-

State and local governments are clearing the policy hurdles that stand in the way of mortgage e-closings and that could pave the way for more progress toward this goal.

February 14 -

Mortgage industry hiring and new job appointments for the week ending Feb. 14.

February 14 -

Mortgage rates ticked up slightly, marking the first increase in four weeks, but they remain at levels which encourage borrowers to refinance, according to Freddie Mac.

February 13 -

While boosting origination volume for lenders and providing financial benefits for borrowers, the refinance boom could have adverse effects down the road, according to TransUnion.

February 12 -

Refinance application activity last week was the highest in nearly seven years, with more than triple the volume from one year ago, according to the Mortgage Bankers Association.

February 12 -

Banks' lowering of origination fees and loosening of underwriting standards often foreshadow a downturn.

February 11 Nations Lending Corp.

Nations Lending Corp. -

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

Ocwen Financial Corp. is on track to become profitable on a pretax basis by the third quarter without any special items enhancing earnings, according to a preliminary release of its fourth-quarter results.

February 7 -

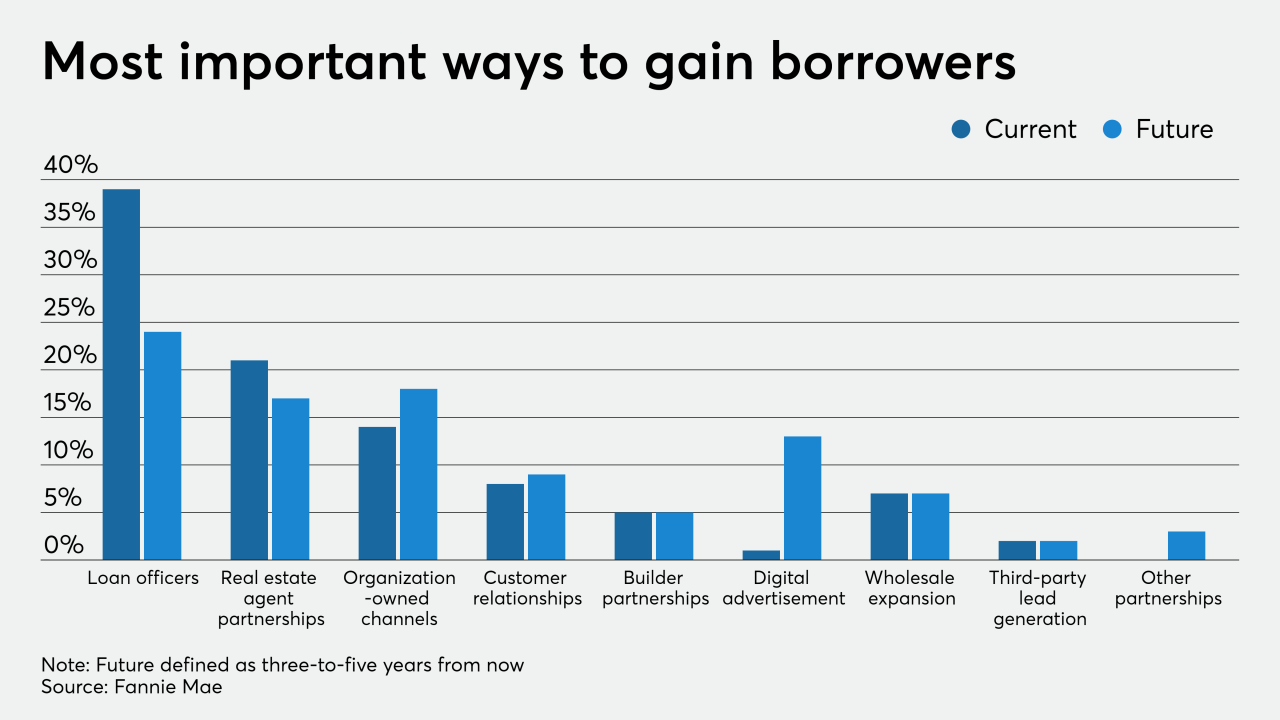

While loan officers will remain mortgage lenders' leading business development tool in the future, those originators believe business will come from a more diversified source pool, a Fannie Mae survey found.

February 7 -

Mortgage industry hiring and new job appointments for the week ending Feb. 7.

February 7 -

Mortgages guaranteed by the Department of Veterans Affairs may increase in certain regions due to a new option that can offset a broader fee increase.

February 6 -

JPMorgan Chase may jump back into a mortgage program that helps low-income Americans buy homes, mulling a return years after most banks pulled back from the business in frustration over billions of dollars in penalties.

February 5 -

Mortgage application volume increased 5%, led by refinancings, as interest rates continued to fall on fears that the coronavirus was spreading in China and elsewhere, according to the Mortgage Bankers Association.

February 5 -

The prevention of wire fraud and cybercrime being perpetrated against the mortgage business is the latest passion for Regina Lowrie, longtime industry executive and the first woman to head up the Mortgage Bankers Association.

February 3 -

The mortgage securitization market can expect some changes, particularly in the specified pool and to-be-announced markets, alongside a continuation of trends in other areas.

January 31 Vice Capital Markets

Vice Capital Markets -

JPMorgan Chase & Co.'s Mike Weinbach, chief executive officer of the home-lending business, is departing the firm after 16 years.

January 31 -

Mortgage industry hiring and new job appointments for the week ending Jan. 31.

January 31 -

Loan application defect risk fell in December after stabilizing the prior month, but it's not dropping as it quickly as it once was, according to First American Financial.

January 30 -

Contract signings to purchase previously owned homes unexpectedly slumped in December, depressed by fewer listings of properties and representing a blemish after a recent spate of positive housing-market news.

January 29 -

Mortgage applications increased 7.2% from one week earlier as consumers reacted to falling interest rates related to news regarding the coronavirus, according to the Mortgage Bankers Association.

January 29