-

The company, OriginPoint, brings together two enterprises active in the jumbo-homes space.

July 13 -

The bank's second quarter production revenue was down 32% from the first quarter, even as volume increased 4%.

July 13 -

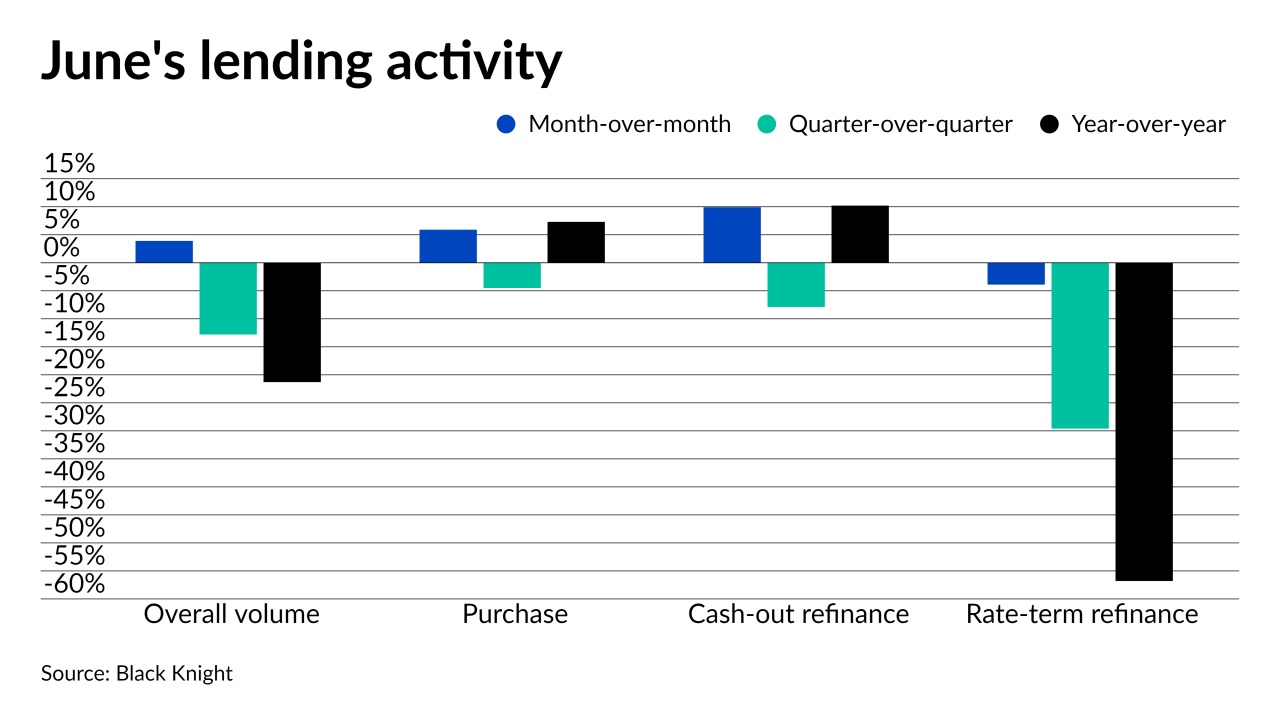

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

Also: Private equity firms to buy Lereta, mortgage rates continue to fall & mortgage applications decline for a second week

July 9 -

Government-sponsored loans gain volume share, but overall numbers tumble to a point not seen since before the pandemic.

July 7 -

Also: Former Zillow execs launch mortgage fintech, housing inventory inches up as lumber prices tumble.

July 2 -

Even though the channel helped the bank do over $2 billion in business last year, going forward it will produce loans through the traditional retail business.

July 2 -

The plateau in non-depository estimates for new jobs in the field reported Friday follows anecdotal accounts of reorganization by banks and nonbanks in the past week.

July 2 -

The financial services company will incentivize existing card members with statement credit for taking out or refinancing a home loan with either lender.

July 1 -

Limited housing supply, climbing rates cause applications to decline across the board.

June 30 -

Also: Critical defects in mortgage files reach highest level in years, interest rates tick up

June 25 -

Even though volumes are expected to taper from 2020’s record highs, lenders plan to take on more employees in 2021, according to the Mortgage Bankers Association and McLagan Data.

June 25 -

A Realtor.com survey of consumers aged 18 to 25 found that 45% share are already saving for a home.

June 24 -

Increases in refinances, both in applications and average size, help lead overall numbers higher

June 23 -

The move is a vote of confidence for the private market in financing, which has been revitalized by limits government-related investors have put on certain loan purchases.

June 23 -

The financial services company will use its new capital to invest in artificial intelligence and machine learning to cut transaction times, as well as build its own servicing platform.

June 23 -

Also: Homespire, Nations Lending, CapStar make new hires across the country, housing market conditions relax (a bit) in May

June 18 -

The Consumer Financial Protection Bureau at press time had promised to take the sudden nature of the new holiday’s implementation into consideration as it consulted with other agencies on the issue.

June 18 -

Announced the day before the first federally recognized Juneteenth holiday, the Black Homeownership Collaborative has a seven-point initiative to improve upon racial equality in home buying in the next nine years.

June 18 -

The new calculation of borrowers’ monthly obligations will allow for a higher debt load from tuition, potentially opening eligibility to more Black applicants, according to public officials.

June 18