-

Subprime originations are climbing in multiple consumer loan categories, including mortgages, but the increase is much smaller in the home loan sector than it is in other markets, according to TransUnion.

November 19 -

Borrowers buying new homes produced fewer loan applications than they did a year earlier due to October's rising interest rates.

November 16 -

Mortgage industry hiring and new job appointments for the week ending Nov. 16.

November 16 -

Wells Fargo will lay off 1,000 workers primarily from its mortgage unit in the first major round of a previously announced plan to cut the bank's workforce by as much as 10% over the next three years.

November 15 -

Mortgage application activity decreased 3.2% from one week earlier as interest rates rose to eight-year highs and refinancings fell to an 18-year low, according to the Mortgage Bankers Association.

November 14 -

Lenders are constantly looking for ways they can streamline their operations and produce savings for themselves and their borrowers in order to compete in a leaner market this year.

November 12 -

American Financial Resources, a Parsippany, N.J.-based mortgage lender, will pay any required agent fees for U.S. Department of Veterans Affairs loans for its brokers and correspondents on all AFR-related VA loan submissions starting Veterans Day.

November 12 -

Ginnie Mae officials are concerned about unusual activity with Department of Veterans Affairs cash-out refinances and are investigating the causes, as well as whether predatory lenders are taking advantage of veterans.

November 12 -

More veterans are turning to Department of Veterans Affairs loans to buy a house as the number of purchase mortgages shot up 59% compared to five years ago.

November 9 -

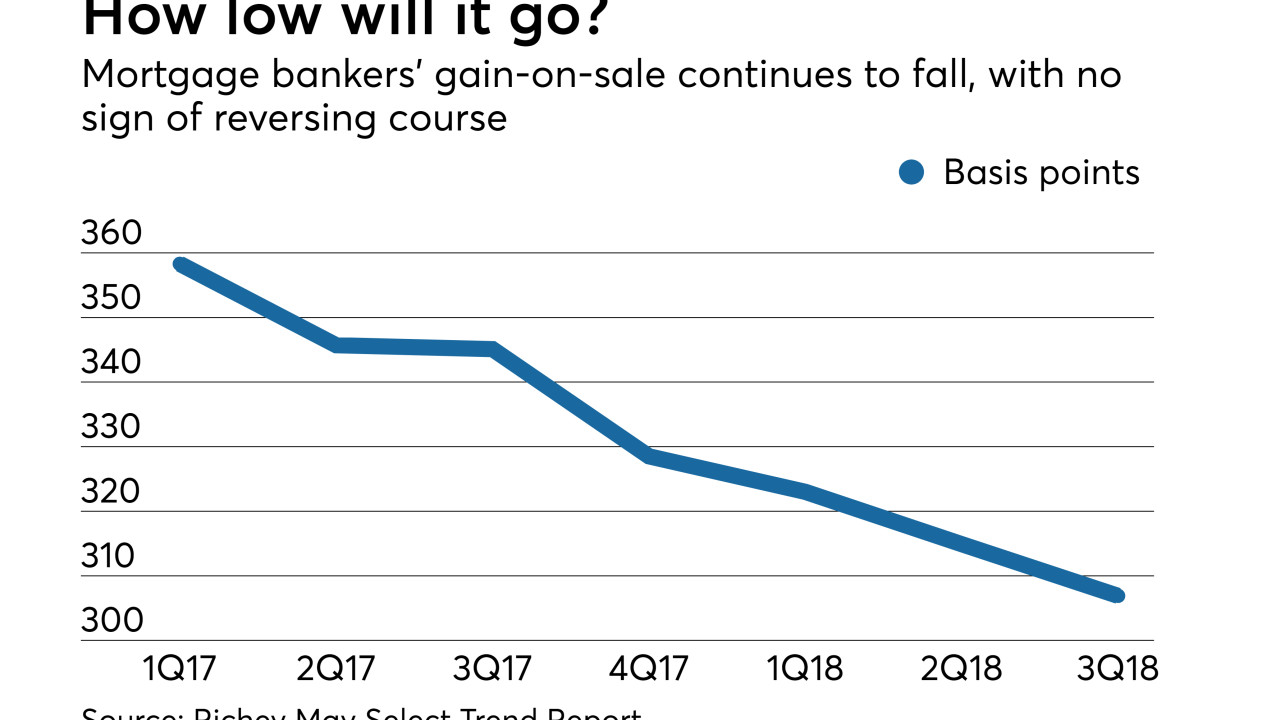

If falling volume and rising costs weren't bad enough for nonbank mortgage lenders, an extended run of tight gain-on-sale margins is further eating into their profits.

November 9 -

-

Mortgage industry hiring and new job appointments for the week ending Nov. 9.

November 9 -

Mortgage application activity dropped to its lowest level since December 2014 as interest rates reached an eight-year high, according to the Mortgage Bankers Association.

November 7 -

Although forecasts anticipate a continuing drop in overall originations, private-label residential mortgage-backed securitizations backed by newer loans are expected to keep increasing through next year, according to Bank of America.

November 5 -

Mortgage industry hiring and new job appointments for the week ending Nov. 2.

November 2 -

Mortgage applications decreased 2.5% from one week earlier as purchase activity compared with 2017 fell for the first time in nearly three months, according to the Mortgage Bankers Association.

October 31 -

Mortgage industry hiring and new job appointments for the week ending Oct. 26.

October 26 -

High property values and low mortgage rates pushed commercial and multifamily originations beyond their projected totals in 2017 to a new market peak, according to the Mortgage Bankers Association.

October 25 -

An increase in refinance activity in the period after Columbus Day drove mortgage applications 4.9% higher from one week earlier, according to the Mortgage Bankers Association.

October 24 -

A surge in home equity borrowing may be around the corner as household equity levels surpassed their previous housing bubble peak, according to a TransUnion study.

October 19