-

The pandemic, a refinancing boom and intensified appraiser shortage boosted appraisal alternatives in line with the rise in remote work. Now an overheating purchase market and policymaker scrutiny are shifting priorities.

September 13 -

The underwriter also agreed to assist in the New York Attorney General's investigation of no-poach agreements in the title industry.

September 10 -

The company will roll out the program it has been piloting, Appraisal Direct, nationwide on Oct. 1.

September 9 -

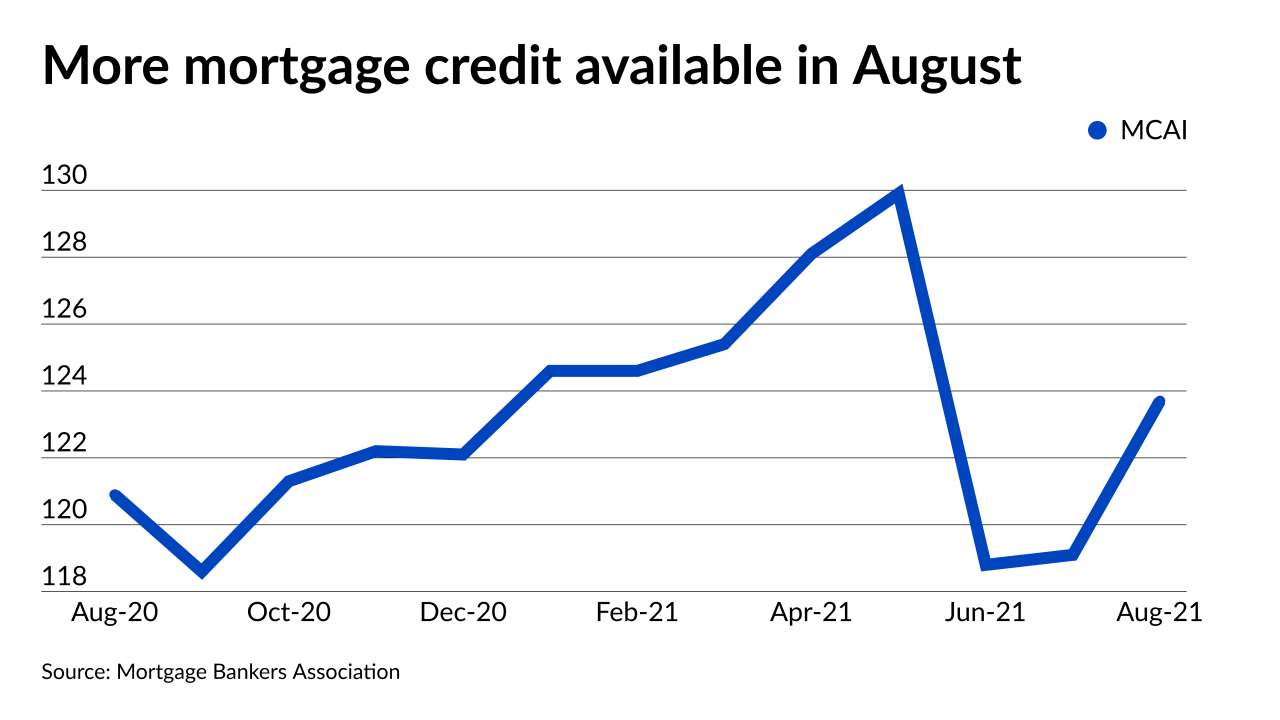

But refinance volume was constrained in recent weeks and many of the new offerings are aimed at low income borrowers, the Mortgage Bankers Association said.

September 9 -

Effects of major economic announcements this summer have had little impact on the lending market, with averages remaining under 3% since July.

September 9 -

But a greater number still expect decreased margins for the fourth straight quarter, due to competitive pressures and shifting demands in purchases and refinances

September 9 -

Both government-sponsored enterprises approve more borrowers across the board than the broader market but the relative progress each has made differs across racial groups, numbers released Wednesday show.

September 8 -

Refinance and purchase applications both declined, while average loan sizes shrunk for the fifth consecutive week.

September 8 -

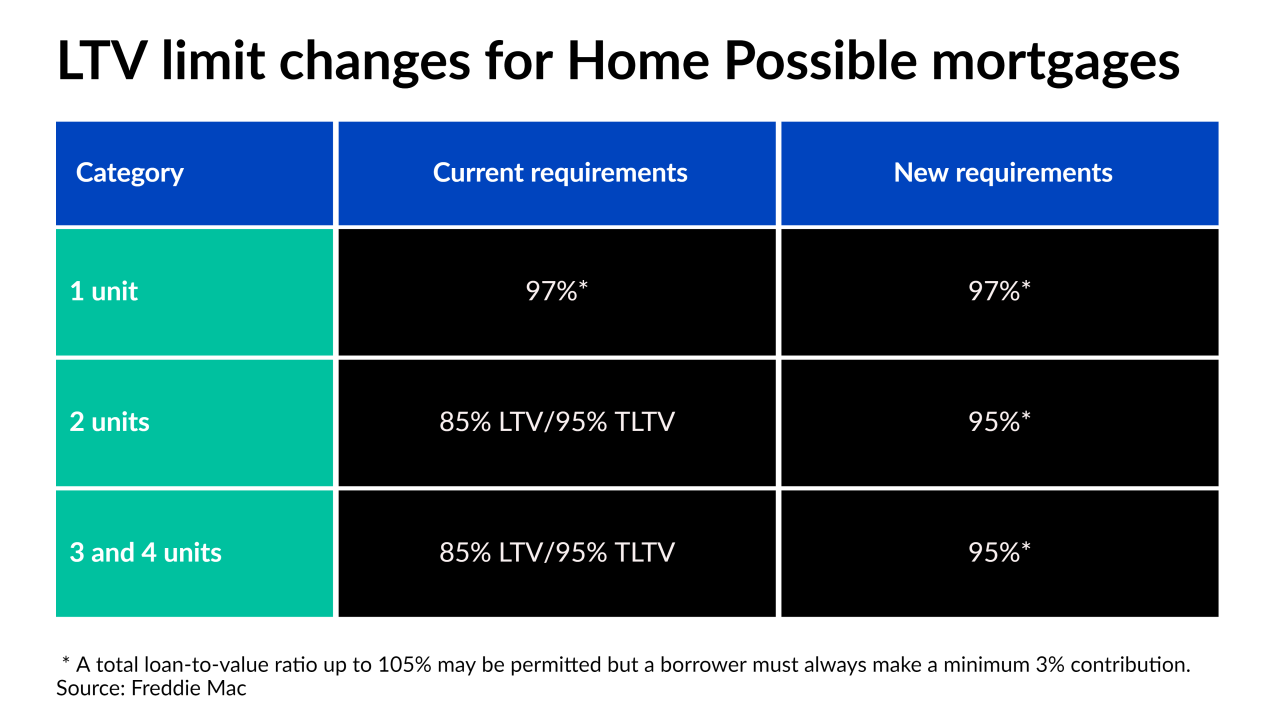

The changes could help one of the Biden administration’s affordable housing goals, which is aimed at making wealth-building through owner-occupied, 2- to 4-unit properties more attainable.

September 3 -

Improved capitalization and smaller balance sheets should help several weather the likely consolidation that is coming, Moody's said.

September 3 -

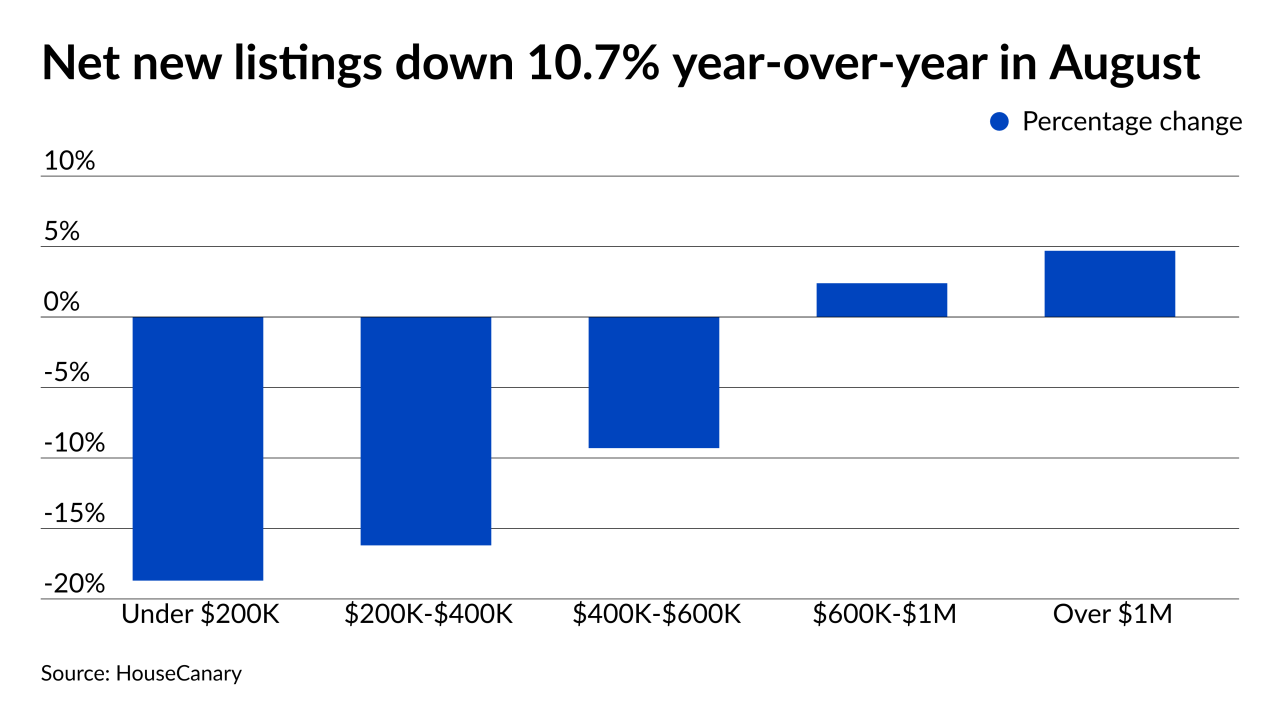

What that means for the industry outlook depends in part on how well the imbalance between supply and demand for homes sustains wavering gains in the housing market.

September 3 -

Price growth is moderating and properties are taking longer to sell — albeit by a modest three days.

September 2 -

The 30-year average has remained below 3% for two months.

September 2 -

The company's new name helps reflect the business lines it expanded into outside of fix-and-flip during the last few years.

September 1 -

Average loan sizes also grew, as continued demand for homes still outpaces inventory.

September 1 -

None of the leading areas ranked by investor share of sales were in the Golden State during 2020, in contrast to the state’s dominance on the list in the wake of the Great Recession.

August 30 -

Payments from PayPal, Venmo and Zelle add an extra wrinkle when dealing with bank statement loans.

August 30 -

Increasing COVID-19 numbers offset promising economic figures, resulting in minimal changes.

August 26 -

Purchases and refinance activity both edged higher, as loan sizes decreased, signaling opportunities may exist for first-time buyers.

August 25 -

Even as lenders increased purchase share, higher expenses and margin compression related to pricing competition led to smaller quarterly net gains.

August 24