-

U.S. homebuilder optimism rose to a record in September, with low mortgage rates driving a housing boom that has boosted the pandemic economy.

September 16 -

Mortgage applications decreased 2.5% from one week earlier as refinance activity appears to decelerating, according to the Mortgage Bankers Association.

September 16 -

The deal brings yet another mortgage origination component under the same roof.

September 16 -

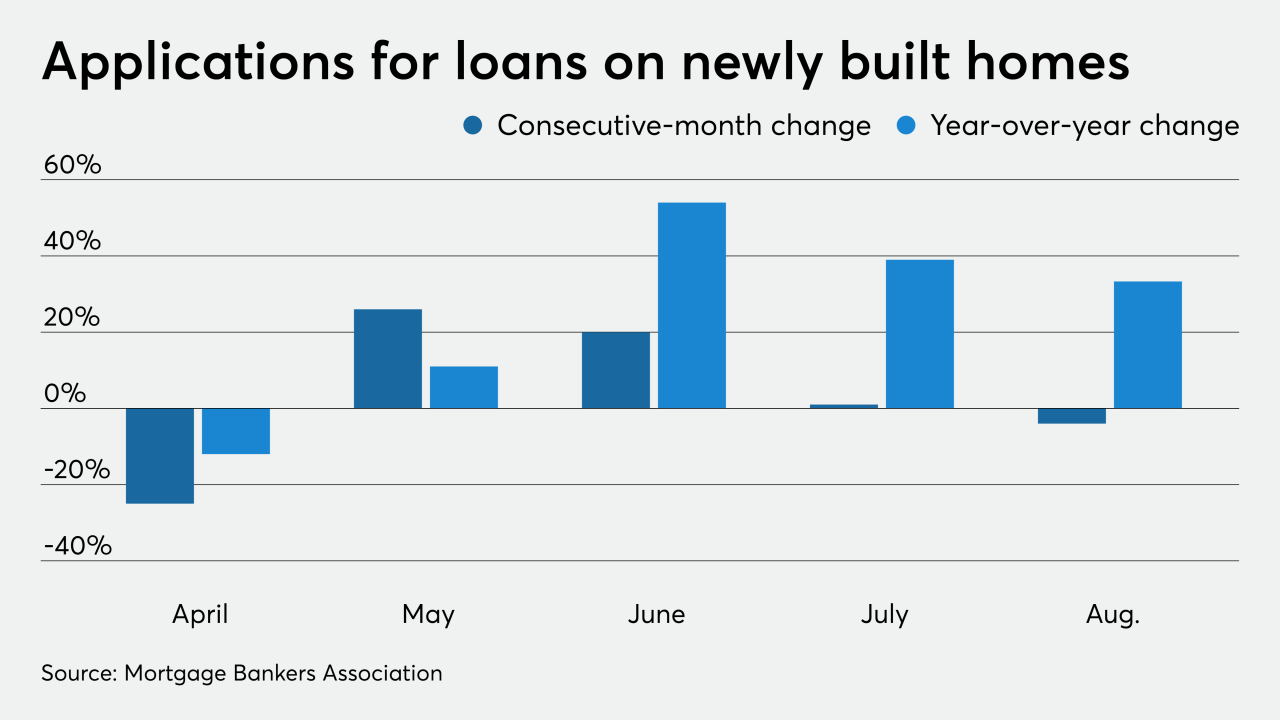

Loan applications for new homes have staged a remarkable turnaround this year after falling 25% month-over-month and 12% year-to-year due to the coronavirus' impact in April.

September 16 -

Electronic notes did come in handy this year given the mortgage industry's need to operate remotely, but they also increase the government-sponsored enterprises' responsibility for monitoring the risk of multiple counterparties.

September 15 -

The potential acquirers included a "go shop" provision as a sweetener in the rejected offer.

September 15 -

Any roadmaps for client service that existed before the pandemic have changed, according speakers at DigMo2020.

September 15 -

Quicken Loans president and COO, Bob Walters, provided the first keynote of the 2020 Digital Mortgage Conference and gave insight into how this year changed the industry.

September 15 -

The proposals offer lenders both cause for celebration and for concern.

September 15 Promontory MortgagePath

Promontory MortgagePath -

Median closing prices hit a new record high during the four-week period ended Sept. 6, Redfin said.

September 14 -

-

Many states currently have temporary work-from-home guidance for licensed mortgage professionals that extends through at least Dec. 31, but some have fall expiration dates.

September 14 -

Plus: mortgage credit availability hits 6-year-low and Ellie Mae and ICE Mortgage change leadership

September 11 -

Jonathan Corr's departure from the nation's largest loan origination system company follows the completion of its sale to Intercontinental Exchange.

September 11 -

Mortgage industry hiring and new job appointments for the week ending Sept. 11.

September 11 -

The post was vacant since Kristy Fercho left to run Wells Fargo Home Loans in July.

September 10 -

Mortgage rates fell 7 basis points this week to yet another record low in the 49-year history of the Freddie Mac Primary Mortgage Market Survey, as stock market indicators sank during the period.

September 10 -

-

Mortgage applications increased 2.9% from one week earlier, rising for the first time in nearly a month with home-buying demand remaining unusually strong as summer ends, according to the Mortgage Bankers Association.

September 9 -

The final version of the amended rule, like the original proposal, makes fair lending claims tougher to prove; but it does soften language that otherwise might have allowed mortgage companies to use algorithms to prove nondiscrimination.

September 9