-

-

Mortgage industry hiring and new job appointments for the week ending Sept. 4.

September 4 -

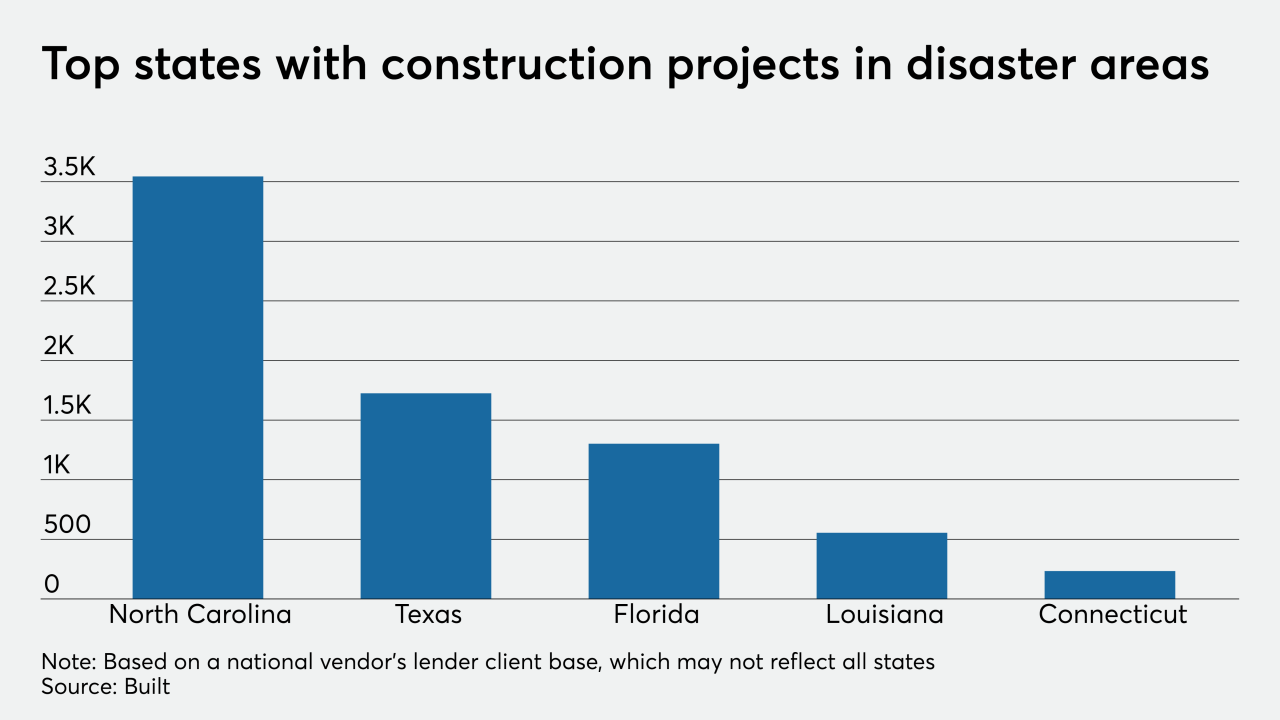

The technology company arrived at this percentage by mapping federally declared disaster areas to the projects it helps lenders manage.

September 3 -

Mortgage rates remained relatively flat this week, as yields for the benchmark 10-year Treasury spiked at the start of the period before dropping, according to Freddie Mac.

September 3 -

Nearly half of the second-quarter volume came from its existing customers.

September 3 -

But federal elections and the pandemic make projections on the sustainability of industry profitability especially tricky.

September 2 -

The pandemic drives home the point that without those funds being siphoned off, the recent fee hikes would not be necessary.

September 2 Community Home Lenders Association

Community Home Lenders Association -

Mortgage applications fell for the third consecutive week, likely because those borrowers motivated to refinance have already done so, according to the Mortgage Bankers Association.

September 2 -

The decision is the latest development in an ongoing dispute between the shuttered company and its regulator.

September 1 -

The third annual survey seeks to identify and recognize the best employers in the industry.

September 1 -

The refinance boom kept mortgage loan application defect risk flat, with record-low levels in July, but fraud risk for purchases climbed again, according to First American Financial.

August 31 -

Mortgage industry hiring and new job appointments for the week ending Aug. 28.

August 28 -

Mortgage rates decreased by 8 basis points this week, remaining near record lows, while a strong purchase market should continue into the fall, according to Freddie Mac.

August 27 -

Mortgage application volume decreased 6.5%, falling for the second consecutive week with refinance activity at its lowest since early July, according to the Mortgage Bankers Association.

August 26 -

Kasasa's turnkey product for community banks and credit unions offers a "take-back" option.

August 25 -

As swelling demand constricts inventory to record-low levels, home price growth cuts into the purchasing power afforded by plunging interest rates, according to First American.

August 24 -

Mortgage industry hiring and new job appointments for the week ending Aug. 21.

August 21 -

Mortgage rates crept up this week, nearly reaching the 3% mark as lenders raised prices because of a new fee, although purchase activity remained solid, according to Freddie Mac.

August 20 -

With mortgage rates tumbling near 3% in the second quarter, refinance originations spiked 400% in some housing markets, pushing overall volume to its highest point since 2009, according to Attom Data Solutions.

August 20 -

The coronavirus continued reshaping the Bay Area housing market last month, as demand for homes was weakest in San Francisco and strongest in the North Bay as buyers untethered to an office sought more space.

August 20