-

Purchase loan volume also increased, as borrowers tried to take advantage of rate dips across all loan types

May 12 -

It’s getting easier to close bigger loans for higher-priced properties, but credit is expanding slower for first-time buyers.

May 11 -

While the first quarter is typically the weakest period for the title business, the sector benefited from strong refinance volumes that were driven by low interest rates.

May 10 -

The real estate investment trust has been buying residential business-purpose loans from the company since 2017.

May 6 -

The company, like many publicly-traded nonbanks, is looking for ways to address the downward pressure that a battle between two large competitors is putting on the wholesale channel’s profitability.

May 6 -

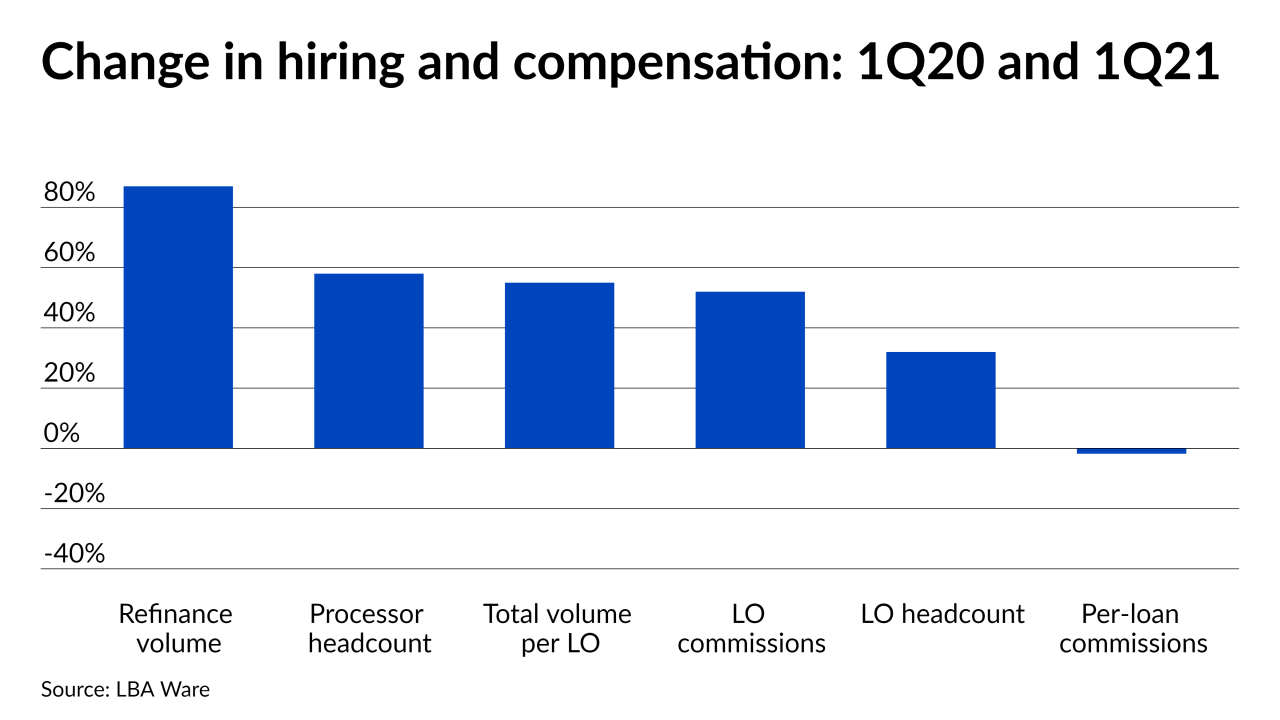

Also, per-loan compensation keeps dropping due to the persistence of refinancing in the mix but it could rise as the purchase share of the market increases.

May 5 -

The recent increase in loan size across all application types reflects rising prices, which contributed to a drop in applications, Mortgage Bankers Association economist Joel Kan said.

May 5 -

Loans bought on the secondary market have become increasingly important as borrower demand has ebbed and companies have sought to obtain mortgages through additional outlets to maintain production levels.

May 4 -

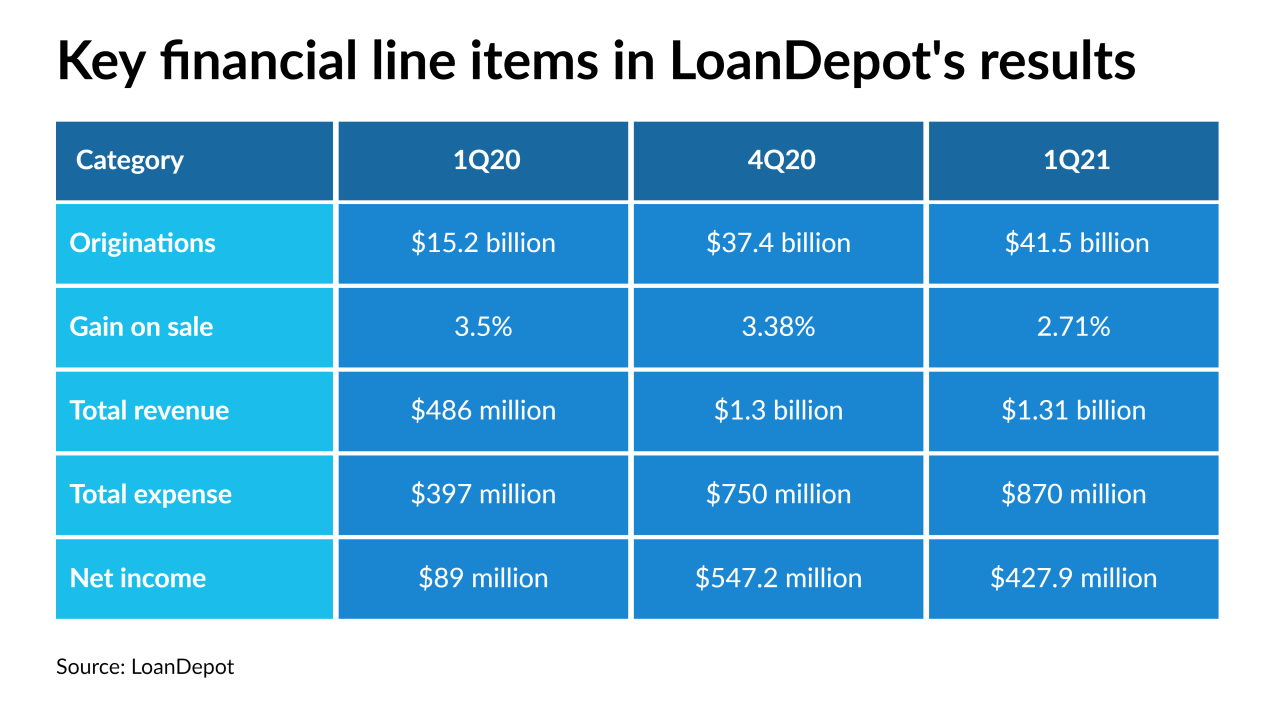

The unusually strong production numbers seen in the first quarter of this year show loanDepot is emerging as a contender in the battle for loan volume and market share amid an industry price war.

May 3 -

This is the first deal that serial acquirer FOA has announced since it went public on April 5.

April 28 -

The Consumer Financial Protection Bureau has moved ahead with an earlier proposal to postpone the full adoption of the qualified-mortgage ability-to-repay rule, citing a need to maximize borrowers' credit access.

April 28 -

After a one-week reprieve, mortgage activity waned again with decreased demand for refinances and extremely low inventory for homebuyers.

April 28 -

The recent compression allays fears that lenders would have difficulty serving the needs of borrowers with time-sensitive purchase contracts during a peak season.

April 27 -

System updates, which may be a result of changes to the Preferred Stock Purchase Agreements, have Community Home Lenders Association members saying loans that were approved previously are getting rejected when put back through.

April 26 -

Despite falling from quarter to quarter, Flagstar’s mortgage revenues remained strong, while its servicing portfolio grew.

April 26 -

Building timelines are finally stable enough for nonbank American Financial Resources to return to the conventional market following the pandemic-related disruption, according to a company executive.

April 23 -

Given the Biden Administration’s regulatory emphasis on the disparate impact of mortgage lender activity on protected classes, originators need to carefully monitor their loan price concessions, according to industry speakers at the Mortgage Bankers Association's Spring Conference.

April 22 -

Although the company’s revenue and incomes spiked from year-ago levels, most benchmarks showed a decline from the fourth quarter.

April 21 -

Fannie Mae and Freddie Mac’s new limits on loans secured by investor properties and second homes may put pressure on applicants to misrepresent their occupancy status.

April 21 -

While purchase volume is seeing its usual seasonal pickup, lower rates caused a spike in activity among existing homeowners looking to refinance.

April 21