-

Guild Mortgage CEO Mary Ann McGarry is giving up the president's title as the San Diego-based company continues its national expansion plans.

November 18 -

The Consumer Financial Protection Bureau issued new rules governing mortgage lenders' screening and training of loan originators with temporary authority.

November 15 -

Mortgage industry hiring and new job appointments for the week ending Nov. 15.

November 15 -

Mortgage rates rose modestly this week as investors have a more positive view of the economy and so they are moving money out of the bond market, according to Freddie Mac.

November 14 -

The percentage of recent mortgage borrowers with subprime credit scores still resides in the single digits, but nearly doubled what is was in 2013, according to TransUnion.

November 13 -

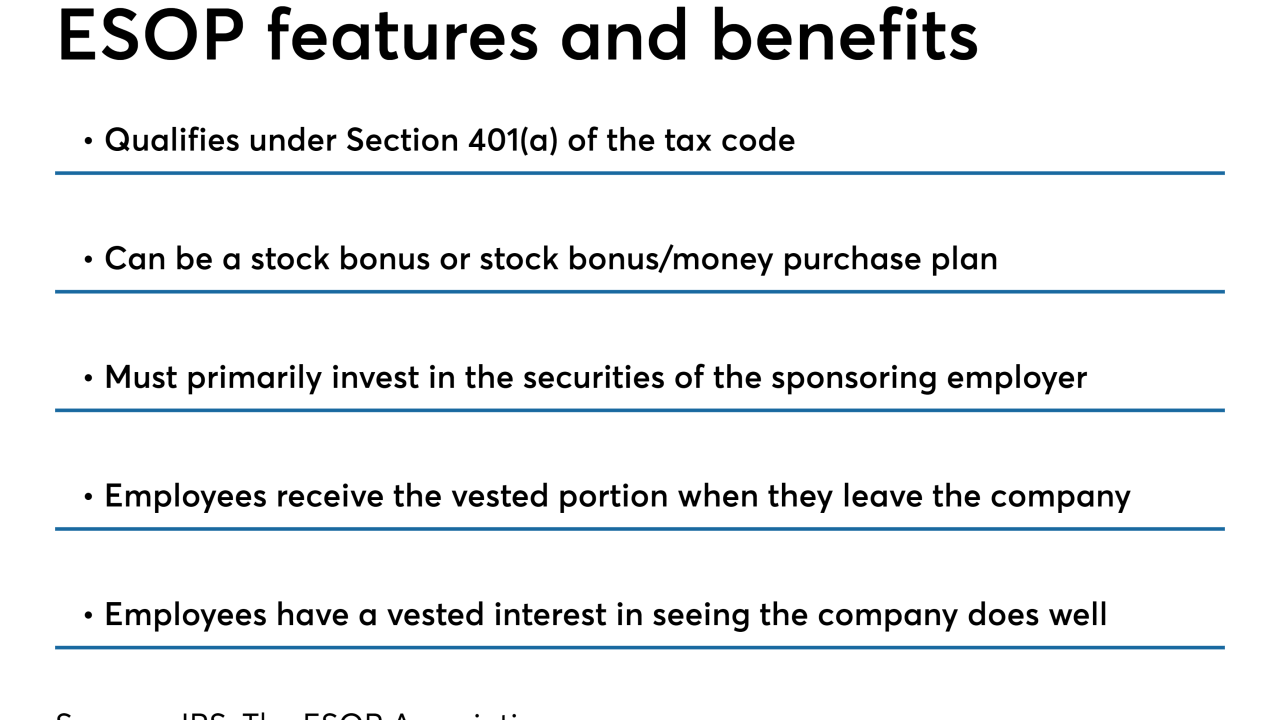

The American Mortgage Network name is being revived again, this time for a de novo company that will be 100% employee owned.

November 13 -

Mortgage applications increased from one week earlier, although conforming loan interest rates moved back over 4%, according to the Mortgage Bankers Association.

November 13 -

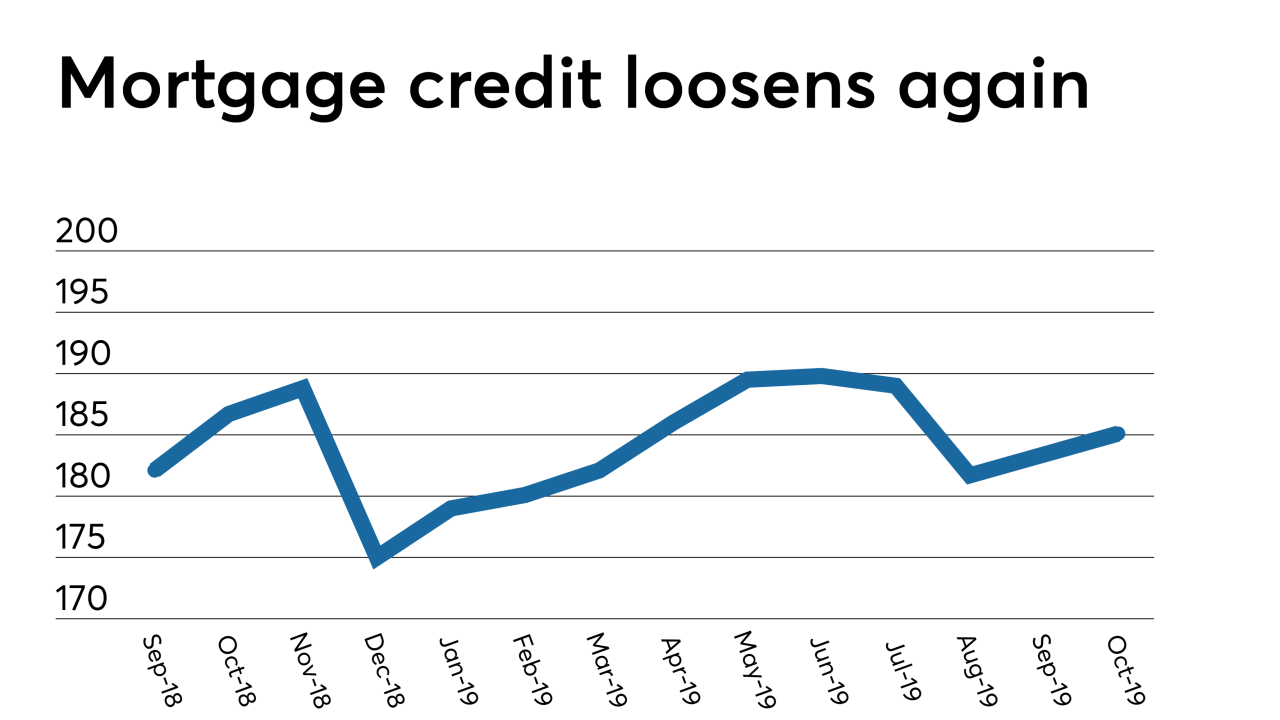

Mortgage credit availability increased in October from the previous month, as mortgage lenders increased their product offerings outside the government market, according to the Mortgage Bankers Association.

November 12 -

Zillow Group reported third-quarter revenue that beat estimates as growing sales in its online marketing and home-flipping businesses sent shares higher in late trading.

November 8 -

Mortgage industry hiring and new job appointments for the week ending Nov. 8.

November 8 -

-

-

Taylor Morrison Home Corp. has agreed to buy William Lyon Homes in a deal that would combine the two companies' in-house mortgage divisions and make the resulting entity the fifth-largest U.S. homebuilder.

November 6 -

-

It was activity at the upper end of the housing market that helped to keep mortgage application volume level with the previous week, the Mortgage Bankers Association said.

November 6 -

Financial regulators have been put on notice about the risk of an economically damaging cash crunch in the home mortgage market. Behind the concern: the rapid growth of shadow banks in the origination and servicing of home loans.

November 5 -

Sixty percent of the loans were underwritten with just 12- or 24-month bank statements, according to ratings agency reports.

November 5 -

Orix Corp. has agreed to buy U.S. commercial real estate lender Hunt Real Estate Capital, its latest acquisition in the field.

November 4 -

Freddie Mac is now forecasting back-to-back years of $2 trillion in mortgage loan originations rather than a drop-off in 2020.

November 1 -

Mortgage industry hiring and new job appointments for the week ending Nov. 1.

November 1