-

Recent developments in the Federal Housing Administration's Home Equity Conversion Mortgage program are making it easier for lenders to originate reverse mortgages to borrowers who want to buy a new-construction home.

March 6 -

Growing competition may prompt commercial mortgage-backed securities issuers to accept higher loan-to-value ratios in their deals.

March 5 -

The new Federal Reserve Board chairman's testimony in Congress was the driver of this week's mortgage rate increase, according to Freddie Mac.

March 1 -

Greenworks CEO Jessica Bailey said execution was good enough that it made economic sense; the company also wanted an early reading from rating agencies and investors.

February 26 -

Financial services groups are calling for more funding for the Internal Revenue Service that could fix flaws in the agency's system for verifying the income of mortgage applicants.

February 22 -

The 30-year fixed mortgage rate moved up for the seventh consecutive week with further increases possible as bond yields rise over concerns about higher inflation.

February 22 -

Private mortgage insurance continued to take market share from the Federal Housing Administration in 2017, with both products outpacing the growth in mortgage debt outstanding.

February 22 -

As inflation fears put upward pressure on 10-year Treasury bonds and mortgage rates nationally, borrowers could start to take more notice of what lenders are charging them locally.

February 20 -

Mortgage borrowers 60 days or more late with their payments declined both quarter-to-quarter and year-over-year, as recession-era defaults work their way out of the system.

February 20 -

Movement Mortgage quietly laid off employees at its Indian Land, S.C., headquarters late last week as well as other offices across the U.S.

February 20 -

Here's a look at the 12 cities where it takes the longest for homebuyers to save up enough money to make a 20% down payment on a house.

February 19 -

National MI set a record for new insurance written in the fourth quarter, but its parent company reported a net loss for the period due to tax reform.

February 16 -

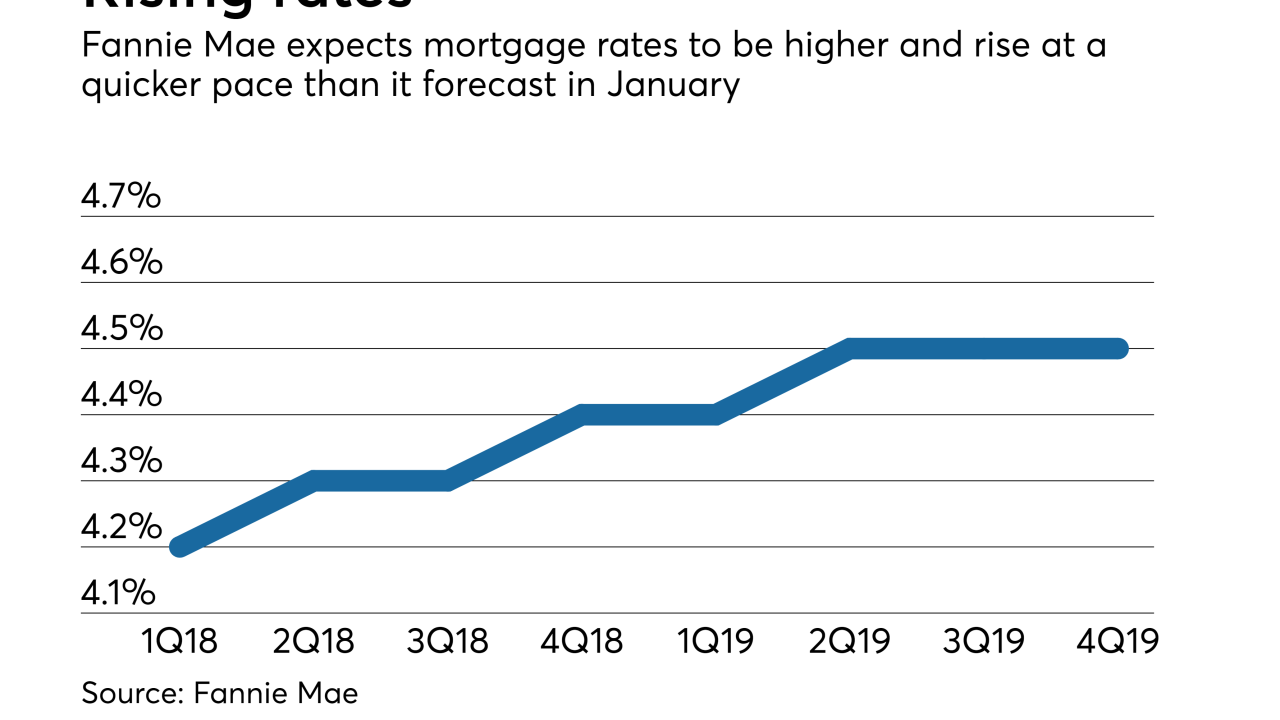

The recent bond market volatility will cause mortgage rates to rise to a higher level than previously projected, according to Fannie Mae.

February 15 -

Mortgage rates rose to their highest level in almost four years, as worries over inflation drove the 10-year Treasury yield to just shy of 3%.

February 15 -

Fannie Mae is doing more to expand its list of Day 1 Certainty report suppliers, naming Blend as the first online point of sale system to directly offer asset validations.

February 13 -

Here's a look at the 10 housing markets with the biggest gap between growth in home prices and wages that could indicate a housing bubble is forming.

February 13 -

Quicken Loans, Citizens Bank and Better Mortgage are refinancing loans using Airbnb income as part of a pilot project with Fannie Mae.

February 9 -

Mortgage rates hit their highest mark since December 2016 as bond yields were affected by the roller coaster stock market, according to Freddie Mac.

February 8 -

The legislation, a similar version of which passed in the last Congress, would give favorable regulatory treatment to certain loans even if real estate-related fees were paid to an affiliate of the lender.

February 8 -

Churchill Mortgage is building the "preunderwriting" process used to give borrowers a stronger sense of preapproval into its workflow to make financed offers on homes more competitive.

February 5