-

That’s an about-face from the bank’s previous transaction, completed in October, which was backed by fixed-rate mortgages, nearly half of which were underwritten to standards for purchase by Fannie Mae or Freddie Mac.

November 16 -

Transfer taxes, settlement services and other home buying fees can vary wildly from state to state. Here's a look at the 10 states where home buyers need the least amount of cash to cover their closing costs.

November 14 -

Equifax reported earnings that were 27% lower and mortgage services revenue was 2% lower on a year-to-year basis after revealing a major breach and taking steps to improve security.

November 10 -

Mortgage rates fell slightly across the board after the release of the Republican Party tax plan and the nomination of a new Federal Reserve chairman.

November 9 -

A slight decrease in the number of jumbo investor offerings contributed to lower consecutive-month credit availability in October, according to the Mortgage Bankers Association.

November 8 -

Lenders selling loans through Freddie Mac's system experienced access difficulties Monday afternoon, when the government-sponsored enterprise sent out an alert to lenders about the problem.

November 6 -

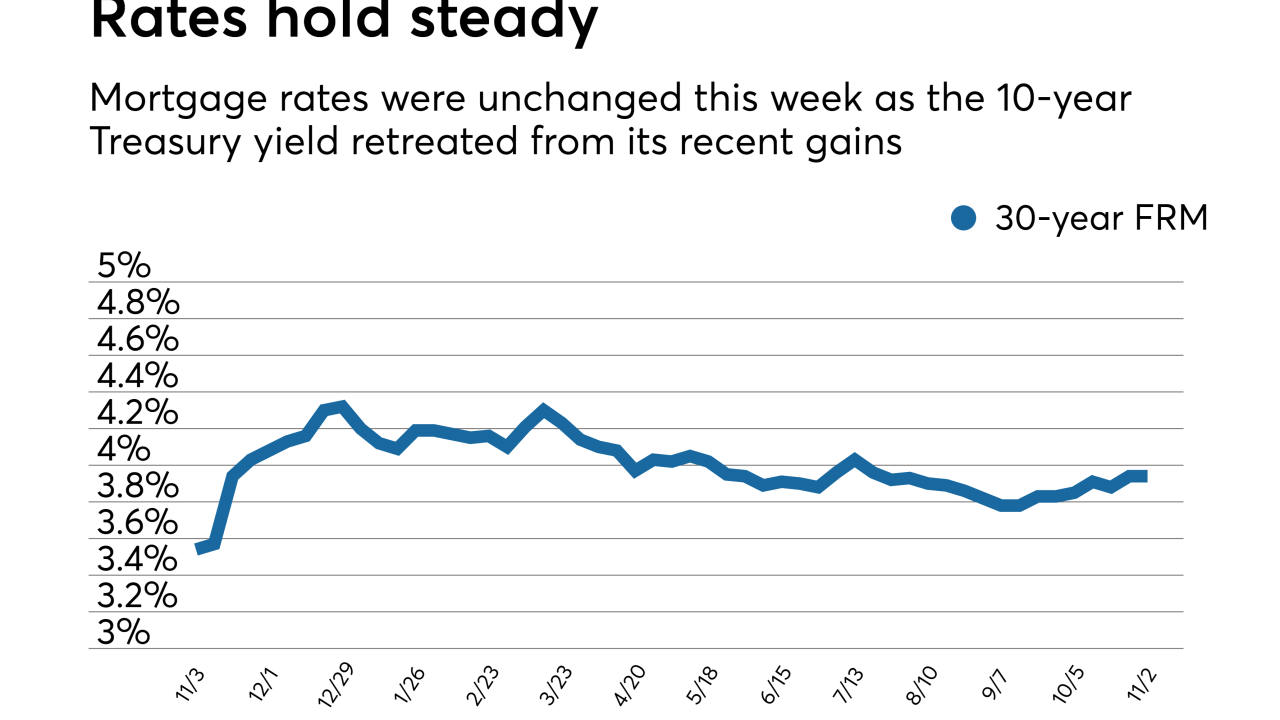

Mortgage rates were unchanged or up slightly this week even as the 10-year Treasury yield retreated from its recent gains, according to Freddie Mac.

November 2 -

A joint venture between loanDepot and OfferPad will broker loans for consumers who need financing to bridge gaps between the sale of one property and the purchase of another.

November 2 -

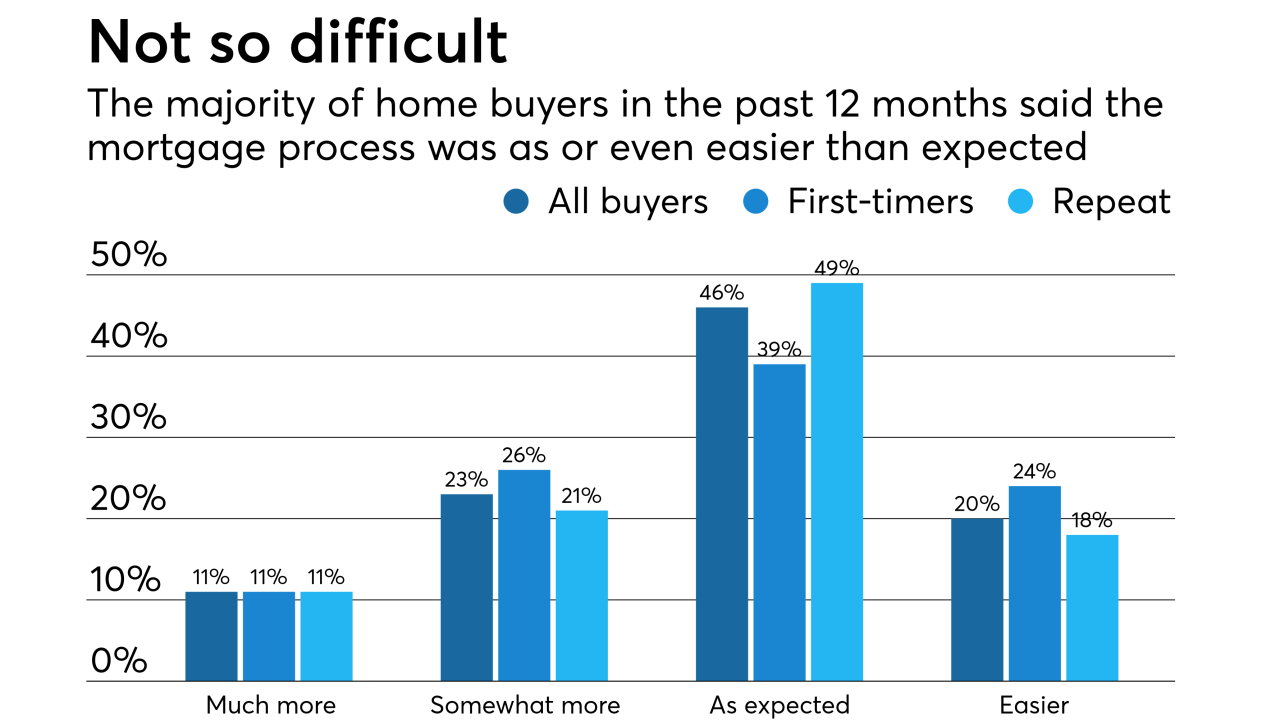

Recent home buyers found it easier getting a mortgage compared with last year's purchasers, but first-timers are being held back by a lack of inventory and student debt, according to a National Association of Realtors survey.

October 31 -

Mortgage rates reached their highest level since July and are closing in on 4%, according to Freddie Mac.

October 26 -

Radian Group reported third-quarter net income of $65 million after taking $57.8 million in pretax charges — $12 million of which is related to the Clayton Holdings restructuring.

October 26 -

Most secondary market outlets, along with the non-qualified mortgage lenders, remain reluctant to lend to legal cannabis workers because of the source and nature of their compensation, but opportunities are beginning to emerge.

October 25 -

Mortgage applications decreased 4.6% from one week earlier because of higher rates for conforming and government loans, according to the Mortgage Bankers Association.

October 25 -

Legalizing the recreational use of marijuana has created jobs in Colorado, bringing people into the state and putting stress on its residential purchase and rental markets.

October 24 -

The forecast for total originations of home equity lines of credit over the next five years is almost twice as high as the five-year total through 2017.

October 24 -

Fannie Mae is staging more pilot projects with lenders and vendors, including one that consolidates submissions of different types of loan data potentially eligible for immediate representation and warranty relief.

October 23 -

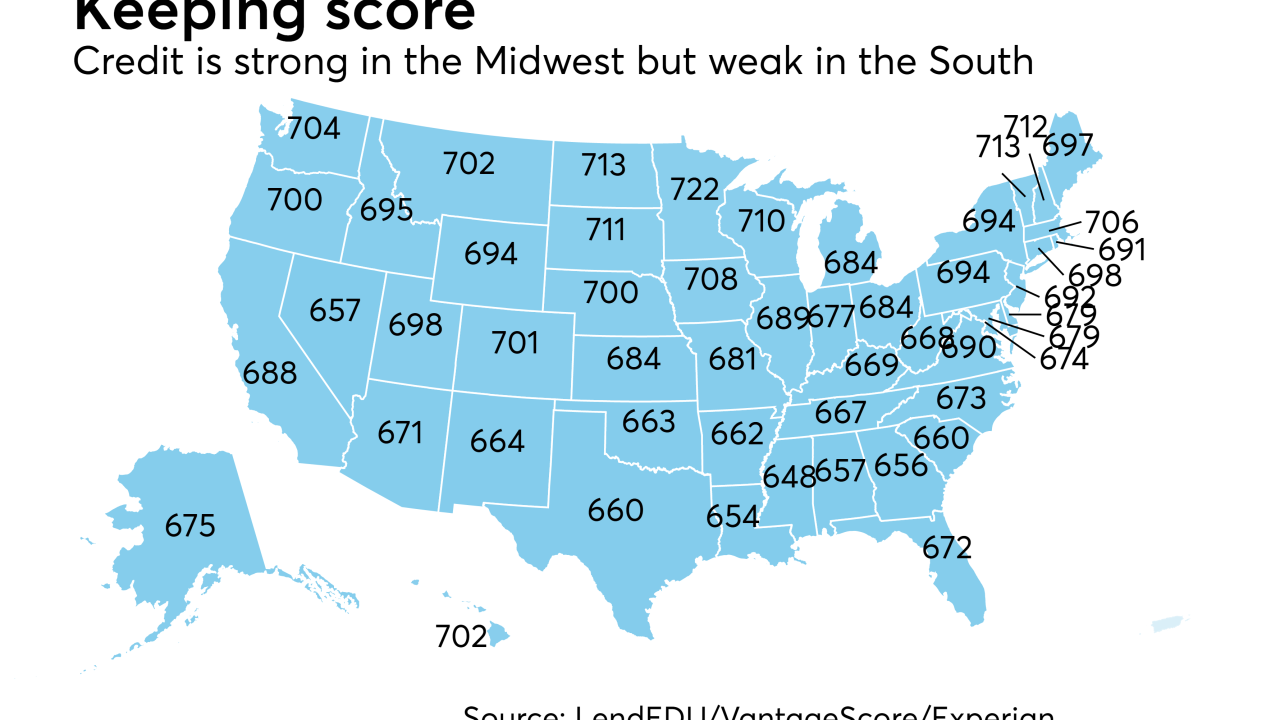

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

Cannabis businesses are legal in 29 states, but compliance questions on the federal level are keeping mortgage lenders from making loans to the industry's workers.

October 23 -

Fannie Mae is authorizing additional suppliers of reports that can give lenders immediate representation and warranty relief on certain data, diversifying beyond an exclusive partnership with Equifax in one category.

October 23 -

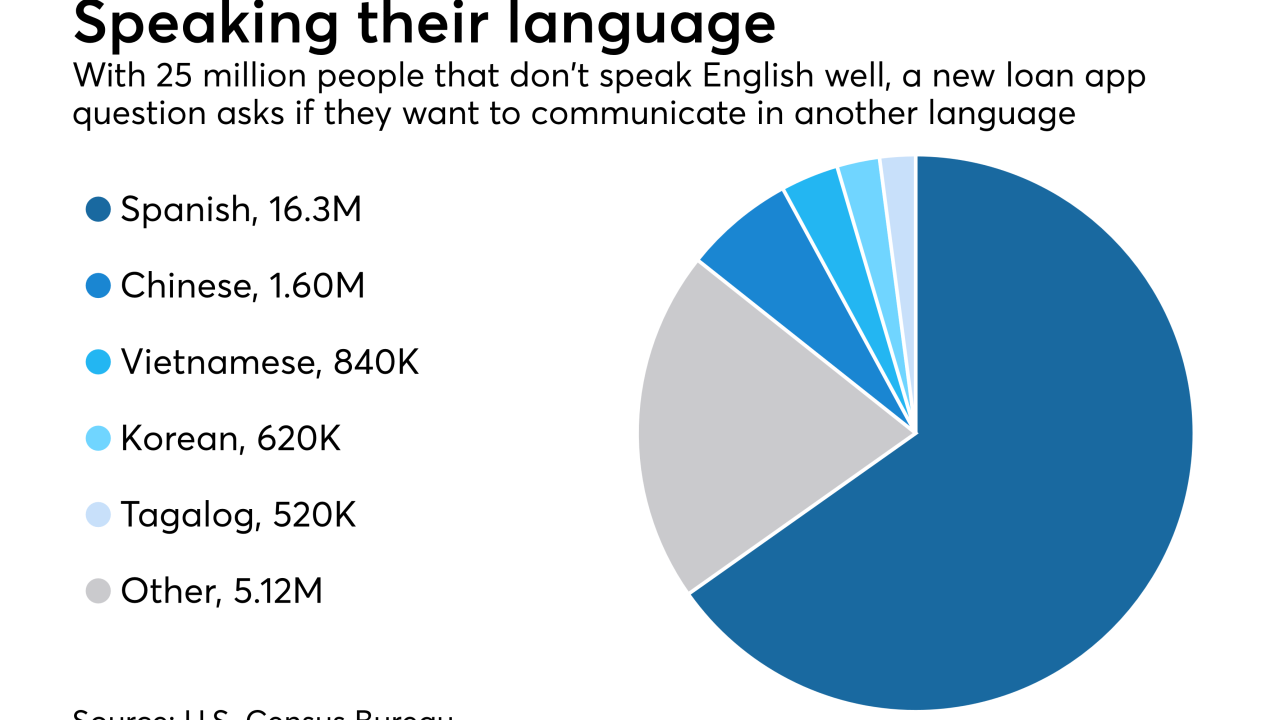

The Federal Housing Finance Agency added a language preference question to the loan application, rejecting the mortgage industry's wishes.

October 20