-

Mortgage applications increased 2.8% from one week earlier as refinancings hit their highest level since November, according to the Mortgage Bankers Association.

June 14 -

Houston-area homebuyers snapped up a record number of houses in May and drove the region's median sales price to unprecedented levels.

June 14 -

The gap between what homeowners believe their home is worth and what the actual value widened for the sixth consecutive month in May, according to Quicken Loans.

June 14 -

Home sales and prices in the Baltimore area continued to climb in May, as buyers vied for properties in a market with historically low inventory.

June 13 -

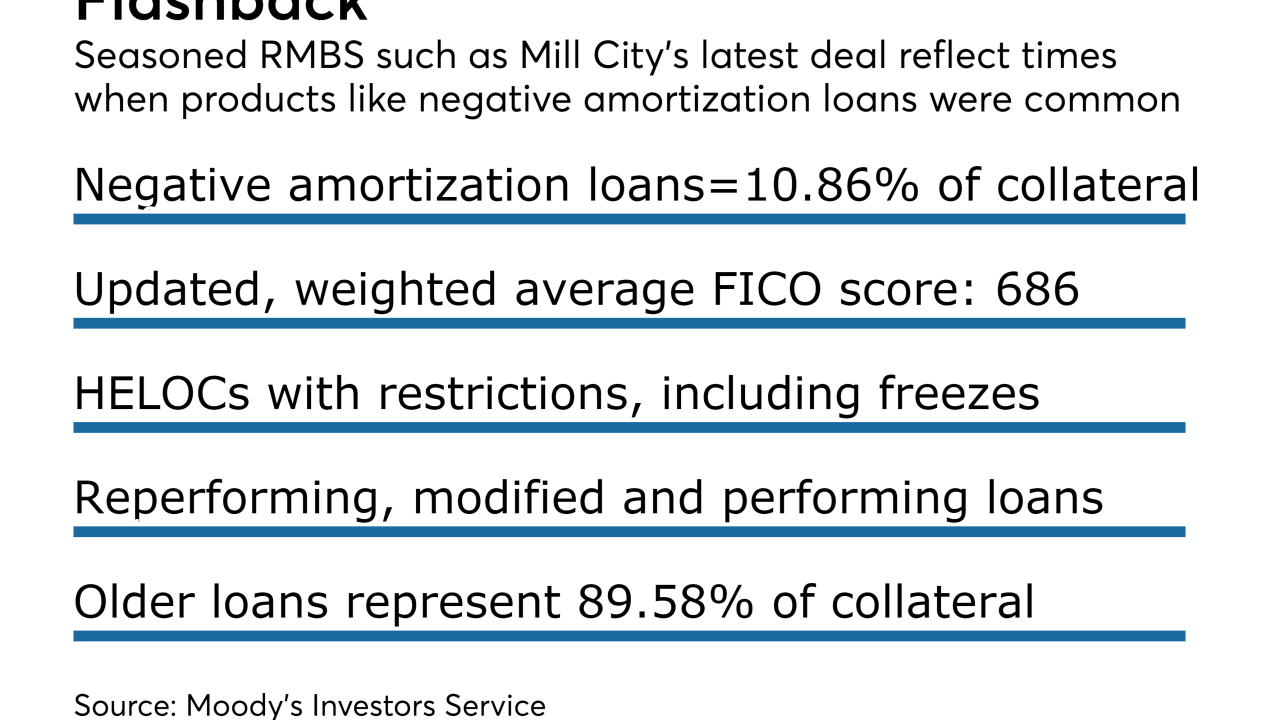

A loan securitization launched by Mill City has the largest concentration of seasoned negative-amortization loans seen in a residential mortgage-backed securities deal since the financial crisis.

June 12 -

American International Group will receive $590 million in gross proceeds from the sale of Arch Capital Group stock it received in the United Guaranty Corp. transaction.

June 12 -

Median prices for single-family houses and condominiums on Maui increased by double-digit percentages in May as low inventory prompted buyers to snap up properties at a rapid pace.

June 12 -

Mortgage credit availability declined in May as lenders reduced the number of government-guaranteed products they market by nearly 2%.

June 9 -

The number of first-time single-family homebuyers has hit a peak not seen since 2005 and is expected to spur the origination of more mortgages with higher loan-to-value ratios.

June 8 -

Mortgage rates dropped for the fourth consecutive week and hit their lowest level in nearly seven months, according to Freddie Mac.

June 8 -

Lower rates led to an increase in both purchase and refinance applications compared with the previous week. according to the Mortgage Bankers Association.

June 7 -

Summer usually ushers in prime homebuying season in Southern Nevada, but that could change drastically in 2017.

June 6 -

The Federal Housing Administration's gateway to homeownership could be widened if the Trump administration takes actions to reduce mortgage insurance premiums and clarify lender penalties under the False Claims Act.

June 2 -

Defects and misrepresentations on mortgage applications rose for the fifth consecutive month in April, with increases for both purchase and refinance loans.

June 2 -

Guild Mortgage is reaching out to millennials who often have higher debt-to-income ratios and lack down payments with a grant that allows them to put just 1% down.

June 1 -

Mortgage rates inched lower for the third consecutive week and set a new low for the year, according to Freddie Mac.

June 1 -

Application volume decreased 3.4% from one week earlier, according to the Mortgage Bankers Association.

May 31 -

On New York's Roosevelt Island, a sliver of land across the East River from Manhattan, real estate broker Ben Garama is trying to set a record — and make a statement.

May 30 -

The Federal Housing Finance Agency has revived the idea of putting a question on the loan application asking consumers what language they want to communicate in.

May 25 -

Home values increased by 7.3% in April, the strongest rate of year-over-year appreciation in more than 10 years, according to Zillow.

May 25