-

The compliance software provider plans to use this funding to add staff and drive customer acquisition.

January 11 -

The division will focus on short-form video favored by emerging homebuyers.

January 5 -

-

-

The 2.5 million-member personal-finance app has saved consumers $100 million-plus since its founding in 2015, and could add a similar amount on an annualized basis to fee income.

December 20 -

The findings in a new TransUnion study could lend momentum to recent efforts by Fannie Mae and Freddie Mac to encourage the reporting and use of rental-payment information in lending.

December 7 -

LoanLogics, a Sun Capital affiliate, has purchased LoanBeam, a company with approvals from major government-related housing finance investors to provide digital processing and income calculations for tax documents.

December 2 -

Announcements from Paramount Residential Mortgage Group and LodeStar Software Solutions are early indications that the company’s aggressive investment in diversified business lines could pay off.

November 17 -

The deal between the two fintechs aims to cut mortgage decisioning times for lenders and expand access to financing for consumers.

November 16 -

The fintech’s algorithms are programmed like "Tesla’s self-driving cars," according to the company’s CEO.

November 15 -

The company increased and diversified its income streams beyond the mortgage sector but expenses associated with stock-based compensation and a recent acquisition outweighed these gains.

November 11 -

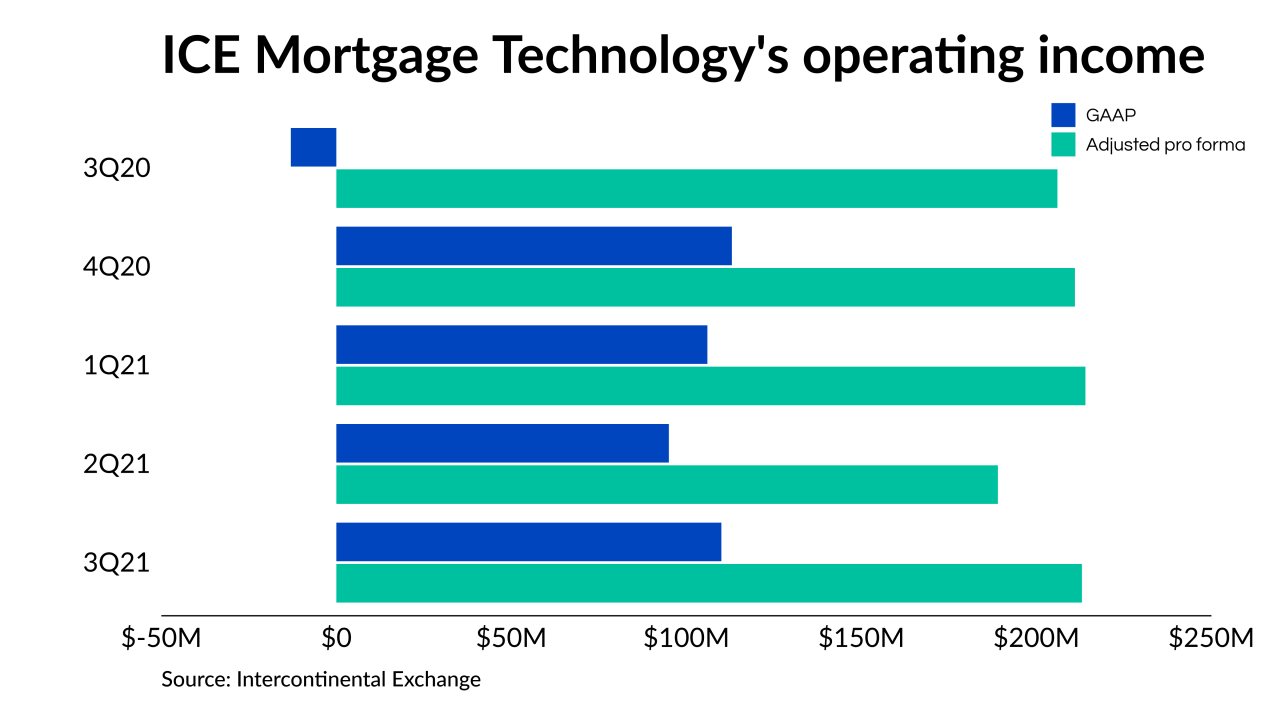

The company is making progress on a focus shift to recurring revenues from transactional activities.

October 28 -

The average of 8% of total expenses that lenders put toward technology has a value, but it shows up more in broader organizational goals and productivity, the study found.

October 26 -

The $146 million deal could indicate that volume in the asset class has gotten large enough to support programmatic activity in the pricey housing market.

October 12 -

With a huge wave of consolidation expected soon, lenders must carefully adjust their mix of personnel and technology to stay profitable, whether they plan to continue to compete or sell.

October 11 -

Take our survey to share your views on how the market will develop in the coming year.

October 6 -

The agreement with affiliate partner ForumPay would allow buyers to convert digital assets at a fixed rate and transfer them directly into escrow.

October 5 -

The platform, built off a recent acquisition, looks to create efficiency in the growing wholesale lending market.

September 15 -

The companies talk through their products aimed at making the processes safer and more inclusive for consumers.

September 14 -

The pandemic, a refinancing boom and intensified appraiser shortage boosted appraisal alternatives in line with the rise in remote work. Now an overheating purchase market and policymaker scrutiny are shifting priorities.

September 13