-

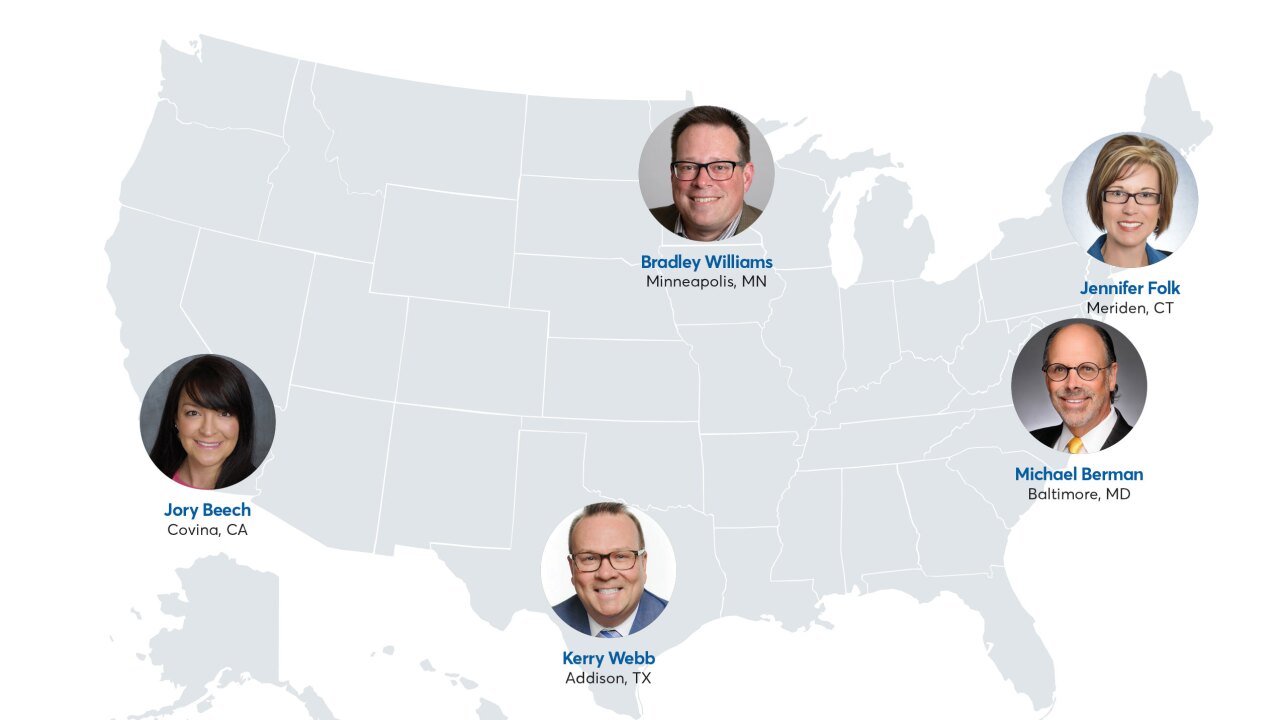

Mortgage industry hiring and new job appointments for the week ending May 31.

May 31 -

Consumer worries over the direction of the U.S. economy affected mortgage application activity this past week even as interest rates remained flat or declined, according to the Mortgage Bankers Association.

May 29 -

First American Financial Corp. tumbled the most in nearly eight years amid concerns that a security flaw at the title insurer may have allowed unauthorized access to more than 885 million records related to mortgage deals going back to 2003.

May 28 -

First American Financial may have allowed unauthorized access to more than 885 million records related to mortgage deals going back to 2003, according to a security researcher.

May 24 -

Mortgage industry hiring and new job appointments for the week ending May 24.

May 24 -

With mortgage rates falling to their lowest level in over a year, refinance volume drove this week's increase in application activity, according to the Mortgage Bankers Association.

May 22 -

Mortgage industry hiring and new job appointments for the week ending May 17.

May 17 -

Mortgage activity plunged before the start of the year, but subprime originations dropped the least, according to TransUnion. Despite dwindling volume, borrower delinquency rates hit historic lows in the first quarter.

May 16 -

Mortgage rates descended through the onset of spring's home buying season, pushing up the share of refinance loans and volume of new-home purchase applications, according to Ellie Mae and the MBA.

May 16 -

Meridian Corp. may have breached sales agreements after originating nearly $100 million in loans in a state where it lacked a license.

May 16 -

The trade dispute with China is likely to affect consumers' willingness to buy a home and apply for a new mortgage loan, according to the Mortgage Bankers Association.

May 15 -

Americans continued to take on debt in the first quarter, though new mortgage borrowing slowed to the weakest level since late 2014, according to a Federal Reserve Bank of New York report.

May 14 -

Mortgage industry hiring and new job appointments for the week ending May 10.

May 10 -

Whether online or advertised on a sign, very few consumers will qualify for that incredible low-rate deal. Here's why.

May 9 -

An increase in purchase activity drove the week-over-week rise in mortgage application volume as homebuyers entered the market while interest rates fell, according to the Mortgage Bankers Association.

May 8 -

Lower interest rates caused mortgage serving rights runoff plus a charge to the fair value of that portfolio and led to Ocwen Financial posting a first-quarter loss.

May 7 -

Movement Mortgage purchased the two branches that comprise Huntsville, Ala.-based Platinum Mortgage's retail business just weeks after the latter company sold its wholesale division.

May 3 -

Mortgage industry hiring and new job appointments for the week ending May 3.

May 3 -

The Consumer Financial Protection Bureau proposed steps to ease Home Mortgage Disclosure Act requirements, just days after announcing it was retiring a platform to let users analyze raw mortgage data.

May 2 -

First-quarter year-over-year results declined at a pair of mortgage bankers active in the acquisitions market as well as at the provider of the most used servicing technology.

May 1