-

The U.S. is taking steps to stamp out the practice of servicemembers and veterans being pressured into taking mortgages they don't need, a move that officials say will lower consumer costs and could lead to financial penalties for lenders.

December 7 -

Mortgage rates ticked up this week, but a larger rise is possible next week depending on what Congress does about tax reform and the budget.

December 7 -

Men listed as the primary borrower on a mortgage on average get approved for larger-balance loans than women, Ellie Mae finds in its latest Millennial Tracker survey.

December 6 -

Dozens of workers at the Frederick, Md., office of First Guaranty Mortgage Corp. will be out of work after layoffs were announced, but the office won't close as initially reported by a state agency.

December 5 -

Mortgage rates moved lower this week, but strong economic data and comments by the outgoing Federal Reserve chair left many anticipating higher rates, according to Freddie Mac.

November 30 -

Sometimes reaching underserved borrowers takes experimenting with changes to the mortgage finance system. That's why Fannie Mae and Freddie Mac are working with lenders to test innovative loan products that meet borrowers' evolving needs.

November 24 -

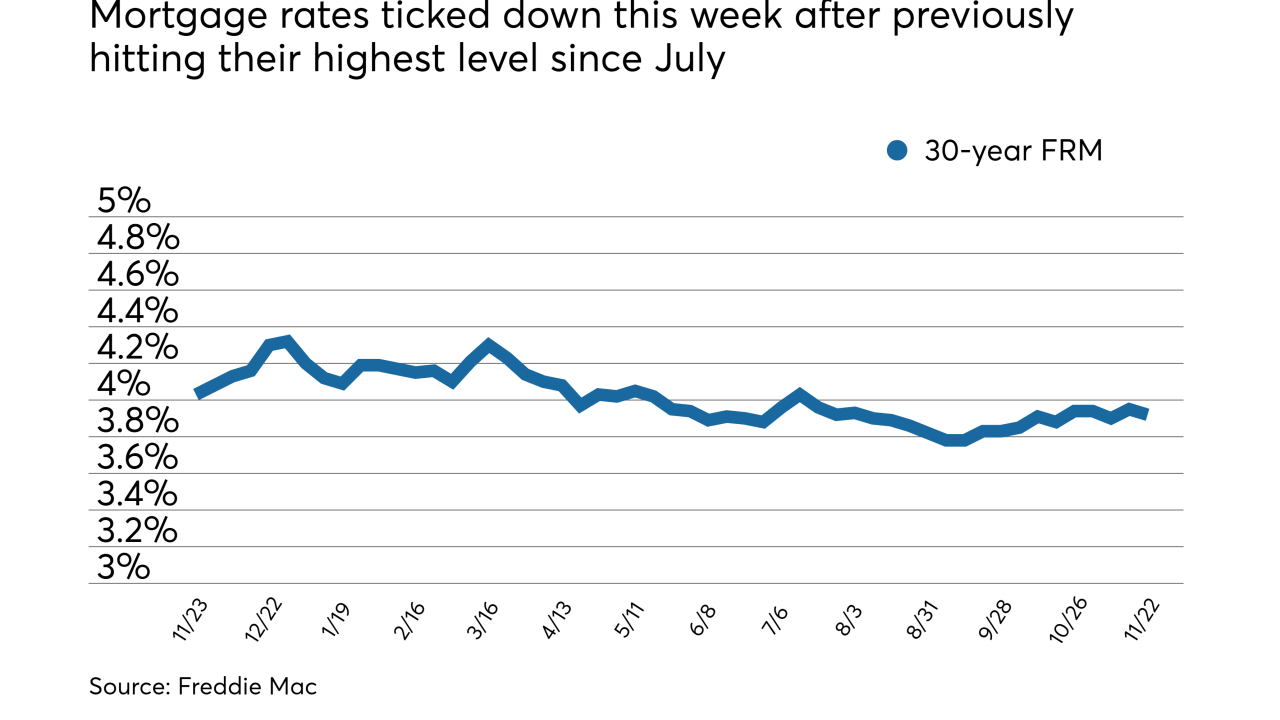

Mortgage rates ticked down this week after previously hitting their highest level since July, according to Freddie Mac.

November 22 -

Consumer default rates are up month-to-month, which may reflect a gap between spending and income that is stressing second mortgages and bank cards, Standard & Poor's and Experian find.

November 22 -

Mortgage closing costs average nearly $4,900 nationwide. But in some states, those fees can reach or exceed five figures. Here's a look at the areas where it costs the most to close a mortgage.

November 21 -

Mortgage rates moved to their highest mark since July and the 10-year Treasury yield ticked up 6 basis points, according to Freddie Mac.

November 16 -

That’s an about-face from the bank’s previous transaction, completed in October, which was backed by fixed-rate mortgages, nearly half of which were underwritten to standards for purchase by Fannie Mae or Freddie Mac.

November 16 -

Transfer taxes, settlement services and other home buying fees can vary wildly from state to state. Here's a look at the 10 states where home buyers need the least amount of cash to cover their closing costs.

November 14 -

Equifax reported earnings that were 27% lower and mortgage services revenue was 2% lower on a year-to-year basis after revealing a major breach and taking steps to improve security.

November 10 -

Mortgage rates fell slightly across the board after the release of the Republican Party tax plan and the nomination of a new Federal Reserve chairman.

November 9 -

A slight decrease in the number of jumbo investor offerings contributed to lower consecutive-month credit availability in October, according to the Mortgage Bankers Association.

November 8 -

Lenders selling loans through Freddie Mac's system experienced access difficulties Monday afternoon, when the government-sponsored enterprise sent out an alert to lenders about the problem.

November 6 -

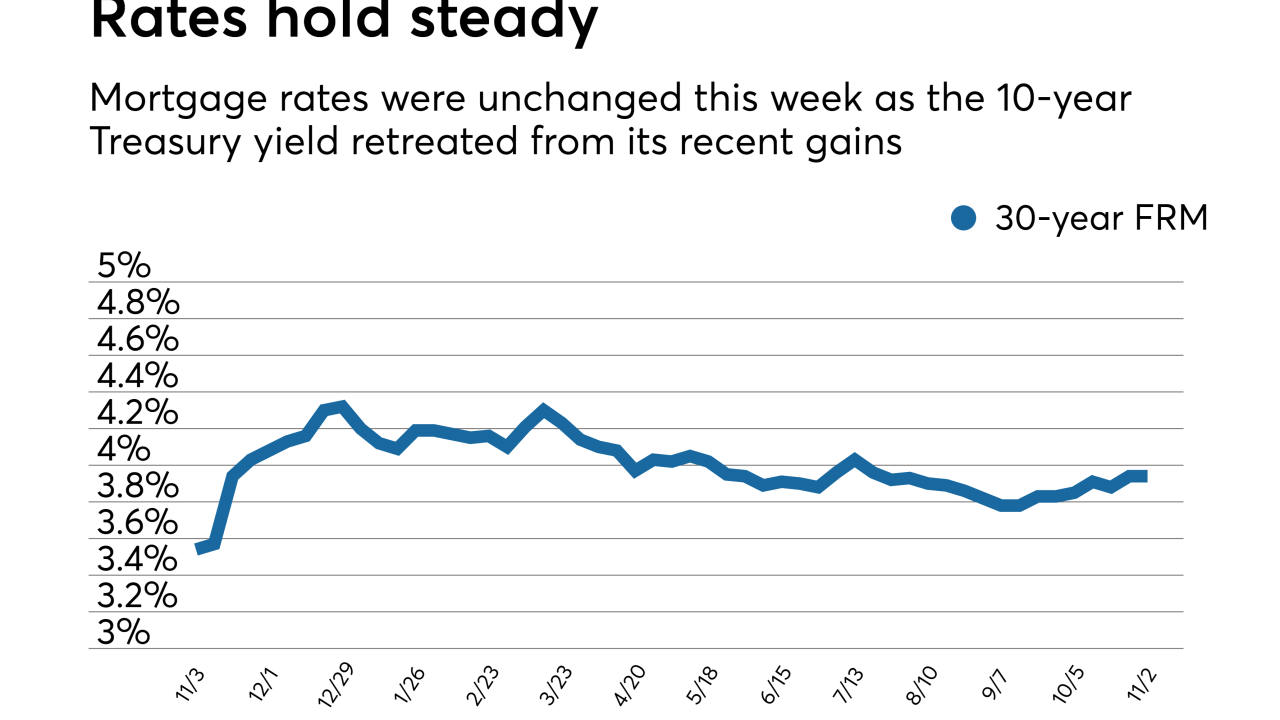

Mortgage rates were unchanged or up slightly this week even as the 10-year Treasury yield retreated from its recent gains, according to Freddie Mac.

November 2 -

A joint venture between loanDepot and OfferPad will broker loans for consumers who need financing to bridge gaps between the sale of one property and the purchase of another.

November 2 -

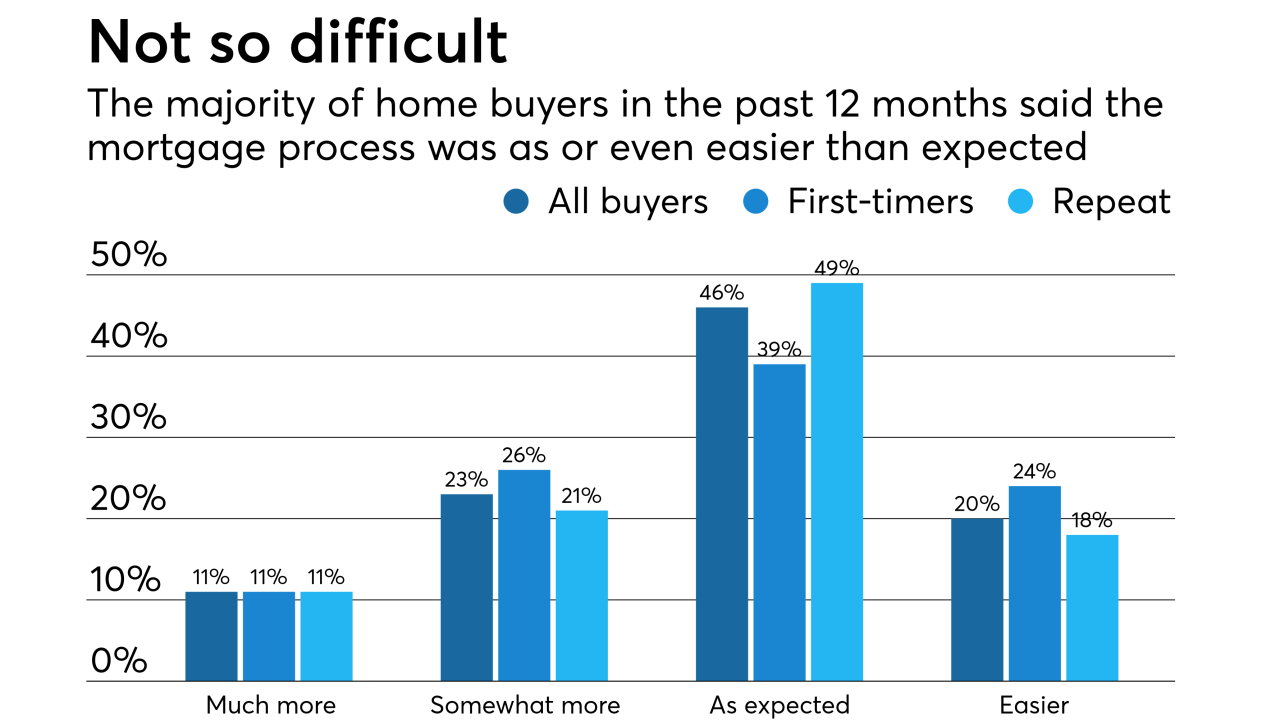

Recent home buyers found it easier getting a mortgage compared with last year's purchasers, but first-timers are being held back by a lack of inventory and student debt, according to a National Association of Realtors survey.

October 31 -

Mortgage rates reached their highest level since July and are closing in on 4%, according to Freddie Mac.

October 26