-

Less than a year after a Series C capital raise, the title insurer formerly known as States Title is about to complete a merger with a special purpose acquisition company.

July 27 -

Also: MeridianLink announces pricing of its IPO, mortgage rates fall following COVID-19 worries, FHFA change

July 23 -

In 2011 Congress paid for payroll tax relief by raising secondary market guarantee fees for 10 years. The Mortgage Bankers Association, and others, don’t want to see that happen again.

July 23 -

Despite lower numbers, refi applications continued trending strongly, while purchases fell close to lows from more than a year ago.

July 21 -

The cloud IT provider for settlement services companies has no timeline on when services will be restored following its shutdown Friday.

July 20 -

Meanwhile, the average new-home mortgage price climbed to a new all-time high, according to the Mortgage Bankers Association.

July 20 -

As rising home valuations force first-time home buyers out of the market, expect to see non-owner-occupied loans to increase.

July 20 -

Also: Fannie Mae, Freddie Mac loan modifications reach a pandemic high, Recreational marijuana is a gateway drug to higher home prices

July 16 -

“One” is the first in a series of non-agency mortgages the wholesaler plans to introduce this year.

July 15 -

Purchase loans also increase, as their average size shrinks

July 14 -

The company, OriginPoint, brings together two enterprises active in the jumbo-homes space.

July 13 -

The bank's second quarter production revenue was down 32% from the first quarter, even as volume increased 4%.

July 13 -

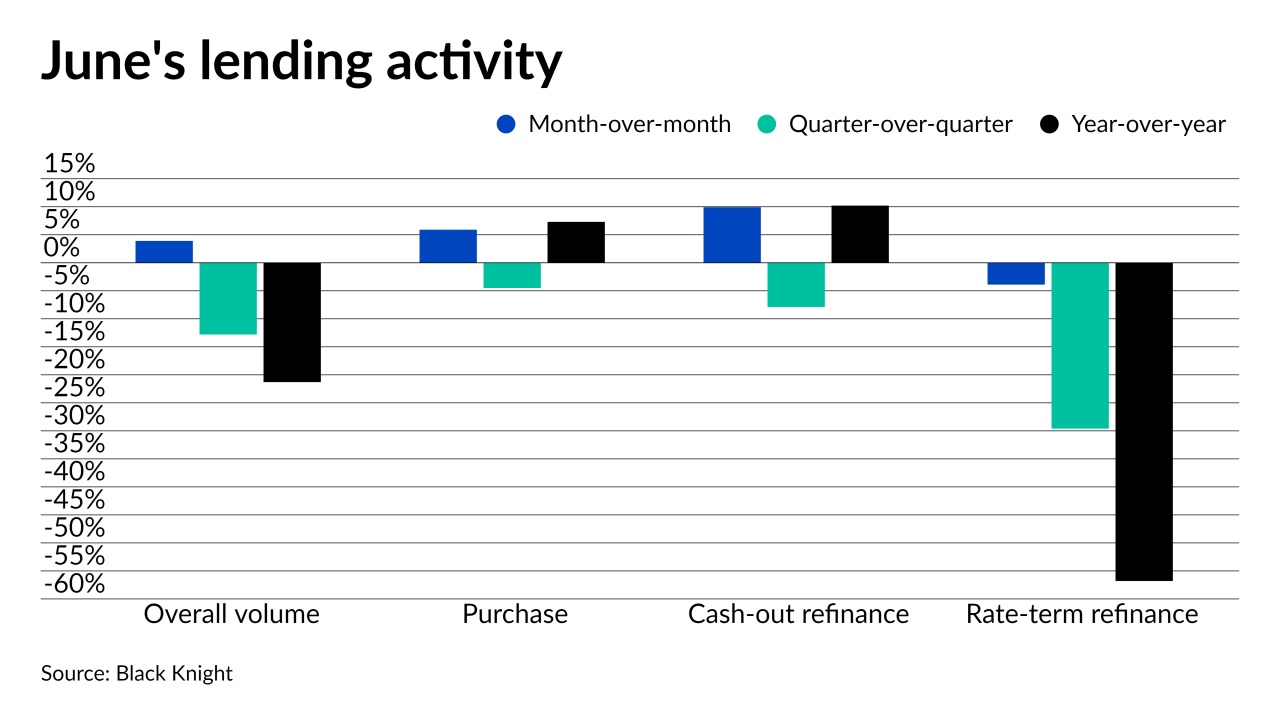

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

Also: Private equity firms to buy Lereta, mortgage rates continue to fall & mortgage applications decline for a second week

July 9 -

Government-sponsored loans gain volume share, but overall numbers tumble to a point not seen since before the pandemic.

July 7 -

Also: Former Zillow execs launch mortgage fintech, housing inventory inches up as lumber prices tumble.

July 2 -

Even though the channel helped the bank do over $2 billion in business last year, going forward it will produce loans through the traditional retail business.

July 2 -

The plateau in non-depository estimates for new jobs in the field reported Friday follows anecdotal accounts of reorganization by banks and nonbanks in the past week.

July 2 -

The financial services company will incentivize existing card members with statement credit for taking out or refinancing a home loan with either lender.

July 1 -

Limited housing supply, climbing rates cause applications to decline across the board.

June 30