-

Meanwhile at Essent, more loans exited the inventory in January than in December.

February 8 -

The housing market’s boom led to more borrowers building home wealth but the pandemic’s negative impact brings concern for underwater owners, according to Attom Data Solutions.

February 5 -

While distressed mortgage rates continued the fall’s short-term slide, serious delinquencies are three times higher than the year-ago total, according to CoreLogic.

January 12 -

For some, including National MI and Essent, the improvement is taking place faster than expected.

January 11 -

Economic instability during the quarter drove the increase in findings regarding income and employment, Aces Quality Management reported.

December 16 -

The largest concerns are with pandemic risk and defaults, along with business resilience and adaptability, according to a Wolters Kluwer survey.

December 14 -

While distressed mortgage rates crept down overall, serious delinquencies still tripled year-ago rates in September, according to CoreLogic.

December 8 -

Lower cure rates and possible rises in foreclosures and claims could force these companies to raise capital next year, Fitch Ratings said.

December 4 -

The Federal Housing Finance Agency said that Fannie Mae and Freddie Mac would extend the measures until “at least” Jan. 21, 2021.

December 3 -

Troubled Veteran’s Administration “no-bid” loans could bankrupt servicers in the near future, says Morgan Snyder of CAllc Research Publications.

December 2 CAllc Research Publications

CAllc Research Publications -

Default risks soar in minority neighborhoods during challenging economic times because, data shows, homes there are overpriced relative to incomes. Zoning and other changes could make loans more affordable by boosting housing stock and driving down prices.

November 25 American Enterprise Institute’s Housing Center

American Enterprise Institute’s Housing Center -

The Federal Housing Administration said in its annual actuarial report that the capital reserve ratio on its mutual mortgage insurance fund increased to 6.10% in fiscal year 2020, up from 4.84% a year earlier.

November 13 -

With an unusually high number of unknowns to factor in, mortgage industry leaders offer a peek at their playbooks for the next year.

November 12 -

Rick Thornberry discusses the company's third-quarter results and the decision to drop traditional appraisals.

November 11 -

More than six months after the CARES Act became law, the two entities joined a host of industry organizations in launching the COVID Help for Home campaign to educate borrowers on the next steps in forbearance.

November 11 -

The overall mortgage delinquency rate improved in the third quarter as the economy got healthier while late-stage delinquencies hit a decade high, according to the Mortgage Bankers Association.

November 11 -

Growing equity levels increased the share of equity-rich and pulled borrowers out from underwater in the third quarter, according to Attom Data Solutions.

November 5 -

And an uptick from second-quarter numbers is attributed to seasonality rather than any upswing in the economy.

November 3 -

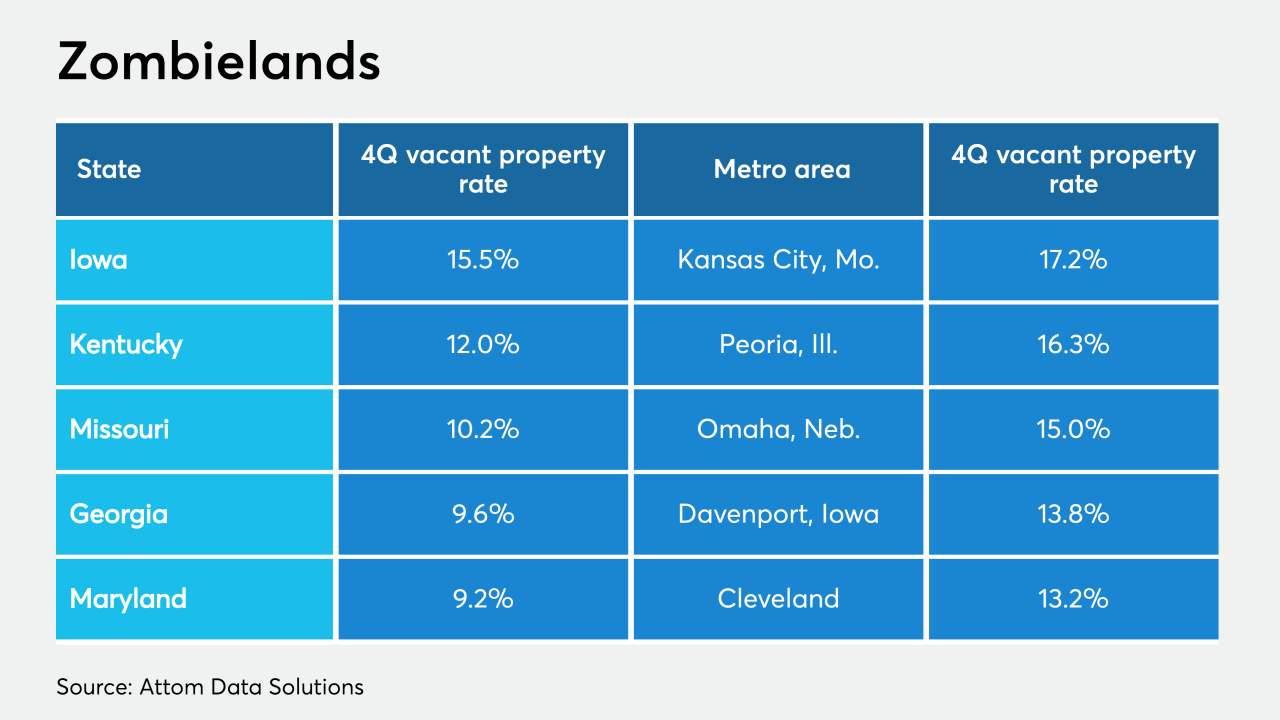

While the total foreclosures continued to fall with coronavirus moratoria in place, the share of zombie properties rose in the fourth quarter, according to Attom Data Solutions.

October 30 -

While overall mortgage delinquency rates slowly descend, serious delinquencies — especially loans past 120 days due — jumped in July, according to CoreLogic.

October 13