-

-

The latest round of earnings reports from home lending businesses and vendors continue the positive vibe for the sector as most reported year-over-year improvement in profitability.

October 24 -

Economic uncertainty continued to affect mortgage rates, which rose to their highest level in 12 weeks, according to Freddie Mac.

October 24 -

The next phase of the digital mortgage revolution is starting and lenders need to use a holistic process to create their plans in order to get up to speed.

October 23 Capco Consulting

Capco Consulting -

The unexpected rise in refinancings during the third quarter affected mortgage industry business results in a mostly positive fashion for the period.

October 23 -

Interest rate swings during this past week resulted in a decline in both refinance and purchase mortgage applications compared with the previous period, according to the Mortgage Bankers Association.

October 23 -

Compass launched its bridge loan services program, aimed at giving homeowners more purchasing power and opportunity to buy a new house before selling theirs.

October 22 -

Home sales continued to perform in line with their potential in September and indicators suggest housing will keep flourishing through the fourth quarter, according to First American.

October 18 -

Mortgage industry hiring and new job appointments for the week ending Oct. 18.

October 18 -

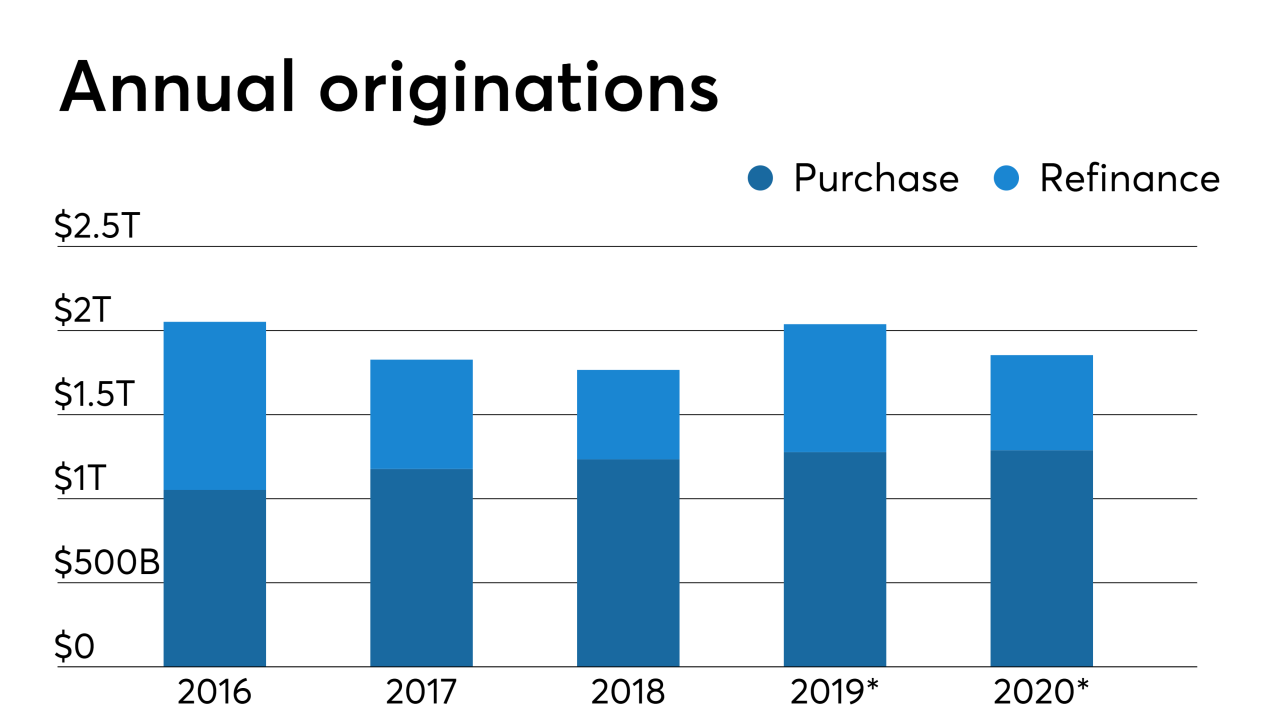

Single-family mortgage production this year is expected to be 3% higher than anticipated last month, according to Fannie Mae, which revised its estimates based partly on a stronger housing outlook.

October 17 -

Mortgage applications to purchase new homes dropped 8% in September from August, as ongoing uncertainty over interest rate movements and economy likely kept buyers out of the market, the Mortgage Bankers Association said.

October 17 -

Bank of America's total first-mortgage originations rose while its home equity production decreased in the third quarter.

October 16 -

Mortgage lenders prefer to invest in improvements to their consumer-facing technology because it offers a better return than similar spending on back-end processes, according to Fannie Mae.

October 16 -

Mortgage applications increased 0.5% from one week earlier, although interest rate instability affected consumers' ability to get the best price for their loan, according to the Mortgage Bankers Association.

October 16 -

Origination volumes continued to drift upward at JPMorgan Chase and Wells Fargo in the third quarter as mortgage servicing rights values fell more sharply than some analysts expected.

October 15 -

The ways in which hedging can be improved by a digital process are more often than not presumed versus proven by industry practice.

October 11 Vice Capital Markets

Vice Capital Markets -

Most home sellers are stressed around issues involving time and money — two things they can't control — because those affect the purchase and financing of their next home, a Zillow survey found.

October 11 -

Mortgage industry hiring and new job appointments for the week ending Oct. 11.

October 11 -

Millennial homeownership rates declined between 2009 and 2016 before picking up in 2017, even as the number of households under the age of 35 dropped by over 1 million, a ValuePenguin study found.

October 10 -

The Department of Veterans Affairs distributed more than $400 million in refunded home loan fees after finding exempt borrowers were mistakenly charged due to clerical errors related to their disability status.

October 10