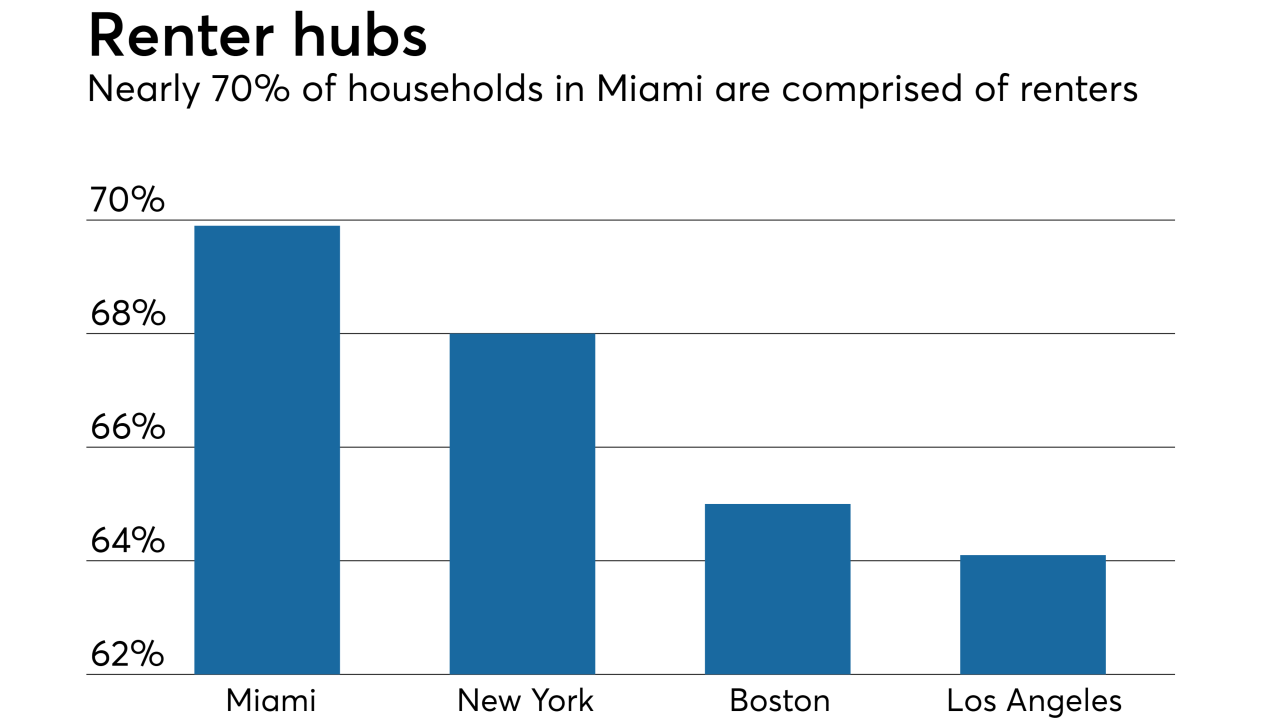

Home price appreciation is preventing consumers from entering the housing market, forcing an accelerated number of potential homeowners to rent.

August 8 -

Growth in home prices continued wearing down affordability at the start of the season, preventing first-time buyers from entering the housing market.

August 7 -

An increase in millennials making home purchases is a call to the mortgage industry for a quicker, more efficient digital process.

August 1 -

The average millennial borrower credit score remained unchanged in May, but values by city painted very different pictures, according to Ellie Mae.

July 11 -

With the supply of housing down and more jobs available in cities, millennials have flocked to urban neighborhoods at a comparable rate to the suburbs for the first time in decades.

July 6 -

The decline in homeownership among young adults can be attributed to a variety of financial headwinds like student loans and societal shifts like marriage rates, but rising housing costs are the core issue, according to research by Freddie Mac economists.

July 2 -

From location and age to gender and price point, here's a look at how demographic differences influence homebuyer confidence about saving for a down payment.

May 15 -

As the American population migrates to the suburbs and midsize cities, mortgage lenders and real estate professionals must re-examine their customer relationship management and lead generation strategies to better serve potential borrowers.

May 9 -

Home prices, jobs and evolving consumer behaviors are restoring prerecession migration patterns.

May 8 -

As the mortgage industry makes more strides with technology, the time it took millennials to close loans for new-home purchases shrank to its fastest time yet.

May 2 -

Purchase loans made to millennial mortgage borrowers rose month-over-month in February despite interest rates increasing at the start of the year, according to Ellie Mae.

April 4 -

Which industries have the highest prevalence of unwanted sexual conduct in the workplace? Will the #MeToo movement have a lasting impact? Key findings from a SourceMedia survey.

March 28 -

While the industry continues adopting digital mortgage methods, homebuyers expect to be able to apply for a mortgage and complete the application online, but still want human interaction, according to Ellie Mae.

March 20 -

An unprecedented, industrywide survey of sexual harassment in the professional workplace reveals industries with the highest prevalence of unwanted sexual behavior, the differences between large and small companies, and blind spots that may be preventing corrections. Fortunately, the data also lights a path forward.

March 12