-

Problems with the IRS-managed Income Verification Express System, or IVES, have stoked concerns about delayed mortgage closings when volume picks up this spring.

February 2 -

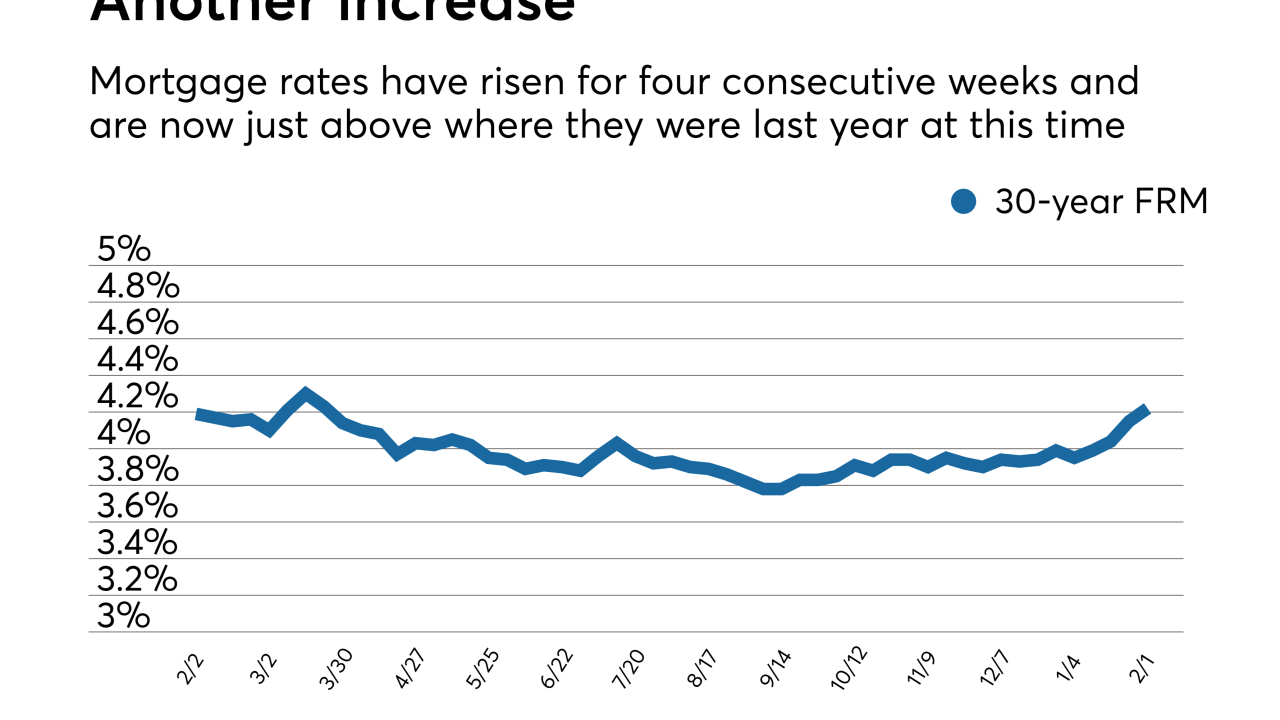

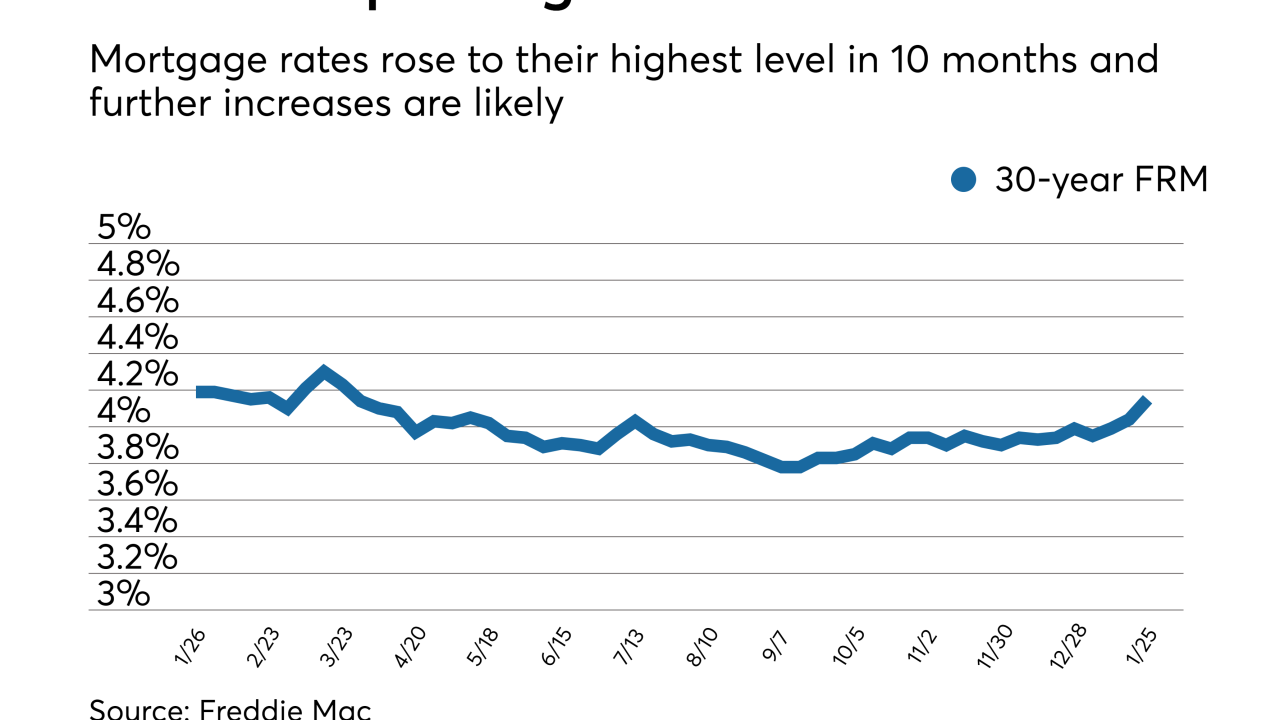

Mortgage rates, which are significantly higher since the start of the year, are likely to rise for weeks to come, according to Freddie Mac.

February 1 -

Lenders need to be aware of a possible investor backlash as critical defects found in closed loans increased in frequency as the shift continued to a purchase market.

January 30 -

From government grants to automating branch management tasks, lenders are using their knowledge of real estate, finance, and government incentives to maximize the resources they invest in facilities.

January 29 -

Borrowers with a problem during the mortgage origination process likely had multiple issues with their lender and a high percentage of those consumers felt the glitch was not resolved.

January 29 -

Roostify has integrated its mortgage transaction technology into LendingTree's lead generation system, creating a seamless path from product search through closing.

January 26 -

Mortgage rates rose for the third consecutive week and with expected continued economic growth, further increases are likely.

January 25 -

The strong housing economy in 2017 led to an increase in premiums earned and lower claims costs for Old Republic International's title insurance business.

January 25 -

While the majority of lenders feel mortgage industry data initiatives have been valuable, their cost is clouding some originators' viewpoint, a Fannie Mae survey found.

January 24 -

The agency is winning praise for changes in how loans are evaluated for defects, which could cut down on the risk of enforcement actions.

January 22 -

The government shutdown and Congress' inability to reauthorize the National Flood Insurance Program could delay some home sales and loan closings.

January 22 -

Here's a look at what happens at five federal agencies that support the mortgage industry during a government shutdown.

January 19 -

Given the improving U.S. economy, mortgage rates will probably not fall back under the 4% mark anytime soon.

January 18 -

The average VantageScore last year was higher than it has been since 2007 due to improved hiring and despite stagnant wages that aren't keeping pace with rising debt levels.

January 11 -

Mortgage rates jumped across the board as investors sold some of their Treasury bond holdings, which led to higher yields, according to Freddie Mac.

January 11 -

CMG Financial is offering a new affinity marketing portal on its crowdfunding platform for down payments and positioning it as a way for employers to retain millennials.

January 10 -

There were fewer mortgage programs available to borrowers at the lower end of the credit spectrum in December, resulting in an overall decrease in credit availability.

January 9 -

Consumer credit scores are improving, but many qualified borrowers are still hesitant about buying a house. New tools are helping lenders better assess risk and show consumers with lower credit scores they can qualify for mortgages.

January 8 -

Mortgage rates dropped to start the year as the markets had little new news to react on during the holiday period.

January 4 -

The gap between the average credit score for homebuyers and other consumers has widened to its highest point in 12 years, and lenders don't know what, if anything, to do about it.

January 3