-

Most digital transformation efforts concentrate on loan origination technology and do not deal with the costs incurred in the settlement and closing process.

August 8 LodeStar Software Solutions

LodeStar Software Solutions -

Rates for 30-year mortgages are at their lowest since late 2016, sending many previously hesitant homeowners to their brokers.

August 8 -

The economic tensions between the U.S. and China drove interest rates down last week, leading to a surge in refinance applications, according to the Mortgage Bankers Association.

August 7 -

Mortgage industry hiring and new job appointments for the week ending Aug. 2.

August 2 -

Purchase mortgage applications continue to decline, falling to their lowest level since the start of the spring, as supply constraints limit homebuyer activity, according to the Mortgage Bankers Association.

July 31 -

Mortgage industry hiring and new job appointments for the week ending July 26.

July 26 -

Fewer consumers applied for mortgages last week even as interest rates declined by 3 to 4 basis points for all product types, according to the Mortgage Bankers Association.

July 24 -

MGIC reported higher-than-expected earnings, seen as a positive for the other mortgage insurers, plus Flagstar and KeyCorp had strong quarters for their mortgage businesses.

July 23 -

Pretax mortgage income at NVR Inc. surged 37% year-over-year in the second quarter while originations rose 1%, contrasting more tepid home-loan earnings results relative to originations at big banks.

July 19 -

Mortgage industry hiring and new job appointments for the week ending July 19.

July 19 -

Mortgage lenders continue prioritizing technology efforts over all else in hopes of tackling a slew of market hurdles and threats, according to Fannie Mae.

July 18 -

Former Lend America executive Michael Ashley was sentenced to three years in prison for his actions that led to the implosion of the once-high-flying Melville, N.Y.-based mortgage lender.

July 18 -

Quicken Loans Inc.'s biggest quarter to date means more jobs in Detroit.

July 18 -

The second quarter continues to shape up as a good one for bank mortgage lenders — and one ancillary service provider — that are benefiting from a spike in volume.

July 17 -

Higher interest rates led to a 1.1% seasonally adjusted decline in mortgage applications compared with the previous week, according to the Mortgage Bankers Association.

July 17 -

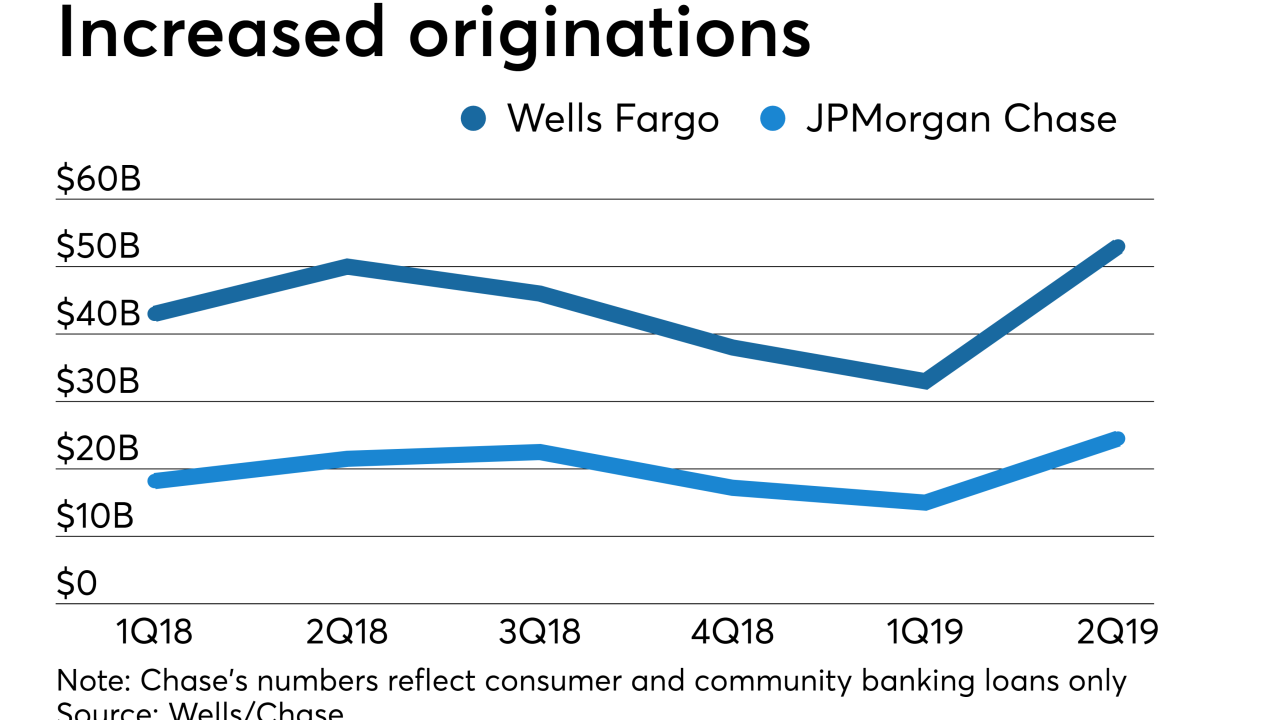

Wells Fargo and JPMorgan Chase recorded stronger mortgage originations in the second quarter as rates fell, but profits from single-family loans were lower than a year ago due to decreased servicing revenue.

July 16 -

Despite a significant rise in first-mortgage production due to lower interest rates, profits from home lending in Citigroup's retail banking division fell slightly in the second quarter.

July 15 -

After two strong months, applications to purchase newly constructed homes retrenched a bit as broader policy issues weighed on consumers, according to the Mortgage Bankers Association.

July 12 -

A new wave of mortgage production technologies empower lenders to create a more personalized approach to serving borrowers compared with the ubiquitous loan origination systems created over 10 years ago.

July 12 Blue Sage Solutions

Blue Sage Solutions -

Savings related to artificial intelligence could add up to a couple million dollars within 12 months for lenders with sufficient scale, according to an independent researcher hired by Black Knight.

July 12