-

Mortgage industry hiring and new job appointments for the week ending Dec. 13.

December 12 -

Mortgage application activity increased 3.8% from one week earlier, with refinance volume for Federal Housing Administration-insured loans taking the spotlight, the Mortgage Bankers Association said.

December 11 -

Florida-based depository Capital City Bank has struck a deal to purchase a 51% share in regional lender BrandMortgage.

December 11 -

The prequalification letter is a great way to move borrowers from casual tire kickers to committed applicants, but advances in digital verification will soon make it obsolete.

December 10 Blend

Blend -

The share of Department of Veterans Affairs-guaranteed loans in Ginnie Mae mortgage-backed securities issuance rose to 42% in the most recent fiscal year from almost 39%, and could continue to rise.

December 9 -

The U.S. Trustee overseeing the bankruptcy filing by Ditech is objecting to certain fees and expenses sought by Weil, Gotshal & Manges, among others.

December 9 -

The U.K.’s Financial Conduct Authority is forcing firms to spell out executives’ responsibilities and put them on the hook for conduct problems. The toughest rules will apply to larger mortgage lenders.

December 6 -

Mortgage industry hiring and new job appointments for the week ending Dec. 6.

December 6 -

Despite an uptick in homebuilding and favorable financing rates, Hovnanian Enterprises' latest earnings results remained in the red due to a charge the company took to reposition debt.

December 5 -

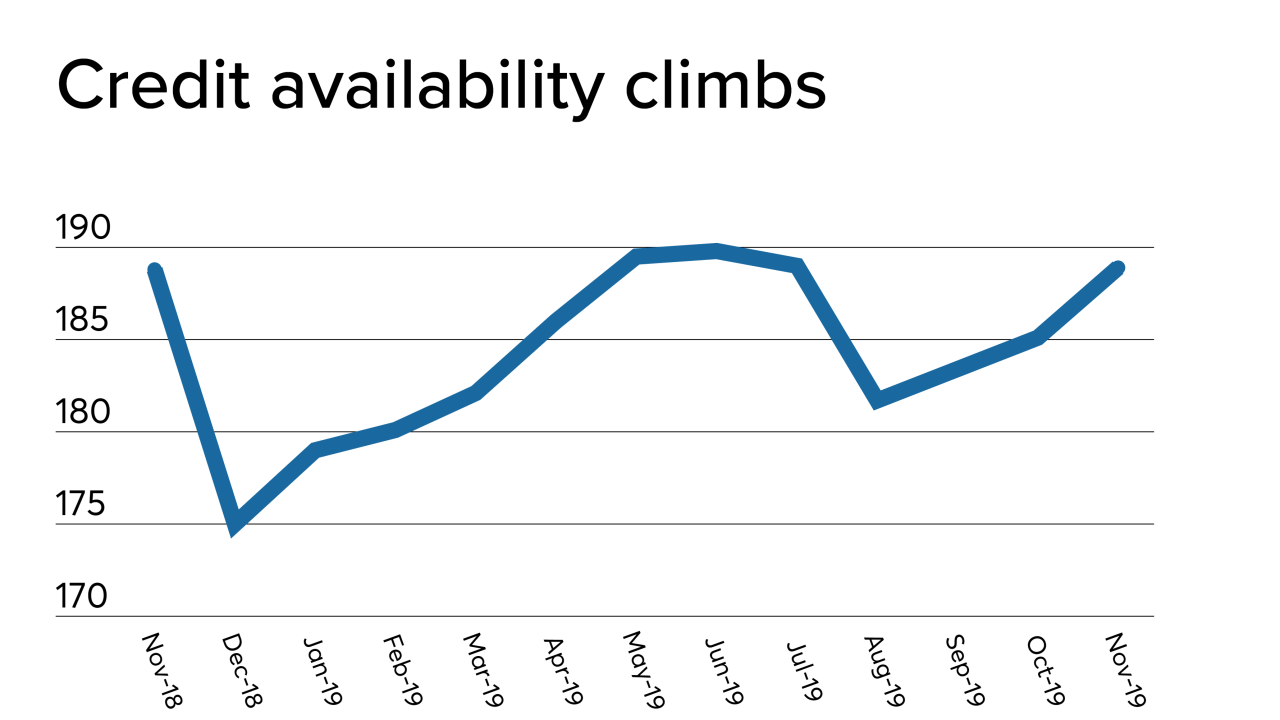

The availability of mortgage credit jumped in November from the previous month as jumbo activity and refinancing in the government market increased, according to the Mortgage Bankers Association.

December 5 -

The Federal Housing Administration's loan limits will generally increase 5% next year, but changes in the composition of statistical areas will lead to decreases in 11 counties.

December 4 -

Wealthfront will add third-party mortgages to its investing platform, while Varo Money says robo advice and mortgages are in its long-term plans.

December 4 -

Purchase mortgage application activity is at its highest level since this summer on a seasonally adjusted basis, and should remain strong in December, according to the Mortgage Bankers Association.

December 4 -

Wealthfront will add third-party mortgages to its investing platform, while Varo Money says robo advice and mortgages are in its long-term plans.

December 3 -

Loan defect risk in purchase applications stopped falling and plateaued in October, according to First American Financial Corp.

December 2 -

Mortgage industry hiring and new job appointments for the week ending Nov. 29.

November 29 -

Loan limits for most mortgages Fannie Mae and Freddie Mac buy will exceed $500,000 for the first time ever next year, and the maximum for most high-cost areas will be $765,000.

November 27 -

From product-specific variations in refinancing rates to pockets of depreciation in an otherwise healthy market, here are some details in housing-related data that highlight important underlying trends in the mortgage business.

November 27 -

Mortgage application activity rose 1.5% compared with one week earlier as interest rates remained below 4%, according to the Mortgage Bankers Association.

November 27 -

The housing market has changed dramatically since 2002 but the current appraisal limit has not. It's time for NCUA to catch up.

November 25